Franklin Resources Inc. lowered its stake in shares of DTE Energy (NYSE:DTE - Free Report) by 7.3% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 2,046,010 shares of the utilities provider's stock after selling 161,786 shares during the period. Franklin Resources Inc. owned approximately 0.99% of DTE Energy worth $256,938,000 at the end of the most recent reporting period.

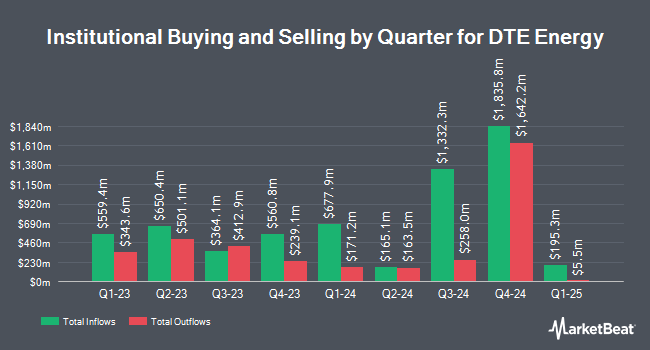

Other hedge funds also recently made changes to their positions in the company. Legacy Investment Solutions LLC purchased a new position in DTE Energy in the third quarter valued at about $30,000. Prospera Private Wealth LLC acquired a new stake in shares of DTE Energy during the 3rd quarter valued at approximately $35,000. Ashton Thomas Securities LLC bought a new position in DTE Energy during the third quarter worth $35,000. Ridgewood Investments LLC acquired a new stake in shares of DTE Energy during the second quarter worth $31,000. Finally, Coastline Trust Co bought a new position in DTE Energy in the third quarter worth about $39,000. Institutional investors and hedge funds own 76.06% of the company's stock.

DTE Energy Stock Up 0.4 %

Shares of DTE stock traded up $0.50 on Friday, hitting $121.28. The company's stock had a trading volume of 1,439,497 shares, compared to its average volume of 1,128,490. The company has a debt-to-equity ratio of 1.76, a current ratio of 0.83 and a quick ratio of 0.62. The stock has a market capitalization of $25.12 billion, a price-to-earnings ratio of 16.43, a P/E/G ratio of 2.23 and a beta of 0.68. DTE Energy has a fifty-two week low of $102.17 and a fifty-two week high of $131.66. The firm's fifty day moving average price is $123.71 and its 200-day moving average price is $120.52.

DTE Energy Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Monday, December 16th will be given a $1.09 dividend. This is an increase from DTE Energy's previous quarterly dividend of $1.02. This represents a $4.36 annualized dividend and a yield of 3.59%. The ex-dividend date is Monday, December 16th. DTE Energy's payout ratio is currently 59.08%.

Analyst Upgrades and Downgrades

DTE has been the topic of a number of recent analyst reports. Wells Fargo & Company lifted their price target on DTE Energy from $133.00 to $145.00 and gave the company an "overweight" rating in a report on Friday, October 25th. Scotiabank lifted their target price on DTE Energy from $137.00 to $147.00 and gave the company a "sector outperform" rating in a research note on Thursday. StockNews.com upgraded shares of DTE Energy from a "sell" rating to a "hold" rating in a research note on Tuesday, November 5th. Barclays increased their target price on shares of DTE Energy from $128.00 to $137.00 and gave the company an "overweight" rating in a research report on Monday, October 7th. Finally, KeyCorp cut shares of DTE Energy from an "overweight" rating to a "sector weight" rating in a research note on Wednesday, December 4th. Seven investment analysts have rated the stock with a hold rating and eight have given a buy rating to the company. According to MarketBeat, DTE Energy currently has a consensus rating of "Moderate Buy" and an average target price of $134.31.

View Our Latest Report on DTE

DTE Energy Profile

(

Free Report)

DTE Energy Company engages in the utility operations. The company's Electric segment generates, purchases, distributes, and sells electricity to various residential, commercial, and industrial customers in southeastern Michigan. It generates electricity through coal-fired plants, hydroelectric pumped storage, and nuclear plants, as well as wind and solar assets.

Read More

Before you consider DTE Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DTE Energy wasn't on the list.

While DTE Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.