Foster & Motley Inc. lessened its holdings in Patterson Companies, Inc. (NASDAQ:PDCO - Free Report) by 27.7% during the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 65,266 shares of the company's stock after selling 25,015 shares during the quarter. Foster & Motley Inc. owned about 0.07% of Patterson Companies worth $1,426,000 at the end of the most recent quarter.

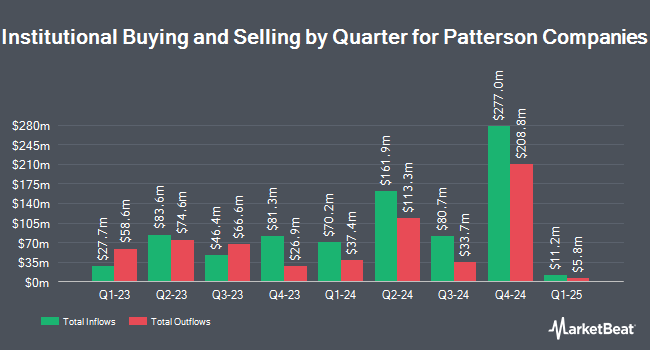

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in PDCO. LRI Investments LLC raised its position in shares of Patterson Companies by 201.2% during the 2nd quarter. LRI Investments LLC now owns 1,262 shares of the company's stock valued at $30,000 after purchasing an additional 843 shares during the period. Mather Group LLC. grew its holdings in Patterson Companies by 1,376.1% during the 2nd quarter. Mather Group LLC. now owns 1,609 shares of the company's stock valued at $39,000 after purchasing an additional 1,500 shares during the last quarter. Canada Pension Plan Investment Board bought a new position in shares of Patterson Companies during the second quarter valued at approximately $41,000. Family Firm Inc. bought a new position in Patterson Companies in the 2nd quarter valued at $45,000. Finally, Meeder Asset Management Inc. bought a new position in shares of Patterson Companies in the second quarter worth about $45,000. Institutional investors own 85.43% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts have issued reports on PDCO shares. UBS Group cut their target price on Patterson Companies from $27.00 to $24.00 and set a "neutral" rating on the stock in a research note on Thursday, September 5th. Evercore ISI lowered their price target on Patterson Companies from $23.00 to $22.00 and set an "in-line" rating on the stock in a research report on Tuesday, October 8th. JPMorgan Chase & Co. cut their target price on shares of Patterson Companies from $29.00 to $26.00 and set a "neutral" rating for the company in a research note on Thursday, August 29th. Bank of America reduced their price objective on Patterson Companies from $31.00 to $29.00 and set a "buy" rating for the company in a research note on Thursday, August 29th. Finally, Robert W. Baird lowered their target price on Patterson Companies from $30.00 to $28.00 and set a "neutral" rating on the stock in a report on Thursday, August 29th. Nine analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $28.30.

Check Out Our Latest Stock Analysis on Patterson Companies

Patterson Companies Stock Down 3.7 %

Patterson Companies stock traded down $0.81 during mid-day trading on Thursday, hitting $21.18. The company had a trading volume of 425,787 shares, compared to its average volume of 940,709. The stock has a market cap of $1.87 billion, a price-to-earnings ratio of 12.02, a PEG ratio of 1.53 and a beta of 1.02. The company has a quick ratio of 0.67, a current ratio of 1.30 and a debt-to-equity ratio of 0.34. Patterson Companies, Inc. has a 1 year low of $19.89 and a 1 year high of $32.58. The business has a fifty day moving average of $21.26 and a 200 day moving average of $23.50.

Patterson Companies (NASDAQ:PDCO - Get Free Report) last posted its earnings results on Wednesday, August 28th. The company reported $0.24 EPS for the quarter, missing analysts' consensus estimates of $0.32 by ($0.08). The firm had revenue of $1.54 billion for the quarter, compared to analyst estimates of $1.59 billion. Patterson Companies had a return on equity of 19.87% and a net margin of 2.58%. The firm's revenue for the quarter was down 2.3% on a year-over-year basis. During the same quarter last year, the firm posted $0.40 EPS. On average, sell-side analysts expect that Patterson Companies, Inc. will post 2.32 earnings per share for the current fiscal year.

Patterson Companies Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, November 1st. Stockholders of record on Wednesday, October 16th were given a $0.26 dividend. This represents a $1.04 dividend on an annualized basis and a dividend yield of 4.91%. The ex-dividend date of this dividend was Friday, October 18th. Patterson Companies's dividend payout ratio is presently 56.83%.

About Patterson Companies

(

Free Report)

Patterson Companies, Inc engages in the distribution of dental and animal health products in the United States, the United Kingdom, and Canada. The company operates through three segments: Dental, Animal Health, and Corporate segments. The Dental segment offers consumable products, including infection control, restorative materials, and instruments; basic and advanced technology and dental equipment; practice optimization solutions, such as practice management software, e-commerce, revenue cycle management, patient engagement solutions, and clinical and patient education systems.

Recommended Stories

Before you consider Patterson Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Patterson Companies wasn't on the list.

While Patterson Companies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.