Foster & Motley Inc. increased its stake in Bunge Global SA (NYSE:BG - Free Report) by 21.6% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 42,928 shares of the basic materials company's stock after buying an additional 7,636 shares during the period. Foster & Motley Inc.'s holdings in Bunge Global were worth $4,149,000 at the end of the most recent reporting period.

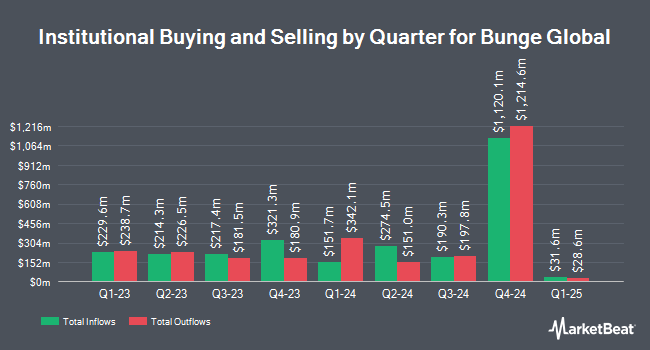

Other institutional investors and hedge funds have also bought and sold shares of the company. Altshuler Shaham Ltd purchased a new stake in shares of Bunge Global in the 2nd quarter worth about $28,000. Blue Trust Inc. boosted its stake in Bunge Global by 52.3% during the second quarter. Blue Trust Inc. now owns 297 shares of the basic materials company's stock worth $30,000 after acquiring an additional 102 shares in the last quarter. Farmers & Merchants Investments Inc. grew its holdings in Bunge Global by 185.2% in the second quarter. Farmers & Merchants Investments Inc. now owns 308 shares of the basic materials company's stock worth $33,000 after purchasing an additional 200 shares during the period. Ashton Thomas Private Wealth LLC bought a new position in shares of Bunge Global during the second quarter valued at approximately $40,000. Finally, Atlas Capital Advisors LLC lifted its holdings in shares of Bunge Global by 261.3% during the second quarter. Atlas Capital Advisors LLC now owns 383 shares of the basic materials company's stock valued at $41,000 after purchasing an additional 277 shares during the last quarter. 86.23% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Separately, Citigroup downgraded Bunge Global from a "buy" rating to a "neutral" rating and cut their price target for the stock from $125.00 to $114.00 in a research note on Thursday, August 1st. Four investment analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $118.00.

Get Our Latest Research Report on BG

Bunge Global Stock Performance

Shares of NYSE:BG traded up $0.96 during midday trading on Wednesday, reaching $85.76. 2,540,341 shares of the company's stock traded hands, compared to its average volume of 1,542,336. The company has a debt-to-equity ratio of 0.43, a quick ratio of 1.10 and a current ratio of 2.07. Bunge Global SA has a one year low of $82.18 and a one year high of $114.92. The company has a market cap of $11.97 billion, a price-to-earnings ratio of 10.73 and a beta of 0.67. The stock has a 50 day moving average of $95.02 and a 200 day moving average of $101.30.

Bunge Global Profile

(

Free Report)

Bunge Global SA operates as an agribusiness and food company worldwide. It operates through four segments: Agribusiness, Refined and Specialty Oils, Milling, and Sugar and Bioenergy. The Agribusiness segment purchases, stores, transports, processes, and sells agricultural commodities and commodity products, including oilseeds primarily soybeans, rapeseed, canola, and sunflower seeds, as well as grains comprising wheat and corn; and processes oilseeds into vegetable oils and protein meals.

Featured Articles

Before you consider Bunge Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bunge Global wasn't on the list.

While Bunge Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.