Citigroup Inc. grew its stake in shares of Fox Co. (NASDAQ:FOXA - Free Report) by 35.3% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 593,104 shares of the company's stock after purchasing an additional 154,680 shares during the quarter. Citigroup Inc. owned approximately 0.13% of FOX worth $25,106,000 as of its most recent filing with the Securities and Exchange Commission.

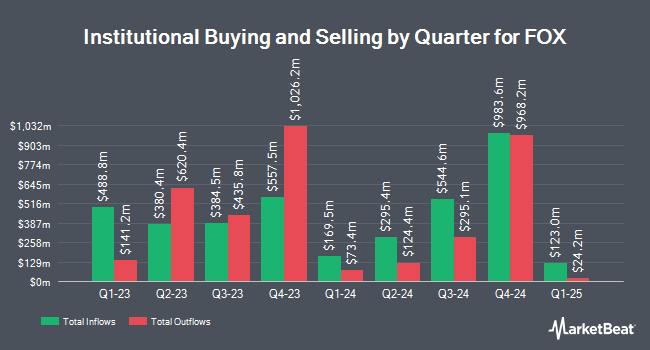

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Massmutual Trust Co. FSB ADV grew its position in shares of FOX by 176.6% during the second quarter. Massmutual Trust Co. FSB ADV now owns 722 shares of the company's stock worth $25,000 after acquiring an additional 461 shares during the last quarter. Quest Partners LLC purchased a new position in shares of FOX during the third quarter worth approximately $51,000. Friedenthal Financial purchased a new position in shares of FOX during the second quarter worth approximately $51,000. Duncker Streett & Co. Inc. purchased a new position in shares of FOX during the second quarter worth approximately $52,000. Finally, Bessemer Group Inc. grew its position in shares of FOX by 11.0% during the first quarter. Bessemer Group Inc. now owns 3,290 shares of the company's stock worth $103,000 after acquiring an additional 326 shares during the last quarter. Institutional investors and hedge funds own 52.52% of the company's stock.

FOX Trading Up 0.2 %

NASDAQ:FOXA opened at $46.15 on Wednesday. The company has a market capitalization of $21.08 billion, a PE ratio of 11.28, a price-to-earnings-growth ratio of 1.20 and a beta of 0.76. The company has a quick ratio of 2.33, a current ratio of 2.59 and a debt-to-equity ratio of 0.58. Fox Co. has a 52-week low of $28.28 and a 52-week high of $47.58. The stock has a fifty day simple moving average of $43.12 and a 200-day simple moving average of $38.90.

FOX (NASDAQ:FOXA - Get Free Report) last released its quarterly earnings results on Monday, November 4th. The company reported $1.45 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.12 by $0.33. The business had revenue of $3.56 billion during the quarter, compared to the consensus estimate of $3.38 billion. FOX had a return on equity of 16.49% and a net margin of 13.40%. The business's revenue was up 11.1% on a year-over-year basis. During the same quarter in the previous year, the company posted $1.09 EPS. On average, equities research analysts expect that Fox Co. will post 3.94 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of equities analysts recently weighed in on the stock. Loop Capital lifted their price objective on shares of FOX from $43.00 to $46.00 and gave the company a "buy" rating in a research report on Tuesday, October 8th. TD Cowen lifted their price objective on shares of FOX from $36.00 to $42.00 and gave the company a "hold" rating in a research report on Tuesday, November 5th. JPMorgan Chase & Co. lifted their price objective on shares of FOX from $41.00 to $42.00 and gave the company a "neutral" rating in a research report on Tuesday, November 5th. Bank of America lifted their price objective on shares of FOX from $45.00 to $50.00 and gave the company a "buy" rating in a research report on Wednesday, September 25th. Finally, Deutsche Bank Aktiengesellschaft lifted their price objective on shares of FOX from $42.00 to $47.00 and gave the company a "buy" rating in a research report on Tuesday, November 5th. One analyst has rated the stock with a sell rating, ten have issued a hold rating and eight have assigned a buy rating to the company's stock. According to MarketBeat.com, the company has an average rating of "Hold" and an average target price of $44.00.

Get Our Latest Research Report on FOXA

Insider Transactions at FOX

In related news, COO John Nallen sold 182,481 shares of the business's stock in a transaction dated Tuesday, November 5th. The shares were sold at an average price of $43.73, for a total value of $7,979,894.13. Following the completion of the transaction, the chief operating officer now owns 249,424 shares of the company's stock, valued at approximately $10,907,311.52. The trade was a 42.25 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Chairman Keith Rupert Murdoch sold 186,871 shares of the business's stock in a transaction dated Monday, November 25th. The shares were sold at an average price of $46.22, for a total transaction of $8,637,177.62. The disclosure for this sale can be found here. Insiders sold 469,352 shares of company stock valued at $20,822,072 in the last 90 days. 21.77% of the stock is currently owned by insiders.

About FOX

(

Free Report)

Fox Corporation operates as a news, sports, and entertainment company in the United States (U.S.). The company operates through four segments: Cable Network Programming, Television, Credible, and The FOX Studio Lot. The Cable Network Programming segment produces and licenses news and sports content for distribution through traditional cable television systems, direct broadcast satellite operators and telecommunication companies, virtual multi-channel video programming distributors, and other digital platforms primarily in the U.S.

Featured Articles

Before you consider FOX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FOX wasn't on the list.

While FOX currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.