Franklin Resources Inc. boosted its position in shares of eBay Inc. (NASDAQ:EBAY - Free Report) by 14.5% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 784,378 shares of the e-commerce company's stock after buying an additional 99,561 shares during the quarter. Franklin Resources Inc. owned 0.16% of eBay worth $52,459,000 as of its most recent filing with the Securities & Exchange Commission.

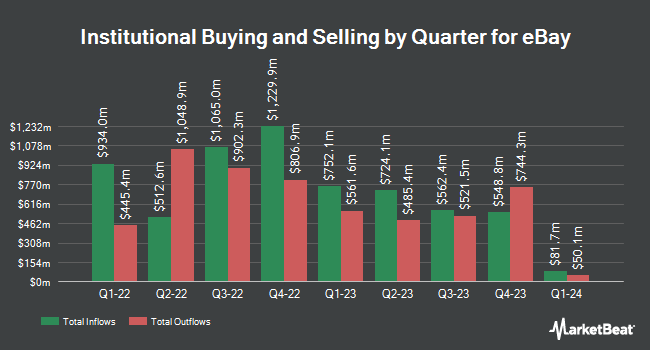

Other hedge funds have also bought and sold shares of the company. Sumitomo Mitsui DS Asset Management Company Ltd boosted its holdings in eBay by 0.3% during the 3rd quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 52,494 shares of the e-commerce company's stock valued at $3,418,000 after acquiring an additional 153 shares during the period. Optas LLC lifted its holdings in eBay by 0.5% during the 3rd quarter. Optas LLC now owns 34,082 shares of the e-commerce company's stock valued at $2,219,000 after buying an additional 171 shares in the last quarter. Davis Investment Partners LLC boosted its position in eBay by 0.8% in the 3rd quarter. Davis Investment Partners LLC now owns 23,475 shares of the e-commerce company's stock valued at $1,531,000 after buying an additional 180 shares during the period. Arvest Investments Inc. boosted its position in eBay by 1.2% in the 3rd quarter. Arvest Investments Inc. now owns 15,205 shares of the e-commerce company's stock valued at $990,000 after buying an additional 183 shares during the period. Finally, Marco Investment Management LLC grew its stake in eBay by 2.0% in the 3rd quarter. Marco Investment Management LLC now owns 10,335 shares of the e-commerce company's stock worth $673,000 after acquiring an additional 200 shares in the last quarter. Institutional investors own 87.48% of the company's stock.

eBay Trading Down 0.2 %

NASDAQ EBAY traded down $0.12 on Wednesday, reaching $64.11. 7,134,088 shares of the company were exchanged, compared to its average volume of 5,300,177. The company has a current ratio of 1.25, a quick ratio of 1.25 and a debt-to-equity ratio of 1.14. The business's fifty day moving average price is $63.19 and its 200 day moving average price is $59.37. The stock has a market capitalization of $30.71 billion, a P/E ratio of 16.11, a price-to-earnings-growth ratio of 2.20 and a beta of 1.35. eBay Inc. has a fifty-two week low of $40.16 and a fifty-two week high of $67.80.

eBay Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, December 13th. Investors of record on Friday, November 29th were issued a $0.27 dividend. This represents a $1.08 dividend on an annualized basis and a dividend yield of 1.68%. The ex-dividend date was Friday, November 29th. eBay's dividend payout ratio is currently 27.14%.

Insider Buying and Selling

In other eBay news, CFO Stephen J. Priest sold 1,167 shares of the company's stock in a transaction dated Wednesday, October 16th. The stock was sold at an average price of $66.63, for a total transaction of $77,757.21. Following the sale, the chief financial officer now owns 65,079 shares in the company, valued at $4,336,213.77. This represents a 1.76 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CEO Jamie Iannone sold 5,625 shares of the business's stock in a transaction dated Monday, October 7th. The stock was sold at an average price of $66.56, for a total value of $374,400.00. Following the transaction, the chief executive officer now directly owns 553,666 shares of the company's stock, valued at approximately $36,852,008.96. This represents a 1.01 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 32,908 shares of company stock worth $2,110,731. Insiders own 0.38% of the company's stock.

Analysts Set New Price Targets

A number of analysts recently issued reports on EBAY shares. Cantor Fitzgerald reiterated a "neutral" rating and issued a $62.00 price target on shares of eBay in a report on Monday, October 7th. JPMorgan Chase & Co. lowered their target price on eBay from $60.00 to $58.00 and set a "neutral" rating for the company in a report on Friday, November 1st. The Goldman Sachs Group raised their price target on eBay from $46.00 to $55.00 and gave the company a "sell" rating in a research note on Tuesday, October 15th. Stifel Nicolaus lifted their price objective on eBay from $56.00 to $64.00 and gave the company a "hold" rating in a report on Monday, October 28th. Finally, UBS Group dropped their price objective on shares of eBay from $72.00 to $66.00 and set a "neutral" rating on the stock in a research note on Thursday, October 31st. Two equities research analysts have rated the stock with a sell rating, seventeen have issued a hold rating and nine have assigned a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $62.63.

Check Out Our Latest Report on eBay

eBay Profile

(

Free Report)

eBay Inc, together with its subsidiaries, operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally. The company's marketplace platform includes its online marketplace at ebay.com, off-platform businesses, and the eBay suite of mobile apps.

Read More

Before you consider eBay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and eBay wasn't on the list.

While eBay currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.