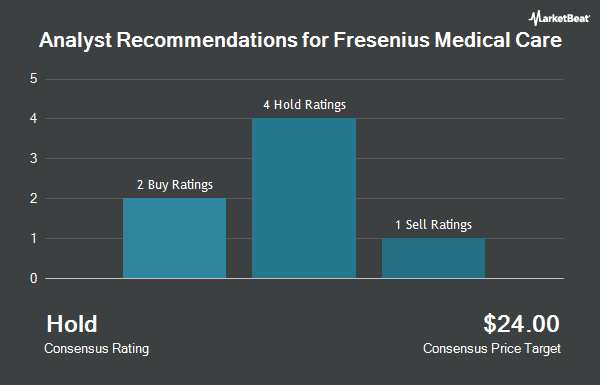

Fresenius Medical Care AG (NYSE:FMS - Get Free Report) has been assigned an average rating of "Hold" from the five brokerages that are presently covering the company, MarketBeat.com reports. One investment analyst has rated the stock with a sell recommendation, two have assigned a hold recommendation and two have given a buy recommendation to the company. The average 1 year price objective among brokerages that have issued ratings on the stock in the last year is $24.30.

Several brokerages recently issued reports on FMS. Berenberg Bank initiated coverage on Fresenius Medical Care in a research report on Wednesday. They set a "buy" rating and a $25.60 target price for the company. StockNews.com began coverage on Fresenius Medical Care in a report on Friday, November 1st. They issued a "strong-buy" rating for the company. Finally, Truist Financial raised their price target on Fresenius Medical Care from $22.00 to $23.00 and gave the stock a "hold" rating in a report on Monday, October 7th.

View Our Latest Analysis on Fresenius Medical Care

Fresenius Medical Care Trading Up 3.5 %

Shares of FMS stock traded up $0.72 during trading hours on Wednesday, hitting $21.05. 259,416 shares of the company's stock traded hands, compared to its average volume of 370,165. The stock has a market cap of $12.35 billion, a PE ratio of 20.95, a price-to-earnings-growth ratio of 0.96 and a beta of 0.91. The stock's 50 day simple moving average is $20.35 and its 200 day simple moving average is $20.21. The company has a quick ratio of 1.09, a current ratio of 1.46 and a debt-to-equity ratio of 0.45. Fresenius Medical Care has a 12 month low of $16.66 and a 12 month high of $22.76.

Institutional Trading of Fresenius Medical Care

Several hedge funds and other institutional investors have recently bought and sold shares of FMS. Venturi Wealth Management LLC lifted its holdings in shares of Fresenius Medical Care by 1,045.8% in the 3rd quarter. Venturi Wealth Management LLC now owns 5,259 shares of the company's stock worth $112,000 after acquiring an additional 4,800 shares during the last quarter. Crossmark Global Holdings Inc. increased its holdings in shares of Fresenius Medical Care by 60.4% in the third quarter. Crossmark Global Holdings Inc. now owns 62,889 shares of the company's stock worth $1,340,000 after buying an additional 23,692 shares during the period. First Trust Direct Indexing L.P. boosted its holdings in Fresenius Medical Care by 9.7% during the 3rd quarter. First Trust Direct Indexing L.P. now owns 22,901 shares of the company's stock valued at $488,000 after acquiring an additional 2,021 shares during the period. Allworth Financial LP increased its stake in Fresenius Medical Care by 53.1% in the 3rd quarter. Allworth Financial LP now owns 1,675 shares of the company's stock worth $36,000 after purchasing an additional 581 shares during the period. Finally, Riverwater Partners LLC increased its stake in Fresenius Medical Care by 29.5% in the 3rd quarter. Riverwater Partners LLC now owns 16,381 shares of the company's stock worth $346,000 after purchasing an additional 3,736 shares during the period. Hedge funds and other institutional investors own 8.25% of the company's stock.

About Fresenius Medical Care

(

Get Free ReportFresenius Medical Care AG provides dialysis and related services for individuals with renal diseases in Germany, North America, and internationally. The company offers dialysis treatment and related laboratory and diagnostic services through a network of outpatient dialysis clinics; materials, training, and patient support services comprising clinical monitoring, follow-up assistance, and arranging for delivery of the supplies to the patient's residence; and dialysis services under contract to hospitals in the United States for the hospitalized end-stage renal disease (ESRD) patients and for patients suffering from acute kidney failure.

See Also

Before you consider Fresenius Medical Care, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fresenius Medical Care wasn't on the list.

While Fresenius Medical Care currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.