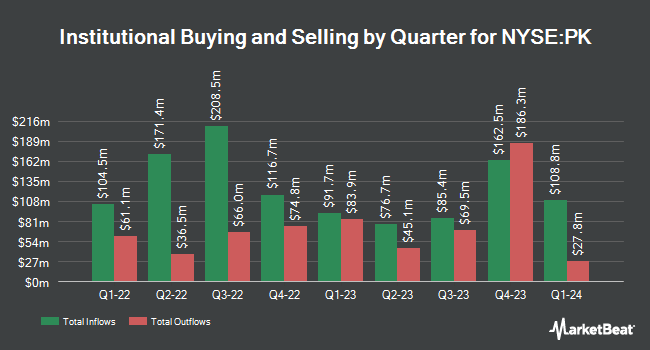

Foundry Partners LLC purchased a new position in Park Hotels & Resorts Inc. (NYSE:PK - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 655,202 shares of the financial services provider's stock, valued at approximately $9,238,000. Foundry Partners LLC owned approximately 0.32% of Park Hotels & Resorts at the end of the most recent quarter.

A number of other institutional investors and hedge funds have also recently bought and sold shares of the business. Blue Zone Wealth Advisors LLC lifted its stake in shares of Park Hotels & Resorts by 0.4% in the 2nd quarter. Blue Zone Wealth Advisors LLC now owns 252,737 shares of the financial services provider's stock valued at $3,786,000 after purchasing an additional 883 shares during the last quarter. Arizona State Retirement System increased its position in shares of Park Hotels & Resorts by 2.1% during the second quarter. Arizona State Retirement System now owns 58,940 shares of the financial services provider's stock valued at $883,000 after acquiring an additional 1,232 shares during the last quarter. Bfsg LLC increased its holdings in Park Hotels & Resorts by 8.7% in the 3rd quarter. Bfsg LLC now owns 15,440 shares of the financial services provider's stock valued at $218,000 after purchasing an additional 1,235 shares during the last quarter. Kendall Capital Management raised its position in Park Hotels & Resorts by 11.0% in the second quarter. Kendall Capital Management now owns 15,095 shares of the financial services provider's stock valued at $226,000 after purchasing an additional 1,500 shares during the period. Finally, United Services Automobile Association lifted its stake in Park Hotels & Resorts by 10.5% during the second quarter. United Services Automobile Association now owns 15,826 shares of the financial services provider's stock worth $237,000 after purchasing an additional 1,509 shares in the last quarter. 92.69% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several equities analysts recently issued reports on PK shares. Truist Financial decreased their target price on Park Hotels & Resorts from $20.00 to $18.00 and set a "buy" rating on the stock in a research note on Wednesday, September 4th. Bank of America lowered their price objective on shares of Park Hotels & Resorts from $17.00 to $16.50 and set a "neutral" rating for the company in a research note on Monday, October 21st. Wells Fargo & Company cut their target price on shares of Park Hotels & Resorts from $17.00 to $14.50 and set an "equal weight" rating on the stock in a research note on Friday, September 13th. Compass Point decreased their price target on shares of Park Hotels & Resorts from $25.00 to $20.00 and set a "buy" rating for the company in a research report on Thursday, October 31st. Finally, StockNews.com cut Park Hotels & Resorts from a "hold" rating to a "sell" rating in a research note on Thursday, November 7th. One analyst has rated the stock with a sell rating, six have issued a hold rating and six have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $18.09.

Read Our Latest Stock Report on Park Hotels & Resorts

Park Hotels & Resorts Stock Down 0.8 %

Shares of NYSE PK opened at $14.19 on Thursday. The business has a 50-day moving average of $14.38 and a two-hundred day moving average of $14.76. The company has a market capitalization of $2.93 billion, a price-to-earnings ratio of 9.04, a price-to-earnings-growth ratio of 0.79 and a beta of 2.02. Park Hotels & Resorts Inc. has a 1 year low of $13.23 and a 1 year high of $18.05. The company has a debt-to-equity ratio of 1.24, a current ratio of 1.51 and a quick ratio of 1.51.

Park Hotels & Resorts (NYSE:PK - Get Free Report) last posted its earnings results on Tuesday, October 29th. The financial services provider reported $0.26 earnings per share for the quarter, missing the consensus estimate of $0.47 by ($0.21). The business had revenue of $649.00 million for the quarter, compared to analysts' expectations of $646.15 million. Park Hotels & Resorts had a return on equity of 9.63% and a net margin of 12.66%. Park Hotels & Resorts's revenue for the quarter was down 4.4% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $0.51 EPS. On average, analysts forecast that Park Hotels & Resorts Inc. will post 2.09 earnings per share for the current fiscal year.

Park Hotels & Resorts Profile

(

Free Report)

Park is one of the largest publicly traded lodging REITs with a diverse portfolio of market-leading hotels and resorts with significant underlying real estate value. Park's portfolio currently consists of 43 premium-branded hotels and resorts with over 26,000 rooms primarily located in prime city center and resort locations.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Park Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Park Hotels & Resorts wasn't on the list.

While Park Hotels & Resorts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.