Fred Alger Management LLC trimmed its holdings in Codexis, Inc. (NASDAQ:CDXS - Free Report) by 64.0% in the third quarter, according to its most recent disclosure with the SEC. The fund owned 125,916 shares of the biotechnology company's stock after selling 223,574 shares during the period. Fred Alger Management LLC owned 0.15% of Codexis worth $388,000 at the end of the most recent reporting period.

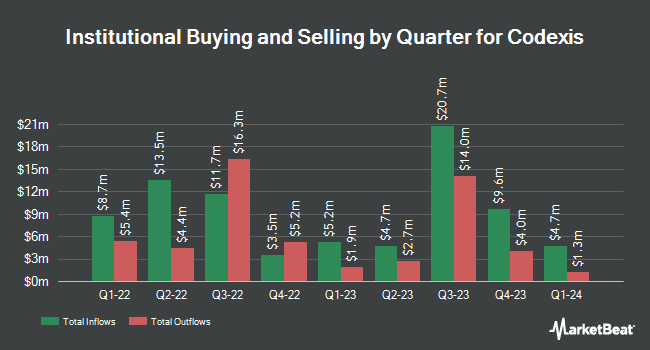

A number of other hedge funds and other institutional investors have also recently made changes to their positions in the stock. Los Angeles Capital Management LLC purchased a new stake in shares of Codexis during the second quarter worth approximately $54,000. Intech Investment Management LLC acquired a new stake in shares of Codexis in the 3rd quarter worth $66,000. Marshall Wace LLP acquired a new stake in Codexis in the second quarter valued at about $89,000. SG Americas Securities LLC boosted its holdings in Codexis by 72.6% in the 2nd quarter. SG Americas Securities LLC now owns 36,677 shares of the biotechnology company's stock valued at $114,000 after purchasing an additional 15,425 shares in the last quarter. Finally, Algert Global LLC increased its position in Codexis by 17.1% during the 2nd quarter. Algert Global LLC now owns 41,556 shares of the biotechnology company's stock worth $129,000 after purchasing an additional 6,069 shares during the period. Hedge funds and other institutional investors own 78.54% of the company's stock.

Codexis Price Performance

Shares of CDXS traded up $0.14 on Monday, reaching $4.72. The stock had a trading volume of 484,617 shares, compared to its average volume of 541,034. Codexis, Inc. has a twelve month low of $1.85 and a twelve month high of $4.91. The firm has a market capitalization of $384.10 million, a PE ratio of -5.47 and a beta of 2.07. The firm has a 50-day moving average of $3.56 and a 200 day moving average of $3.29. The company has a quick ratio of 3.15, a current ratio of 3.21 and a debt-to-equity ratio of 0.39.

Codexis (NASDAQ:CDXS - Get Free Report) last posted its earnings results on Thursday, October 31st. The biotechnology company reported ($0.29) earnings per share for the quarter, missing the consensus estimate of ($0.25) by ($0.04). Codexis had a negative net margin of 96.35% and a negative return on equity of 71.56%. The firm had revenue of $12.83 million during the quarter, compared to analyst estimates of $11.64 million. During the same period last year, the company posted ($0.26) EPS. Sell-side analysts expect that Codexis, Inc. will post -0.76 EPS for the current year.

Insider Activity

In other news, major shareholder Opaleye Management Inc. purchased 1,055,000 shares of the firm's stock in a transaction on Friday, September 20th. The shares were bought at an average cost of $3.01 per share, with a total value of $3,175,550.00. Following the purchase, the insider now directly owns 8,390,000 shares of the company's stock, valued at approximately $25,253,900. This trade represents a 14.38 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Insiders have acquired 1,166,000 shares of company stock worth $3,514,910 over the last ninety days. 2.10% of the stock is currently owned by insiders.

Analyst Ratings Changes

A number of analysts recently weighed in on CDXS shares. Benchmark restated a "hold" rating on shares of Codexis in a research note on Monday, November 4th. Cantor Fitzgerald restated an "overweight" rating and set a $11.00 target price on shares of Codexis in a research report on Friday, November 22nd.

View Our Latest Report on CDXS

Codexis Profile

(

Free Report)

Codexis, Inc discovers, develops, and sells enzymes and other proteins. The company operates through two segments, Performance Enzymes and Novel Biotherapeutics. It offers biocatalyst products and services. The company also provides biocatalyst screening and protein engineering services. In addition, it offers CodeEvolver, a technology platform, which helps in developing and delivering biocatalysts that perform chemical transformations and enhance the efficiency and productivity of manufacturing processes.

Featured Articles

Before you consider Codexis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Codexis wasn't on the list.

While Codexis currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.