Franklin Resources Inc. boosted its position in shares of Capital Southwest Co. (NASDAQ:CSWC - Free Report) by 34.6% during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 207,330 shares of the asset manager's stock after purchasing an additional 53,292 shares during the period. Franklin Resources Inc. owned about 0.41% of Capital Southwest worth $4,524,000 as of its most recent SEC filing.

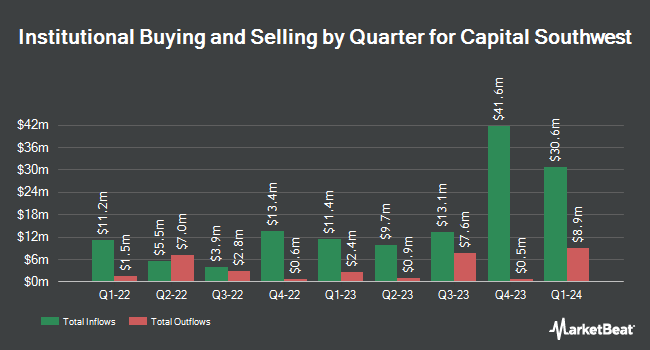

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Brown Brothers Harriman & Co. bought a new stake in shares of Capital Southwest during the 4th quarter worth approximately $59,000. Nomura Asset Management Co. Ltd. boosted its stake in shares of Capital Southwest by 243.2% during the fourth quarter. Nomura Asset Management Co. Ltd. now owns 2,217 shares of the asset manager's stock valued at $48,000 after purchasing an additional 1,571 shares during the period. JPMorgan Chase & Co. increased its stake in Capital Southwest by 934.8% in the 4th quarter. JPMorgan Chase & Co. now owns 39,259 shares of the asset manager's stock worth $857,000 after buying an additional 35,465 shares during the period. Samalin Investment Counsel LLC increased its stake in Capital Southwest by 10.9% in the 4th quarter. Samalin Investment Counsel LLC now owns 22,704 shares of the asset manager's stock worth $495,000 after buying an additional 2,228 shares during the period. Finally, Quantbot Technologies LP boosted its position in Capital Southwest by 190.1% in the 4th quarter. Quantbot Technologies LP now owns 36,631 shares of the asset manager's stock valued at $799,000 after buying an additional 24,006 shares during the period. 23.42% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Separately, StockNews.com lowered Capital Southwest from a "hold" rating to a "sell" rating in a research report on Friday, April 11th.

View Our Latest Research Report on Capital Southwest

Capital Southwest Stock Down 0.0 %

NASDAQ:CSWC traded down $0.01 during midday trading on Wednesday, reaching $19.75. 62,464 shares of the stock traded hands, compared to its average volume of 412,770. The stock has a market capitalization of $998.74 million, a PE ratio of 14.01 and a beta of 0.99. Capital Southwest Co. has a 12-month low of $17.46 and a 12-month high of $27.23. The company has a debt-to-equity ratio of 0.64, a quick ratio of 0.18 and a current ratio of 0.18. The business has a 50-day moving average of $22.00 and a two-hundred day moving average of $22.77.

Capital Southwest (NASDAQ:CSWC - Get Free Report) last posted its quarterly earnings data on Monday, February 3rd. The asset manager reported $0.63 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.62 by $0.01. Capital Southwest had a net margin of 33.49% and a return on equity of 15.18%. On average, equities analysts forecast that Capital Southwest Co. will post 2.54 earnings per share for the current fiscal year.

Capital Southwest Cuts Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, March 31st. Stockholders of record on Friday, March 14th were issued a $0.58 dividend. The ex-dividend date was Friday, March 14th. This represents a $2.32 annualized dividend and a dividend yield of 11.75%. Capital Southwest's dividend payout ratio (DPR) is presently 164.54%.

Capital Southwest Profile

(

Free Report)

Capital Southwest Corporation is a business development company specializing in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, industry consolidation, recapitalizations and growth capital investments.

Read More

Before you consider Capital Southwest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Capital Southwest wasn't on the list.

While Capital Southwest currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.