Franklin Resources Inc. lessened its stake in shares of On Holding AG (NYSE:ONON - Free Report) by 5.1% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 991,247 shares of the company's stock after selling 53,694 shares during the period. Franklin Resources Inc. owned approximately 0.16% of ON worth $49,556,000 at the end of the most recent reporting period.

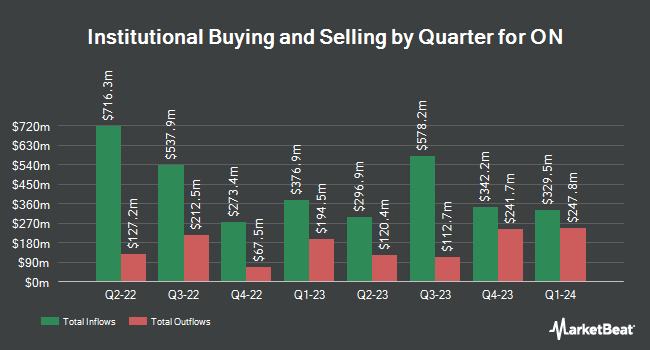

Other institutional investors have also recently made changes to their positions in the company. Envestnet Portfolio Solutions Inc. lifted its stake in ON by 48.4% during the 2nd quarter. Envestnet Portfolio Solutions Inc. now owns 18,284 shares of the company's stock valued at $709,000 after acquiring an additional 5,964 shares during the period. Raymond James & Associates raised its stake in ON by 7.8% during the 2nd quarter. Raymond James & Associates now owns 208,125 shares of the company's stock valued at $8,075,000 after buying an additional 15,011 shares during the last quarter. Calamos Advisors LLC lifted its holdings in shares of ON by 63.7% during the 2nd quarter. Calamos Advisors LLC now owns 40,808 shares of the company's stock valued at $1,583,000 after buying an additional 15,883 shares during the period. WD Rutherford LLC lifted its holdings in shares of ON by 155.0% during the 2nd quarter. WD Rutherford LLC now owns 3,748 shares of the company's stock valued at $145,000 after buying an additional 2,278 shares during the period. Finally, SlateStone Wealth LLC boosted its stake in shares of ON by 4.1% in the 2nd quarter. SlateStone Wealth LLC now owns 24,820 shares of the company's stock worth $963,000 after buying an additional 975 shares during the last quarter. Hedge funds and other institutional investors own 36.39% of the company's stock.

ON Stock Performance

ONON stock traded down $0.30 during trading on Wednesday, reaching $56.34. 416,754 shares of the company traded hands, compared to its average volume of 4,794,030. The company has a market capitalization of $35.47 billion, a price-to-earnings ratio of 131.67 and a beta of 2.30. The business has a 50 day simple moving average of $52.77 and a 200 day simple moving average of $46.38. On Holding AG has a 12 month low of $25.78 and a 12 month high of $60.12.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently issued reports on ONON shares. Robert W. Baird boosted their price objective on shares of ON from $55.00 to $63.00 and gave the company an "outperform" rating in a research report on Wednesday, November 13th. Raymond James upgraded ON from an "outperform" rating to a "strong-buy" rating and boosted their price objective for the company from $58.00 to $63.00 in a research note on Thursday, November 21st. Telsey Advisory Group restated an "outperform" rating and set a $53.00 target price on shares of ON in a research note on Tuesday, November 12th. Hsbc Global Res raised shares of ON to a "hold" rating in a report on Thursday, September 5th. Finally, HSBC began coverage on ON in a research report on Thursday, September 5th. They issued a "hold" rating and a $52.00 target price on the stock. Five equities research analysts have rated the stock with a hold rating, eighteen have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $56.77.

View Our Latest Stock Report on ON

About ON

(

Free Report)

On Holding AG engages in the development and distribution of sports products worldwide. The company offers athletic footwear, apparel, and accessories for high-performance running, outdoor, training, all-day activities, and tennis. It offers its products through independent retailers and distributors, online, and stores.

Read More

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.