Franklin Resources Inc. lifted its stake in The Descartes Systems Group Inc. (NASDAQ:DSGX - Free Report) TSE: DSG by 3.1% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,367,946 shares of the technology company's stock after buying an additional 40,807 shares during the period. Franklin Resources Inc. owned about 1.60% of The Descartes Systems Group worth $142,693,000 at the end of the most recent reporting period.

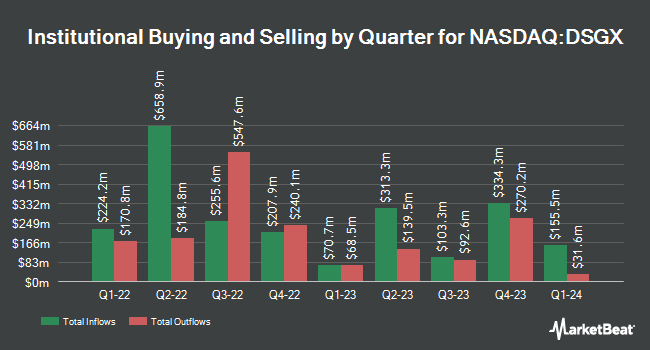

A number of other hedge funds and other institutional investors also recently made changes to their positions in DSGX. Avior Wealth Management LLC boosted its position in The Descartes Systems Group by 2.8% in the 3rd quarter. Avior Wealth Management LLC now owns 4,273 shares of the technology company's stock valued at $440,000 after buying an additional 117 shares during the last quarter. Legacy Wealth Asset Management LLC lifted its stake in The Descartes Systems Group by 3.8% in the third quarter. Legacy Wealth Asset Management LLC now owns 3,771 shares of the technology company's stock valued at $388,000 after buying an additional 137 shares during the period. Assenagon Asset Management S.A. boosted its holdings in The Descartes Systems Group by 4.3% during the second quarter. Assenagon Asset Management S.A. now owns 3,832 shares of the technology company's stock worth $371,000 after buying an additional 158 shares during the last quarter. Assetmark Inc. grew its position in shares of The Descartes Systems Group by 3.5% during the 3rd quarter. Assetmark Inc. now owns 5,839 shares of the technology company's stock worth $601,000 after buying an additional 197 shares during the period. Finally, Parkside Financial Bank & Trust increased its stake in shares of The Descartes Systems Group by 18.3% in the 2nd quarter. Parkside Financial Bank & Trust now owns 1,417 shares of the technology company's stock valued at $137,000 after acquiring an additional 219 shares during the last quarter. 77.73% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of research analysts recently issued reports on the stock. National Bankshares set a $125.00 price objective on shares of The Descartes Systems Group and gave the company an "outperform" rating in a report on Thursday, September 26th. Canaccord Genuity Group set a $108.00 target price on The Descartes Systems Group and gave the stock a "buy" rating in a report on Thursday, September 5th. StockNews.com downgraded The Descartes Systems Group from a "buy" rating to a "hold" rating in a report on Thursday. Royal Bank of Canada increased their target price on The Descartes Systems Group from $115.00 to $133.00 and gave the stock an "outperform" rating in a research note on Friday, November 29th. Finally, National Bank Financial raised shares of The Descartes Systems Group to a "strong-buy" rating in a research note on Wednesday, September 25th. Five analysts have rated the stock with a hold rating, nine have issued a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $114.17.

Read Our Latest Report on The Descartes Systems Group

The Descartes Systems Group Price Performance

NASDAQ DSGX traded down $0.46 on Monday, hitting $119.27. 163,769 shares of the stock were exchanged, compared to its average volume of 160,470. The business's fifty day moving average is $111.94 and its 200 day moving average is $103.05. The Descartes Systems Group Inc. has a 52 week low of $79.21 and a 52 week high of $122.88. The company has a market capitalization of $10.19 billion, a PE ratio of 75.01 and a beta of 0.98.

About The Descartes Systems Group

(

Free Report)

The Descartes Systems Group Inc provides cloud-based logistics and supply chain management solutions worldwide. Its Logistics Technology platform offers a range of modular, interoperable web and wireless logistics management solutions. The company provides a suite of solutions that include routing, mobile, and telematics; transportation management; ecommerce, shipping, and fulfillment; customs and regulatory compliance; global trade intelligence; broker and forwarder enterprise systems; and B2B messaging and connectivity services.

Read More

Before you consider The Descartes Systems Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Descartes Systems Group wasn't on the list.

While The Descartes Systems Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.