Franklin Resources (NYSE:BEN - Get Free Report) had its target price boosted by analysts at Barclays from $19.00 to $21.00 in a research note issued to investors on Monday,Benzinga reports. The firm presently has an "underweight" rating on the closed-end fund's stock. Barclays's price target would indicate a potential downside of 5.87% from the company's previous close.

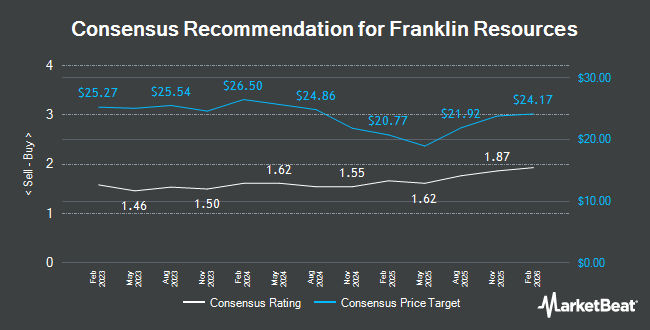

Other equities research analysts have also issued reports about the company. Keefe, Bruyette & Woods reaffirmed an "underperform" rating and issued a $19.00 price objective (down from $20.00) on shares of Franklin Resources in a research note on Tuesday, November 5th. UBS Group lowered their price target on Franklin Resources from $24.00 to $21.00 and set a "neutral" rating for the company in a research report on Tuesday, October 22nd. Morgan Stanley cut their price objective on shares of Franklin Resources from $21.00 to $19.00 and set an "underweight" rating on the stock in a research report on Friday, October 18th. StockNews.com upgraded shares of Franklin Resources from a "sell" rating to a "hold" rating in a report on Thursday, November 14th. Finally, Wells Fargo & Company lifted their price target on shares of Franklin Resources from $19.00 to $19.50 and gave the stock an "equal weight" rating in a research note on Tuesday, November 5th. Five analysts have rated the stock with a sell rating and seven have issued a hold rating to the company's stock. According to MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $20.39.

View Our Latest Analysis on Franklin Resources

Franklin Resources Price Performance

BEN traded up $0.39 during trading hours on Monday, hitting $22.31. The company's stock had a trading volume of 4,161,150 shares, compared to its average volume of 4,020,220. The stock has a market cap of $11.68 billion, a price-to-earnings ratio of 25.49, a P/E/G ratio of 2.38 and a beta of 1.39. The business's 50-day moving average price is $21.06 and its 200-day moving average price is $21.62. The company has a current ratio of 1.63, a quick ratio of 1.63 and a debt-to-equity ratio of 0.92. Franklin Resources has a 12 month low of $18.94 and a 12 month high of $30.32.

Franklin Resources (NYSE:BEN - Get Free Report) last posted its earnings results on Monday, November 4th. The closed-end fund reported $0.59 earnings per share for the quarter, missing analysts' consensus estimates of $0.60 by ($0.01). Franklin Resources had a return on equity of 9.62% and a net margin of 5.48%. The business had revenue of $2.21 billion during the quarter, compared to the consensus estimate of $1.70 billion. During the same quarter last year, the firm earned $0.84 earnings per share. The business's quarterly revenue was up 11.3% on a year-over-year basis. Sell-side analysts expect that Franklin Resources will post 2.39 earnings per share for the current fiscal year.

Insider Activity at Franklin Resources

In other Franklin Resources news, major shareholder Charles B. Johnson bought 100,000 shares of the company's stock in a transaction on Wednesday, September 11th. The shares were bought at an average cost of $19.08 per share, for a total transaction of $1,908,000.00. Following the acquisition, the insider now directly owns 89,308,192 shares in the company, valued at approximately $1,704,000,303.36. The trade was a 0.11 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, insider Franklin Resources Inc sold 8,467 shares of the business's stock in a transaction dated Wednesday, October 16th. The shares were sold at an average price of $43.69, for a total transaction of $369,923.23. Following the completion of the sale, the insider now owns 51,019 shares of the company's stock, valued at approximately $2,229,020.11. This represents a 14.23 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 24,024 shares of company stock worth $1,051,375. Company insiders own 24.13% of the company's stock.

Institutional Trading of Franklin Resources

A number of hedge funds have recently bought and sold shares of BEN. AQR Capital Management LLC raised its position in shares of Franklin Resources by 250.7% in the 2nd quarter. AQR Capital Management LLC now owns 2,450,190 shares of the closed-end fund's stock worth $54,664,000 after acquiring an additional 1,751,587 shares in the last quarter. Marshall Wace LLP grew its stake in Franklin Resources by 517.5% in the second quarter. Marshall Wace LLP now owns 1,406,324 shares of the closed-end fund's stock valued at $31,431,000 after purchasing an additional 1,178,594 shares during the last quarter. Charles Schwab Investment Management Inc. raised its holdings in Franklin Resources by 44.7% in the third quarter. Charles Schwab Investment Management Inc. now owns 2,998,574 shares of the closed-end fund's stock worth $60,421,000 after purchasing an additional 925,590 shares in the last quarter. Millennium Management LLC lifted its position in shares of Franklin Resources by 110.3% during the second quarter. Millennium Management LLC now owns 1,623,236 shares of the closed-end fund's stock valued at $36,279,000 after buying an additional 851,442 shares during the last quarter. Finally, Squarepoint Ops LLC boosted its holdings in shares of Franklin Resources by 325.1% in the 2nd quarter. Squarepoint Ops LLC now owns 906,270 shares of the closed-end fund's stock valued at $20,255,000 after buying an additional 693,074 shares in the last quarter. Hedge funds and other institutional investors own 47.56% of the company's stock.

About Franklin Resources

(

Get Free Report)

Franklin Resources, Inc is a publicly owned asset management holding company. Through its subsidiaries, the firm provides its services to individuals, institutions, pension plans, trusts, and partnerships. It launches equity, fixed income, balanced, and multi-asset mutual funds through its subsidiaries.

See Also

Before you consider Franklin Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Franklin Resources wasn't on the list.

While Franklin Resources currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.