Franklin Resources Inc. grew its position in Zoom Video Communications, Inc. (NASDAQ:ZM - Free Report) by 53.6% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 331,782 shares of the company's stock after purchasing an additional 115,837 shares during the quarter. Franklin Resources Inc. owned approximately 0.11% of Zoom Video Communications worth $22,537,000 at the end of the most recent reporting period.

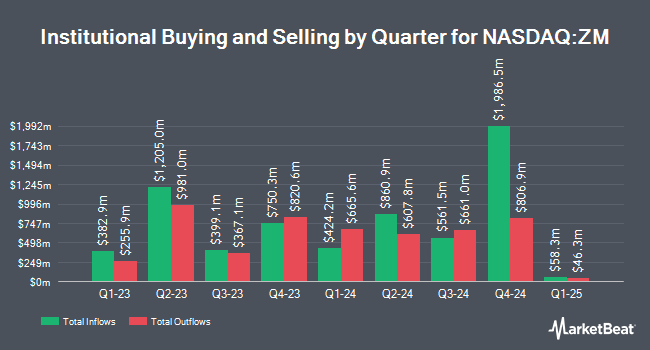

A number of other hedge funds and other institutional investors have also modified their holdings of ZM. Innealta Capital LLC purchased a new position in Zoom Video Communications in the second quarter valued at approximately $33,000. Truvestments Capital LLC purchased a new position in shares of Zoom Video Communications in the 3rd quarter valued at $37,000. Migdal Insurance & Financial Holdings Ltd. acquired a new stake in Zoom Video Communications during the 2nd quarter worth $41,000. Allworth Financial LP lifted its position in Zoom Video Communications by 43.8% in the third quarter. Allworth Financial LP now owns 591 shares of the company's stock valued at $41,000 after acquiring an additional 180 shares during the last quarter. Finally, Venturi Wealth Management LLC boosted its stake in Zoom Video Communications by 56.0% in the third quarter. Venturi Wealth Management LLC now owns 763 shares of the company's stock valued at $53,000 after acquiring an additional 274 shares in the last quarter. 66.54% of the stock is currently owned by institutional investors and hedge funds.

Zoom Video Communications Stock Up 1.8 %

Shares of NASDAQ ZM traded up $1.55 during midday trading on Friday, hitting $85.60. The stock had a trading volume of 5,020,837 shares, compared to its average volume of 3,338,576. Zoom Video Communications, Inc. has a 1-year low of $55.06 and a 1-year high of $92.80. The company has a market capitalization of $26.24 billion, a price-to-earnings ratio of 28.53, a PEG ratio of 5.29 and a beta of -0.03. The company has a fifty day moving average price of $79.55 and a 200 day moving average price of $68.37.

Analyst Ratings Changes

A number of research analysts have commented on ZM shares. Piper Sandler lifted their price objective on shares of Zoom Video Communications from $68.00 to $89.00 and gave the company a "neutral" rating in a research note on Tuesday, November 26th. Scotiabank upgraded Zoom Video Communications to a "hold" rating in a research report on Tuesday, November 19th. Mizuho increased their price objective on Zoom Video Communications from $90.00 to $105.00 and gave the stock an "outperform" rating in a research report on Tuesday, November 26th. Benchmark boosted their target price on Zoom Video Communications from $85.00 to $97.00 and gave the company a "buy" rating in a report on Tuesday, November 26th. Finally, UBS Group boosted their price objective on shares of Zoom Video Communications from $75.00 to $90.00 and gave the company a "neutral" rating in a research note on Tuesday, November 26th. Two analysts have rated the stock with a sell rating, fourteen have assigned a hold rating, eight have assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $87.10.

Check Out Our Latest Research Report on ZM

Insiders Place Their Bets

In other news, CAO Shane Crehan sold 2,478 shares of the firm's stock in a transaction dated Monday, October 7th. The stock was sold at an average price of $69.09, for a total transaction of $171,205.02. Following the completion of the sale, the chief accounting officer now directly owns 2,383 shares in the company, valued at $164,641.47. This trade represents a 50.98 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider Velchamy Sankarlingam sold 3,618 shares of the stock in a transaction dated Tuesday, December 10th. The shares were sold at an average price of $84.94, for a total value of $307,312.92. Following the completion of the transaction, the insider now directly owns 107,826 shares of the company's stock, valued at $9,158,740.44. This represents a 3.25 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 428,513 shares of company stock worth $32,366,914 over the last quarter. 10.78% of the stock is owned by corporate insiders.

Zoom Video Communications Company Profile

(

Free Report)

Zoom Video Communications, Inc provides unified communications platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. The company offers Zoom Meetings that offers HD video, voice, chat, and content sharing through mobile devices, desktops, laptops, telephones, and conference room systems; Zoom Phone, an enterprise cloud phone system; and Zoom Chat enables users to share messages, images, audio files, and content in desktop, laptop, tablet, and mobile devices.

Further Reading

Before you consider Zoom Video Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zoom Video Communications wasn't on the list.

While Zoom Video Communications currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.