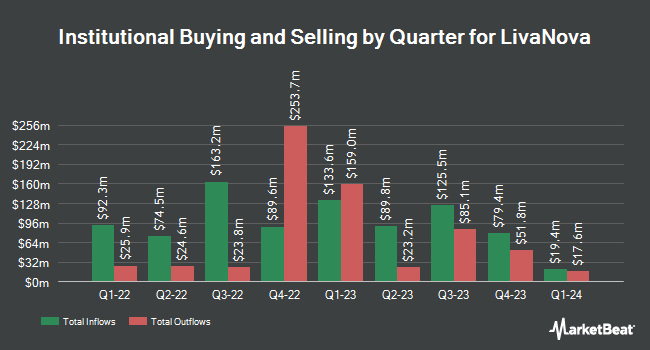

Fox Run Management L.L.C. increased its position in LivaNova PLC (NASDAQ:LIVN - Free Report) by 183.7% during the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 19,843 shares of the company's stock after purchasing an additional 12,848 shares during the period. Fox Run Management L.L.C.'s holdings in LivaNova were worth $919,000 at the end of the most recent reporting period.

Other institutional investors also recently bought and sold shares of the company. Atria Investments Inc increased its holdings in shares of LivaNova by 6.2% in the 3rd quarter. Atria Investments Inc now owns 5,653 shares of the company's stock worth $297,000 after purchasing an additional 331 shares in the last quarter. Xponance Inc. increased its holdings in LivaNova by 6.1% in the 4th quarter. Xponance Inc. now owns 7,762 shares of the company's stock worth $359,000 after buying an additional 445 shares in the last quarter. Swiss National Bank raised its position in LivaNova by 0.7% in the 4th quarter. Swiss National Bank now owns 106,819 shares of the company's stock worth $4,947,000 after buying an additional 700 shares during the last quarter. Central Pacific Bank Trust Division lifted its stake in LivaNova by 21.2% during the 4th quarter. Central Pacific Bank Trust Division now owns 4,117 shares of the company's stock valued at $191,000 after acquiring an additional 720 shares during the period. Finally, Amalgamated Bank boosted its holdings in shares of LivaNova by 3.0% during the 4th quarter. Amalgamated Bank now owns 24,900 shares of the company's stock valued at $1,153,000 after acquiring an additional 729 shares during the last quarter. 97.64% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of equities research analysts have weighed in on LIVN shares. Mizuho decreased their target price on shares of LivaNova from $70.00 to $60.00 and set an "outperform" rating for the company in a research note on Wednesday, February 26th. StockNews.com raised LivaNova from a "buy" rating to a "strong-buy" rating in a report on Tuesday. The Goldman Sachs Group reduced their price target on LivaNova from $64.00 to $55.00 and set a "buy" rating for the company in a research report on Monday, March 3rd. Barclays lowered their price objective on LivaNova from $58.00 to $56.00 and set an "equal weight" rating on the stock in a research report on Friday, March 7th. Finally, Wolfe Research downgraded shares of LivaNova from an "outperform" rating to a "peer perform" rating in a report on Wednesday, February 26th. Two investment analysts have rated the stock with a hold rating, five have given a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Buy" and a consensus target price of $61.17.

Get Our Latest Stock Report on LIVN

LivaNova Price Performance

Shares of LivaNova stock traded down $0.28 during trading on Thursday, reaching $39.62. 487,663 shares of the stock traded hands, compared to its average volume of 593,402. LivaNova PLC has a 52-week low of $36.85 and a 52-week high of $64.48. The company has a debt-to-equity ratio of 0.46, a current ratio of 3.37 and a quick ratio of 2.87. The business has a fifty day simple moving average of $44.86 and a two-hundred day simple moving average of $48.58. The company has a market capitalization of $2.15 billion, a price-to-earnings ratio of 94.33 and a beta of 1.10.

LivaNova Profile

(

Free Report)

LivaNova PLC, a medical device company, designs, develops, manufactures, and sells therapeutic solutions worldwide. The company operates through Cardiopulmonary, Neuromodulation, and Advanced Circulatory Support segments. The Cardiopulmonary segment develops, produces, and sells cardiopulmonary products, including oxygenators, heart-lung machines, autotransfusion systems, perfusion tubing systems, cannulae, connect, and other related products.

Featured Articles

Before you consider LivaNova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LivaNova wasn't on the list.

While LivaNova currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.