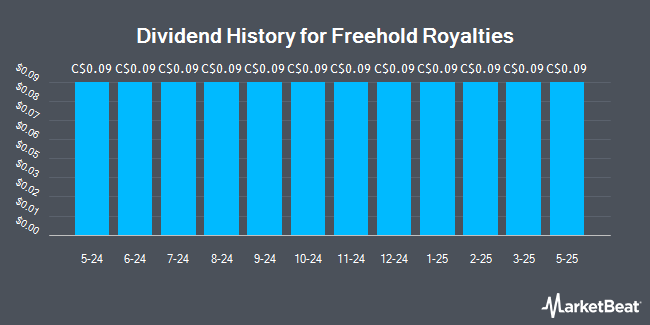

Freehold Royalties Ltd. (TSE:FRU - Get Free Report) declared a monthly dividend on Thursday, November 7th,Zacks Dividends reports. Shareholders of record on Friday, November 29th will be paid a dividend of 0.09 per share on Monday, December 16th. This represents a $1.08 dividend on an annualized basis and a dividend yield of 7.86%. The ex-dividend date is Friday, November 29th.

Freehold Royalties Price Performance

Shares of FRU traded down C$0.10 during trading hours on Friday, hitting C$13.74. 445,400 shares of the stock were exchanged, compared to its average volume of 439,435. The stock's 50-day moving average price is C$13.84 and its two-hundred day moving average price is C$13.85. Freehold Royalties has a 12-month low of C$12.66 and a 12-month high of C$15.06. The company has a debt-to-equity ratio of 24.83, a quick ratio of 1.50 and a current ratio of 2.05. The company has a market cap of C$2.07 billion, a price-to-earnings ratio of 13.74, a price-to-earnings-growth ratio of -0.92 and a beta of 1.93.

Wall Street Analyst Weigh In

A number of equities analysts recently weighed in on the stock. Atb Cap Markets lowered shares of Freehold Royalties from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, October 15th. Raymond James raised shares of Freehold Royalties to a "hold" rating in a research report on Thursday, October 17th. Scotiabank decreased their price objective on shares of Freehold Royalties from C$18.00 to C$17.00 in a report on Friday, July 12th. Finally, Canaccord Genuity Group dropped their target price on shares of Freehold Royalties from C$19.00 to C$18.00 in a report on Tuesday, October 22nd. Four equities research analysts have rated the stock with a hold rating and four have issued a buy rating to the company. According to MarketBeat.com, Freehold Royalties currently has an average rating of "Moderate Buy" and a consensus price target of C$17.35.

Check Out Our Latest Research Report on Freehold Royalties

Freehold Royalties Company Profile

(

Get Free Report)

Freehold Royalties Ltd. engages in the acquiring and managing royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Western Canada and the United States. Freehold Royalties Ltd. was founded in 1996 and is headquartered in Calgary, Canada.

Read More

Before you consider Freehold Royalties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Freehold Royalties wasn't on the list.

While Freehold Royalties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.