Franklin Resources Inc. increased its holdings in shares of Snowflake Inc. (NYSE:SNOW - Free Report) by 1.4% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 536,588 shares of the company's stock after purchasing an additional 7,373 shares during the period. Franklin Resources Inc. owned approximately 0.16% of Snowflake worth $66,086,000 at the end of the most recent quarter.

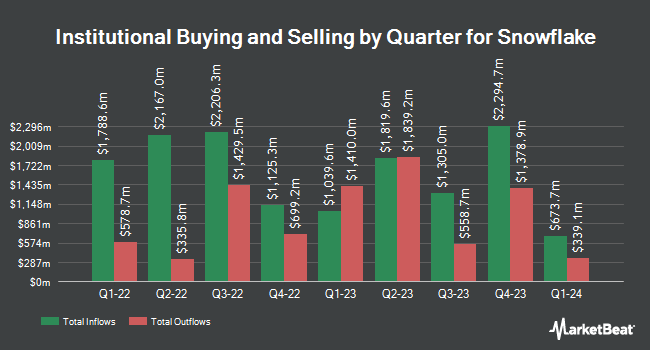

Several other institutional investors and hedge funds also recently made changes to their positions in SNOW. Synovus Financial Corp lifted its stake in Snowflake by 28.6% in the 3rd quarter. Synovus Financial Corp now owns 6,077 shares of the company's stock valued at $698,000 after acquiring an additional 1,352 shares in the last quarter. Blankinship & Foster LLC acquired a new position in Snowflake during the third quarter valued at approximately $896,000. Wilmington Savings Fund Society FSB grew its stake in shares of Snowflake by 50.3% in the third quarter. Wilmington Savings Fund Society FSB now owns 4,659 shares of the company's stock valued at $535,000 after buying an additional 1,559 shares in the last quarter. Sanctuary Advisors LLC increased its stake in shares of Snowflake by 2.1% during the 3rd quarter. Sanctuary Advisors LLC now owns 25,328 shares of the company's stock worth $2,909,000 after purchasing an additional 514 shares during the last quarter. Finally, Westside Investment Management Inc. raised its stake in Snowflake by 47.4% in the third quarter. Westside Investment Management Inc. now owns 12,344 shares of the company's stock valued at $1,438,000 after buying an additional 3,971 shares during the period. Institutional investors and hedge funds own 65.10% of the company's stock.

Analysts Set New Price Targets

Several brokerages have recently weighed in on SNOW. Loop Capital dropped their price objective on shares of Snowflake from $225.00 to $185.00 and set a "buy" rating on the stock in a research report on Wednesday, August 21st. Hsbc Global Res raised shares of Snowflake from a "moderate sell" rating to a "hold" rating in a research report on Friday, August 23rd. KeyCorp raised their price target on shares of Snowflake from $185.00 to $210.00 and gave the stock an "overweight" rating in a research report on Thursday, December 5th. HSBC raised shares of Snowflake from a "reduce" rating to a "hold" rating and boosted their price objective for the company from $119.00 to $121.00 in a report on Friday, August 23rd. Finally, Robert W. Baird decreased their target price on shares of Snowflake from $200.00 to $165.00 and set an "outperform" rating on the stock in a report on Tuesday, August 20th. Two research analysts have rated the stock with a sell rating, ten have assigned a hold rating and twenty-seven have issued a buy rating to the stock. According to data from MarketBeat.com, Snowflake has an average rating of "Moderate Buy" and an average target price of $184.46.

Read Our Latest Stock Report on Snowflake

Insider Buying and Selling at Snowflake

In other news, Director Frank Slootman sold 1,712 shares of the stock in a transaction dated Tuesday, December 10th. The shares were sold at an average price of $179.00, for a total transaction of $306,448.00. Following the transaction, the director now directly owns 205,965 shares in the company, valued at $36,867,735. This represents a 0.82 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, CAO Emily Ho sold 2,021 shares of the company's stock in a transaction on Monday, November 25th. The stock was sold at an average price of $173.68, for a total value of $351,007.28. Following the sale, the chief accounting officer now owns 26,874 shares of the company's stock, valued at approximately $4,667,476.32. The trade was a 6.99 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 283,158 shares of company stock valued at $46,709,467. Insiders own 7.80% of the company's stock.

Snowflake Price Performance

SNOW stock traded down $1.66 during trading on Tuesday, reaching $170.81. 5,052,623 shares of the company were exchanged, compared to its average volume of 6,793,485. The company has a market cap of $56.38 billion, a P/E ratio of -50.51 and a beta of 1.03. The company has a debt-to-equity ratio of 0.77, a quick ratio of 1.88 and a current ratio of 1.88. The stock's 50 day moving average price is $140.12 and its 200 day moving average price is $129.75. Snowflake Inc. has a 52-week low of $107.13 and a 52-week high of $237.72.

Snowflake Profile

(

Free Report)

Snowflake Inc provides a cloud-based data platform for various organizations in the United States and internationally. Its platform offers Data Cloud, which enables customers to consolidate data into a single source of truth to drive meaningful business insights, build data-driven applications, and share data and data products, as well as applies artificial intelligence (AI) for solving business problems.

Read More

Before you consider Snowflake, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Snowflake wasn't on the list.

While Snowflake currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.