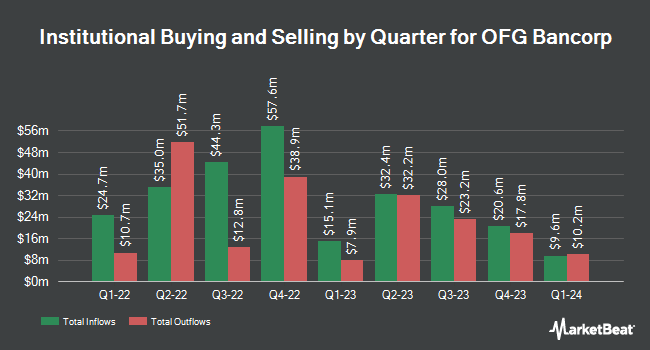

Foundry Partners LLC bought a new position in shares of OFG Bancorp (NYSE:OFG - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund bought 134,423 shares of the bank's stock, valued at approximately $6,038,000. Foundry Partners LLC owned approximately 0.29% of OFG Bancorp as of its most recent SEC filing.

Other institutional investors have also added to or reduced their stakes in the company. New Millennium Group LLC bought a new position in shares of OFG Bancorp in the second quarter worth approximately $30,000. Blue Trust Inc. lifted its holdings in shares of OFG Bancorp by 2,377.8% during the 3rd quarter. Blue Trust Inc. now owns 1,115 shares of the bank's stock worth $50,000 after acquiring an additional 1,070 shares during the last quarter. CWM LLC grew its position in OFG Bancorp by 147.1% in the second quarter. CWM LLC now owns 1,868 shares of the bank's stock worth $70,000 after acquiring an additional 1,112 shares in the last quarter. Quarry LP raised its position in OFG Bancorp by 98.7% during the second quarter. Quarry LP now owns 2,005 shares of the bank's stock valued at $75,000 after purchasing an additional 996 shares in the last quarter. Finally, Farther Finance Advisors LLC lifted its stake in OFG Bancorp by 4,014.6% during the third quarter. Farther Finance Advisors LLC now owns 1,975 shares of the bank's stock worth $89,000 after purchasing an additional 1,927 shares during the last quarter. 92.73% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Separately, Piper Sandler decreased their price objective on OFG Bancorp from $49.00 to $47.00 and set an "overweight" rating on the stock in a report on Thursday, October 17th.

Read Our Latest Stock Analysis on OFG Bancorp

OFG Bancorp Trading Up 2.2 %

OFG Bancorp stock traded up $0.97 during mid-day trading on Thursday, hitting $44.41. The company's stock had a trading volume of 211,701 shares, compared to its average volume of 240,754. The business has a 50 day moving average price of $42.89 and a 200-day moving average price of $41.15. OFG Bancorp has a 12 month low of $32.96 and a 12 month high of $47.57. The stock has a market cap of $2.04 billion, a price-to-earnings ratio of 10.58 and a beta of 1.00. The company has a debt-to-equity ratio of 0.21, a current ratio of 0.86 and a quick ratio of 0.86.

OFG Bancorp (NYSE:OFG - Get Free Report) last released its earnings results on Wednesday, October 16th. The bank reported $1.00 earnings per share for the quarter, missing analysts' consensus estimates of $1.02 by ($0.02). The company had revenue of $174.10 million during the quarter, compared to the consensus estimate of $178.25 million. OFG Bancorp had a net margin of 22.68% and a return on equity of 15.69%. The company's revenue was up 1.1% on a year-over-year basis. During the same period last year, the firm posted $0.95 EPS. As a group, analysts forecast that OFG Bancorp will post 4.11 EPS for the current year.

OFG Bancorp Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be issued a dividend of $0.25 per share. The ex-dividend date is Tuesday, December 31st. This represents a $1.00 dividend on an annualized basis and a yield of 2.25%. OFG Bancorp's dividend payout ratio is currently 24.33%.

OFG Bancorp declared that its board has initiated a share repurchase plan on Monday, October 28th that permits the company to repurchase $50.00 million in outstanding shares. This repurchase authorization permits the bank to buy up to 2.6% of its stock through open market purchases. Stock repurchase plans are typically a sign that the company's management believes its shares are undervalued.

OFG Bancorp Profile

(

Free Report)

OFG Bancorp, a financial holding company, provides a range of banking and financial services. It operates through three segments: Banking, Wealth Management, and Treasury. The company offers checking and savings accounts, and individual retirement accounts; certificate of deposits, as well as time deposit products; commercial, consumer, auto leasing, and mortgage lending services; credit cards; cash management; financial planning and insurance services; and corporate and individual trust, and retirement services.

Featured Articles

Before you consider OFG Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OFG Bancorp wasn't on the list.

While OFG Bancorp currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.