Foundry Partners LLC acquired a new position in shares of Gates Industrial Corp PLC (NYSE:GTES - Free Report) in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 241,980 shares of the company's stock, valued at approximately $4,247,000. Foundry Partners LLC owned 0.09% of Gates Industrial as of its most recent SEC filing.

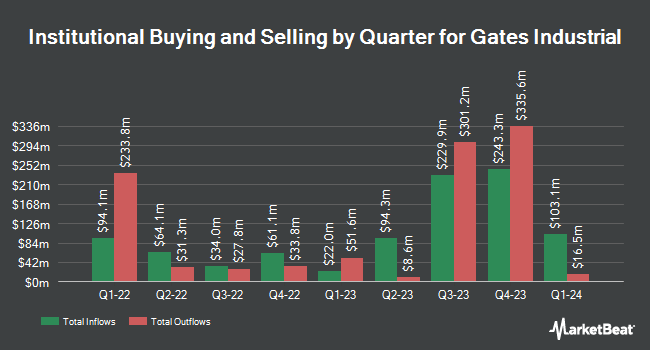

Other hedge funds have also bought and sold shares of the company. Venturi Wealth Management LLC raised its holdings in Gates Industrial by 35.9% during the third quarter. Venturi Wealth Management LLC now owns 3,079 shares of the company's stock worth $54,000 after buying an additional 814 shares during the last quarter. Bank of Montreal Can lifted its position in shares of Gates Industrial by 2.5% during the second quarter. Bank of Montreal Can now owns 33,800 shares of the company's stock valued at $535,000 after purchasing an additional 823 shares in the last quarter. Covestor Ltd increased its stake in Gates Industrial by 26.3% in the 3rd quarter. Covestor Ltd now owns 4,812 shares of the company's stock valued at $84,000 after buying an additional 1,001 shares during the last quarter. Tectonic Advisors LLC boosted its stake in shares of Gates Industrial by 5.5% in the 3rd quarter. Tectonic Advisors LLC now owns 20,128 shares of the company's stock worth $353,000 after buying an additional 1,043 shares during the last quarter. Finally, Fort L.P. lifted its holdings in Gates Industrial by 9.3% during the third quarter. Fort L.P. now owns 14,423 shares of the company's stock worth $253,000 after acquiring an additional 1,222 shares during the period. Institutional investors own 98.50% of the company's stock.

Wall Street Analyst Weigh In

GTES has been the topic of a number of research analyst reports. KeyCorp boosted their target price on shares of Gates Industrial from $22.00 to $23.00 and gave the company an "overweight" rating in a research note on Thursday. Morgan Stanley assumed coverage on shares of Gates Industrial in a report on Friday, September 6th. They set an "equal weight" rating and a $19.00 target price on the stock. Barclays lifted their target price on shares of Gates Industrial from $16.00 to $21.00 and gave the company an "equal weight" rating in a research report on Tuesday, November 5th. Robert W. Baird reduced their target price on Gates Industrial from $26.00 to $22.00 and set an "outperform" rating on the stock in a research note on Thursday, August 1st. Finally, Evercore ISI increased their target price on shares of Gates Industrial from $15.00 to $16.00 and gave the company an "in-line" rating in a report on Monday, August 19th. Four equities research analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $20.40.

Check Out Our Latest Report on GTES

Gates Industrial Stock Performance

Shares of GTES stock traded up $0.61 on Friday, reaching $22.00. The stock had a trading volume of 3,061,999 shares, compared to its average volume of 3,073,333. The stock has a market cap of $5.60 billion, a P/E ratio of 26.47 and a beta of 1.38. The company has a debt-to-equity ratio of 0.70, a quick ratio of 2.11 and a current ratio of 3.02. Gates Industrial Corp PLC has a 1 year low of $11.22 and a 1 year high of $22.05. The company has a 50 day simple moving average of $18.77 and a 200 day simple moving average of $17.50.

Gates Industrial announced that its Board of Directors has initiated a share repurchase plan on Wednesday, July 31st that authorizes the company to buyback $250.00 million in shares. This buyback authorization authorizes the company to repurchase up to 5.4% of its shares through open market purchases. Shares buyback plans are generally an indication that the company's board of directors believes its stock is undervalued.

Gates Industrial Profile

(

Free Report)

Gates Industrial Corporation PLC designs and manufactures power transmission equipment. Its products serves harsh and hazardous industries such as agriculture, construction, manufacturing and energy, to everyday consumer applications such as printers, power washers, automatic doors and vacuum cleaners and virtually every form of transportation.

Featured Stories

Before you consider Gates Industrial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gates Industrial wasn't on the list.

While Gates Industrial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.