Frazier Financial Advisors LLC lowered its stake in shares of Accenture plc (NYSE:ACN - Free Report) by 35.2% during the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 12,971 shares of the information technology services provider's stock after selling 7,058 shares during the period. Accenture accounts for 3.6% of Frazier Financial Advisors LLC's investment portfolio, making the stock its 6th largest position. Frazier Financial Advisors LLC's holdings in Accenture were worth $4,585,000 as of its most recent filing with the SEC.

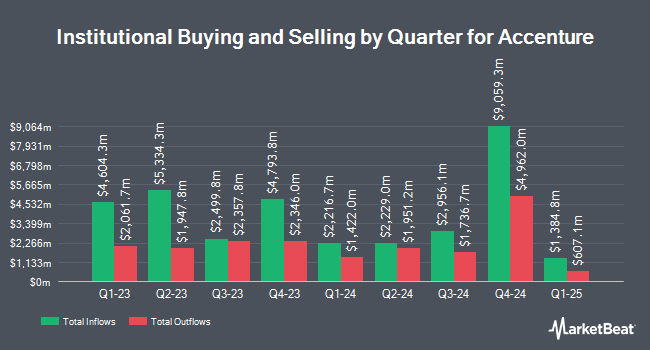

Several other institutional investors have also modified their holdings of the stock. Swedbank AB purchased a new position in shares of Accenture during the 1st quarter worth $820,912,000. Clearbridge Investments LLC boosted its stake in Accenture by 44.7% during the second quarter. Clearbridge Investments LLC now owns 2,709,989 shares of the information technology services provider's stock worth $822,238,000 after buying an additional 837,677 shares during the period. 1832 Asset Management L.P. increased its position in shares of Accenture by 251.3% during the second quarter. 1832 Asset Management L.P. now owns 995,896 shares of the information technology services provider's stock valued at $302,165,000 after acquiring an additional 712,400 shares during the last quarter. Capital International Investors lifted its holdings in shares of Accenture by 196.5% in the 1st quarter. Capital International Investors now owns 988,094 shares of the information technology services provider's stock worth $342,483,000 after acquiring an additional 654,807 shares during the last quarter. Finally, International Assets Investment Management LLC boosted its position in shares of Accenture by 37,788.5% during the 3rd quarter. International Assets Investment Management LLC now owns 510,358 shares of the information technology services provider's stock worth $180,401,000 after purchasing an additional 509,011 shares during the period. Hedge funds and other institutional investors own 75.14% of the company's stock.

Analysts Set New Price Targets

ACN has been the topic of a number of research reports. Mizuho upped their price target on Accenture from $352.00 to $365.00 and gave the stock an "outperform" rating in a research note on Wednesday, September 18th. Piper Sandler upgraded Accenture from a "neutral" rating to an "overweight" rating and raised their target price for the company from $329.00 to $395.00 in a report on Thursday, September 26th. Bank of America increased their price target on shares of Accenture from $365.00 to $388.00 and gave the stock a "buy" rating in a research report on Friday, September 27th. UBS Group upped their target price on shares of Accenture from $400.00 to $415.00 and gave the stock a "buy" rating in a research note on Friday, September 27th. Finally, TD Cowen upgraded shares of Accenture from a "hold" rating to a "buy" rating and increased their target price for the stock from $321.00 to $400.00 in a report on Monday, September 30th. Ten analysts have rated the stock with a hold rating and thirteen have given a buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $368.23.

Check Out Our Latest Stock Analysis on Accenture

Accenture Stock Down 2.3 %

Accenture stock traded down $8.50 during mid-day trading on Friday, hitting $353.57. The company had a trading volume of 3,624,539 shares, compared to its average volume of 2,555,959. The stock has a market cap of $221.04 billion, a price-to-earnings ratio of 30.93, a PEG ratio of 3.09 and a beta of 1.25. Accenture plc has a 1 year low of $278.69 and a 1 year high of $387.51. The business has a fifty day moving average of $355.55 and a 200 day moving average of $327.26.

Accenture (NYSE:ACN - Get Free Report) last announced its quarterly earnings results on Thursday, September 26th. The information technology services provider reported $2.79 EPS for the quarter, topping the consensus estimate of $2.78 by $0.01. Accenture had a net margin of 11.20% and a return on equity of 26.83%. The firm had revenue of $16.41 billion for the quarter, compared to analyst estimates of $16.37 billion. During the same period last year, the business earned $2.71 EPS. Accenture's revenue for the quarter was up 2.6% compared to the same quarter last year. Equities analysts anticipate that Accenture plc will post 12.77 earnings per share for the current year.

Accenture Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, November 15th. Shareholders of record on Thursday, October 10th were given a dividend of $1.48 per share. This is a positive change from Accenture's previous quarterly dividend of $1.29. The ex-dividend date was Thursday, October 10th. This represents a $5.92 annualized dividend and a yield of 1.67%. Accenture's payout ratio is 51.79%.

Accenture announced that its Board of Directors has initiated a share buyback program on Thursday, September 26th that permits the company to buyback $4.00 billion in outstanding shares. This buyback authorization permits the information technology services provider to reacquire up to 1.8% of its stock through open market purchases. Stock buyback programs are usually an indication that the company's board believes its shares are undervalued.

Insider Buying and Selling at Accenture

In other news, insider Angela Beatty sold 673 shares of the stock in a transaction dated Tuesday, October 22nd. The shares were sold at an average price of $372.18, for a total value of $250,477.14. Following the completion of the transaction, the insider now owns 5,650 shares in the company, valued at $2,102,817. This trade represents a 10.64 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CAO Melissa A. Burgum sold 458 shares of Accenture stock in a transaction on Thursday, October 17th. The stock was sold at an average price of $373.25, for a total value of $170,948.50. Following the transaction, the chief accounting officer now directly owns 9,777 shares of the company's stock, valued at approximately $3,649,265.25. This represents a 4.47 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 36,298 shares of company stock worth $13,372,661. 0.07% of the stock is owned by insiders.

Accenture Profile

(

Free Report)

Accenture plc, a professional services company, provides strategy and consulting, industry X, song, and technology and operation services worldwide. The company offers application services, including agile transformation, DevOps, application modernization, enterprise architecture, software and quality engineering, data management; intelligent automation comprising robotic process automation, natural language processing, and virtual agents; and application management services, as well as software engineering services; strategy and consulting services; data and analytics strategy, data discovery and augmentation, data management and beyond, data democratization, and industrialized solutions comprising turnkey analytics and artificial intelligence (AI) solutions; metaverse; and sustainability services.

Recommended Stories

Before you consider Accenture, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Accenture wasn't on the list.

While Accenture currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report