Franklin Resources Inc. raised its holdings in shares of ICU Medical, Inc. (NASDAQ:ICUI - Free Report) by 65.1% in the fourth quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 19,333 shares of the medical instruments supplier's stock after buying an additional 7,625 shares during the period. Franklin Resources Inc. owned about 0.08% of ICU Medical worth $3,000,000 as of its most recent SEC filing.

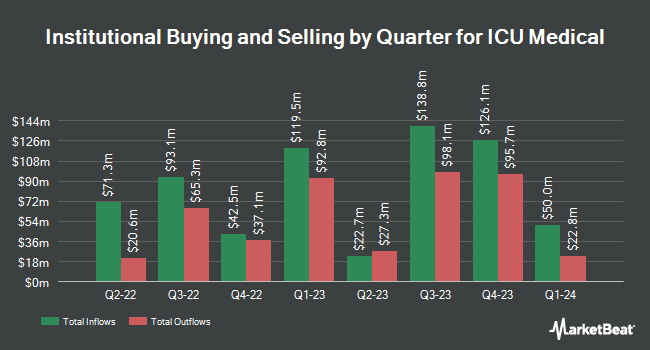

A number of other large investors have also recently added to or reduced their stakes in the business. Harvest Fund Management Co. Ltd bought a new stake in shares of ICU Medical during the 4th quarter worth $33,000. Murphy & Mullick Capital Management Corp acquired a new position in shares of ICU Medical in the 4th quarter valued at $52,000. Venturi Wealth Management LLC raised its holdings in ICU Medical by 64.0% during the 4th quarter. Venturi Wealth Management LLC now owns 528 shares of the medical instruments supplier's stock worth $82,000 after buying an additional 206 shares during the period. Smartleaf Asset Management LLC lifted its stake in ICU Medical by 166.8% during the fourth quarter. Smartleaf Asset Management LLC now owns 907 shares of the medical instruments supplier's stock valued at $140,000 after buying an additional 567 shares in the last quarter. Finally, OLD National Bancorp IN boosted its holdings in shares of ICU Medical by 22.0% in the fourth quarter. OLD National Bancorp IN now owns 1,462 shares of the medical instruments supplier's stock worth $227,000 after buying an additional 264 shares during the period. 96.10% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

ICUI has been the topic of several recent analyst reports. Needham & Company LLC reissued a "hold" rating on shares of ICU Medical in a research note on Tuesday, April 8th. Raymond James set a $97.00 price objective on ICU Medical in a research note on Wednesday, March 12th. Finally, StockNews.com raised ICU Medical from a "hold" rating to a "buy" rating in a research note on Friday, April 4th. One investment analyst has rated the stock with a hold rating, three have given a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, ICU Medical currently has an average rating of "Buy" and an average price target of $168.67.

Read Our Latest Stock Report on ICU Medical

ICU Medical Stock Down 0.6 %

NASDAQ ICUI traded down $0.90 on Tuesday, reaching $139.64. The stock had a trading volume of 148,529 shares, compared to its average volume of 269,288. The company has a current ratio of 2.29, a quick ratio of 1.03 and a debt-to-equity ratio of 0.75. ICU Medical, Inc. has a 1 year low of $93.36 and a 1 year high of $196.26. The business has a 50 day moving average price of $147.50 and a 200 day moving average price of $160.47. The company has a market capitalization of $3.42 billion, a price-to-earnings ratio of -30.56 and a beta of 0.86.

ICU Medical Company Profile

(

Free Report)

ICU Medical, Inc, together with its subsidiaries, develops, manufactures, and sells medical devices used in infusion therapy, vascular access, and vital care applications worldwide. Its infusion therapy products include needlefree products under the MicroClave, MicroClave Clear, and NanoClave brands; Neutron catheter patency devices; ChemoClave and ChemoLock closed system transfer devices, which are used to limit the escape of hazardous drugs or vapor concentrations, block the transfer of environmental contaminants into the system, and eliminates the risk of needlestick injury; Tego needle free connectors; Deltec GRIPPER non-coring needles for portal access; and ClearGuard, SwabCap, and SwabTip disinfection caps.

Read More

Before you consider ICU Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ICU Medical wasn't on the list.

While ICU Medical currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.