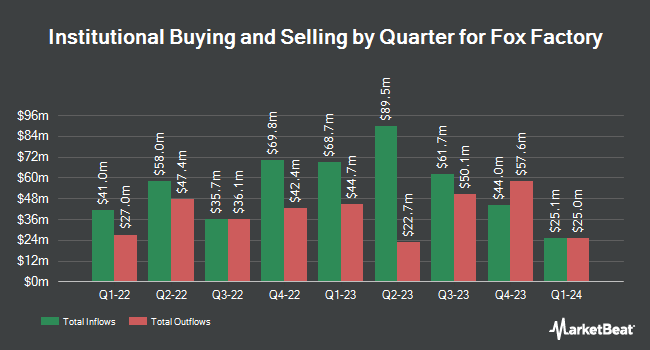

Advantage Alpha Capital Partners LP grew its stake in shares of Fox Factory Holding Corp. (NASDAQ:FOXF - Free Report) by 30.8% in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 68,221 shares of the company's stock after acquiring an additional 16,081 shares during the period. Advantage Alpha Capital Partners LP owned about 0.16% of Fox Factory worth $2,065,000 at the end of the most recent reporting period.

Several other large investors also recently modified their holdings of the stock. William Blair Investment Management LLC grew its holdings in Fox Factory by 17.1% during the fourth quarter. William Blair Investment Management LLC now owns 2,983,482 shares of the company's stock valued at $90,310,000 after purchasing an additional 434,998 shares during the period. Assenagon Asset Management S.A. lifted its position in shares of Fox Factory by 595.6% during the 4th quarter. Assenagon Asset Management S.A. now owns 247,435 shares of the company's stock valued at $7,490,000 after buying an additional 211,864 shares during the last quarter. JPMorgan Chase & Co. grew its stake in shares of Fox Factory by 271.6% during the 3rd quarter. JPMorgan Chase & Co. now owns 190,870 shares of the company's stock worth $7,921,000 after acquiring an additional 139,512 shares during the period. Disciplined Growth Investors Inc. MN purchased a new stake in Fox Factory in the 3rd quarter worth about $5,743,000. Finally, ArrowMark Colorado Holdings LLC raised its stake in Fox Factory by 15.9% in the 3rd quarter. ArrowMark Colorado Holdings LLC now owns 927,006 shares of the company's stock valued at $38,471,000 after acquiring an additional 127,187 shares during the period.

Fox Factory Price Performance

NASDAQ:FOXF traded down $1.48 during trading hours on Friday, hitting $24.26. 565,960 shares of the company's stock traded hands, compared to its average volume of 635,835. Fox Factory Holding Corp. has a 52 week low of $23.80 and a 52 week high of $54.86. The business's fifty day simple moving average is $26.42 and its two-hundred day simple moving average is $31.74. The company has a quick ratio of 1.62, a current ratio of 3.21 and a debt-to-equity ratio of 0.62. The firm has a market cap of $1.01 billion, a P/E ratio of 93.31, a P/E/G ratio of 1.45 and a beta of 1.65.

Fox Factory (NASDAQ:FOXF - Get Free Report) last issued its quarterly earnings data on Thursday, February 27th. The company reported $0.31 EPS for the quarter, topping the consensus estimate of $0.29 by $0.02. The company had revenue of $352.84 million during the quarter, compared to analyst estimates of $321.31 million. Fox Factory had a return on equity of 5.23% and a net margin of 0.78%. On average, research analysts anticipate that Fox Factory Holding Corp. will post 1.31 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of equities analysts have weighed in on FOXF shares. Truist Financial cut their target price on shares of Fox Factory from $42.00 to $40.00 and set a "buy" rating for the company in a research report on Tuesday, January 7th. StockNews.com upgraded shares of Fox Factory from a "sell" rating to a "hold" rating in a research note on Thursday, November 28th. Jefferies Financial Group dropped their target price on Fox Factory from $45.00 to $38.00 and set a "buy" rating on the stock in a research report on Friday, February 28th. Stifel Nicolaus upgraded Fox Factory from a "hold" rating to a "buy" rating and set a $40.00 price target for the company in a research report on Wednesday, December 11th. Finally, Robert W. Baird dropped their price objective on Fox Factory from $38.00 to $32.00 and set a "neutral" rating on the stock in a report on Friday, February 28th. Five research analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus target price of $39.14.

View Our Latest Analysis on Fox Factory

Fox Factory Company Profile

(

Free Report)

Fox Factory Holding Corp. designs, engineers, manufactures, and markets performance-defining products and system worldwide. The company offers powered vehicle products for side-by-side vehicles, on-road vehicles with and without off-road capabilities, off-road vehicles and trucks, all-terrain vehicles, snowmobiles, and specialty vehicles and applications, such as military, motorcycles, and commercial trucks; lift kits and components with shock products and aftermarket accessory packages for trucks; and mid-end and high-end front fork and rear suspension products.

Featured Stories

Before you consider Fox Factory, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fox Factory wasn't on the list.

While Fox Factory currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.