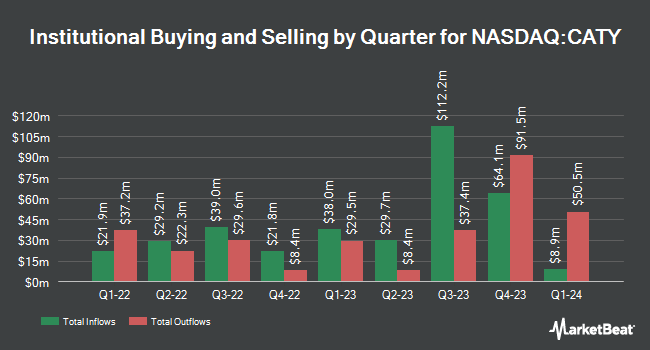

Foundry Partners LLC acquired a new stake in Cathay General Bancorp (NASDAQ:CATY - Free Report) during the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm acquired 174,453 shares of the bank's stock, valued at approximately $7,493,000. Foundry Partners LLC owned approximately 0.24% of Cathay General Bancorp as of its most recent SEC filing.

Several other institutional investors have also recently bought and sold shares of the business. Dimensional Fund Advisors LP lifted its stake in Cathay General Bancorp by 4.4% in the 2nd quarter. Dimensional Fund Advisors LP now owns 4,194,232 shares of the bank's stock valued at $158,206,000 after purchasing an additional 176,215 shares during the last quarter. American Century Companies Inc. boosted its stake in shares of Cathay General Bancorp by 19.8% during the second quarter. American Century Companies Inc. now owns 1,262,970 shares of the bank's stock valued at $47,639,000 after purchasing an additional 208,599 shares in the last quarter. Boston Trust Walden Corp grew its holdings in shares of Cathay General Bancorp by 4.1% during the second quarter. Boston Trust Walden Corp now owns 736,727 shares of the bank's stock worth $27,789,000 after purchasing an additional 28,968 shares during the last quarter. Stieven Capital Advisors L.P. raised its holdings in Cathay General Bancorp by 39.3% in the 3rd quarter. Stieven Capital Advisors L.P. now owns 256,404 shares of the bank's stock valued at $11,013,000 after buying an additional 72,300 shares during the last quarter. Finally, Public Sector Pension Investment Board boosted its position in Cathay General Bancorp by 7.6% during the 2nd quarter. Public Sector Pension Investment Board now owns 160,241 shares of the bank's stock worth $6,044,000 after buying an additional 11,324 shares during the period. Institutional investors and hedge funds own 75.01% of the company's stock.

Cathay General Bancorp Price Performance

CATY stock opened at $50.75 on Thursday. Cathay General Bancorp has a 1 year low of $33.88 and a 1 year high of $54.07. The stock has a market capitalization of $3.61 billion, a PE ratio of 12.78 and a beta of 1.10. The company's 50-day moving average is $45.67 and its 200-day moving average is $41.63. The company has a debt-to-equity ratio of 0.07, a current ratio of 1.03 and a quick ratio of 1.03.

Cathay General Bancorp (NASDAQ:CATY - Get Free Report) last released its quarterly earnings data on Monday, October 21st. The bank reported $0.94 EPS for the quarter, missing the consensus estimate of $0.95 by ($0.01). Cathay General Bancorp had a net margin of 20.57% and a return on equity of 11.30%. The firm had revenue of $359.86 million for the quarter, compared to the consensus estimate of $182.70 million. During the same quarter in the prior year, the firm earned $1.13 EPS. Equities research analysts expect that Cathay General Bancorp will post 3.99 EPS for the current fiscal year.

Cathay General Bancorp Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, December 9th. Investors of record on Wednesday, November 27th will be issued a dividend of $0.34 per share. The ex-dividend date is Wednesday, November 27th. This represents a $1.36 annualized dividend and a yield of 2.68%. Cathay General Bancorp's dividend payout ratio (DPR) is currently 34.26%.

Analyst Ratings Changes

Several equities analysts have recently issued reports on the stock. Truist Financial raised their price target on shares of Cathay General Bancorp from $45.00 to $47.00 and gave the company a "hold" rating in a research note on Friday, September 20th. Wedbush lifted their target price on Cathay General Bancorp from $50.00 to $52.00 and gave the stock an "outperform" rating in a report on Wednesday, October 23rd. One analyst has rated the stock with a sell rating, three have assigned a hold rating and one has issued a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Hold" and an average target price of $44.00.

Check Out Our Latest Report on CATY

Insider Buying and Selling at Cathay General Bancorp

In other Cathay General Bancorp news, Chairman Dunson K. Cheng sold 12,401 shares of the company's stock in a transaction dated Monday, August 26th. The shares were sold at an average price of $44.79, for a total value of $555,440.79. Following the completion of the sale, the chairman now directly owns 149,566 shares of the company's stock, valued at approximately $6,699,061.14. This represents a 7.66 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, EVP Thomas M. Lo sold 900 shares of Cathay General Bancorp stock in a transaction that occurred on Wednesday, October 30th. The stock was sold at an average price of $47.00, for a total transaction of $42,300.00. Following the transaction, the executive vice president now directly owns 3,359 shares in the company, valued at approximately $157,873. This represents a 21.13 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 60,590 shares of company stock worth $3,055,488. Corporate insiders own 4.76% of the company's stock.

Cathay General Bancorp Profile

(

Free Report)

Cathay General Bancorp operates as the holding company for Cathay Bank that offers various commercial banking products and services to individuals, professionals, and small to medium-sized businesses in the United States. The company offers various deposit products, including passbook accounts, checking accounts, money market deposit accounts, certificates of deposit, individual retirement accounts, and public funds deposits.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cathay General Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cathay General Bancorp wasn't on the list.

While Cathay General Bancorp currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.