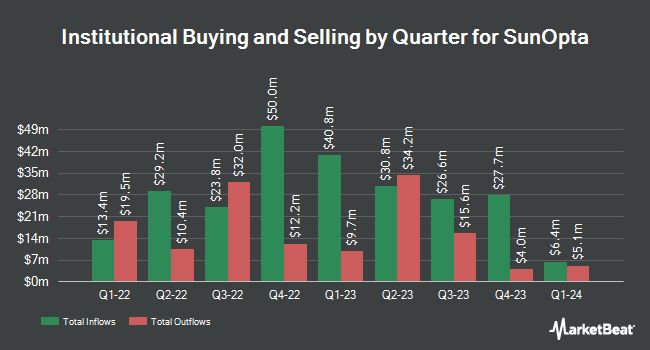

Franklin Resources Inc. increased its holdings in shares of SunOpta Inc. (NASDAQ:STKL - Free Report) TSE: SOY by 1,015.0% during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 587,749 shares of the company's stock after purchasing an additional 535,034 shares during the quarter. Franklin Resources Inc. owned 0.49% of SunOpta worth $4,526,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other institutional investors also recently modified their holdings of the business. EP Wealth Advisors LLC purchased a new stake in shares of SunOpta during the 3rd quarter valued at about $79,000. D.A. Davidson & CO. purchased a new stake in SunOpta during the 4th quarter valued at $81,000. Quantinno Capital Management LP lifted its holdings in shares of SunOpta by 33.1% during the 3rd quarter. Quantinno Capital Management LP now owns 13,522 shares of the company's stock valued at $86,000 after buying an additional 3,360 shares during the period. Mutual Advisors LLC bought a new position in shares of SunOpta during the 4th quarter valued at $92,000. Finally, Patriot Financial Group Insurance Agency LLC purchased a new position in shares of SunOpta in the 4th quarter worth $116,000. 85.39% of the stock is owned by hedge funds and other institutional investors.

SunOpta Stock Performance

Shares of NASDAQ STKL traded up $0.02 during trading on Tuesday, hitting $4.12. The company had a trading volume of 550,517 shares, compared to its average volume of 763,239. The stock has a 50 day simple moving average of $5.72 and a 200 day simple moving average of $6.67. The firm has a market capitalization of $493.39 million, a P/E ratio of -22.89 and a beta of 1.83. The company has a debt-to-equity ratio of 1.61, a quick ratio of 0.53 and a current ratio of 1.20. SunOpta Inc. has a 12 month low of $3.65 and a 12 month high of $8.11.

SunOpta (NASDAQ:STKL - Get Free Report) TSE: SOY last posted its quarterly earnings results on Wednesday, February 26th. The company reported $0.06 earnings per share for the quarter, hitting analysts' consensus estimates of $0.06. The business had revenue of $193.91 million during the quarter, compared to analyst estimates of $189.90 million. SunOpta had a negative net margin of 2.74% and a positive return on equity of 7.92%. As a group, analysts anticipate that SunOpta Inc. will post 0.13 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of research analysts have weighed in on STKL shares. StockNews.com raised SunOpta from a "sell" rating to a "hold" rating in a report on Tuesday, March 11th. Stephens reiterated an "overweight" rating and issued a $10.00 price target on shares of SunOpta in a research report on Thursday, January 2nd.

Get Our Latest Stock Report on STKL

Insider Transactions at SunOpta

In related news, SVP Bryan P. Clark sold 8,500 shares of the business's stock in a transaction that occurred on Thursday, March 13th. The stock was sold at an average price of $5.32, for a total value of $45,220.00. Following the transaction, the senior vice president now directly owns 28,150 shares of the company's stock, valued at approximately $149,758. The trade was a 23.19 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Corporate insiders own 6.48% of the company's stock.

About SunOpta

(

Free Report)

SunOpta Inc engages in manufacture and sale of plant-based and fruit-based food and beverage products in the United States, Canada, and internationally. The company provides plant-based beverages utilizing oat, almond, soy, coconut, rice, hemp, and other bases under the Dream and West Life brands; oat-based creamers under the SOWN brand; ready-to-drink protein shakes; and nut, grain, seed, and legume based beverages; packaged teas and concentrates; and meat and vegetable broths and stocks.

See Also

Before you consider SunOpta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SunOpta wasn't on the list.

While SunOpta currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.