WestBridge Capital Management LLC trimmed its holdings in Freshworks Inc. (NASDAQ:FRSH - Free Report) by 2.0% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 13,379,260 shares of the company's stock after selling 275,000 shares during the quarter. Freshworks makes up about 100.0% of WestBridge Capital Management LLC's holdings, making the stock its biggest position. WestBridge Capital Management LLC owned 4.43% of Freshworks worth $153,594,000 as of its most recent SEC filing.

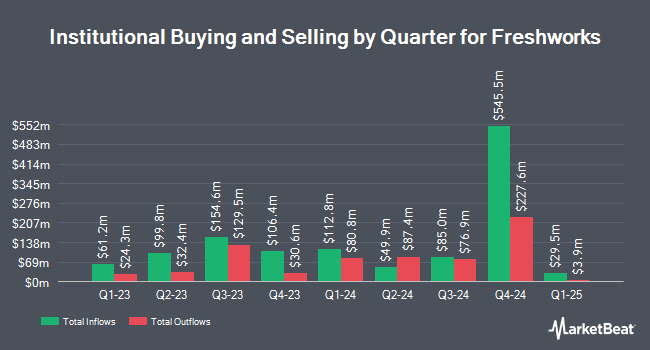

A number of other institutional investors and hedge funds have also made changes to their positions in FRSH. Advisors Asset Management Inc. lifted its holdings in Freshworks by 34.2% in the first quarter. Advisors Asset Management Inc. now owns 2,971 shares of the company's stock valued at $54,000 after acquiring an additional 757 shares during the period. California State Teachers Retirement System raised its stake in shares of Freshworks by 0.5% during the 1st quarter. California State Teachers Retirement System now owns 161,706 shares of the company's stock worth $2,945,000 after buying an additional 831 shares during the last quarter. Amalgamated Bank boosted its position in shares of Freshworks by 29.1% in the 2nd quarter. Amalgamated Bank now owns 7,054 shares of the company's stock worth $90,000 after buying an additional 1,588 shares in the last quarter. Covestor Ltd grew its stake in Freshworks by 89.9% in the 3rd quarter. Covestor Ltd now owns 3,599 shares of the company's stock valued at $41,000 after acquiring an additional 1,704 shares during the last quarter. Finally, ProShare Advisors LLC raised its position in Freshworks by 8.5% during the first quarter. ProShare Advisors LLC now owns 29,127 shares of the company's stock worth $530,000 after acquiring an additional 2,293 shares during the last quarter. 75.58% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

FRSH has been the subject of a number of recent research reports. Piper Sandler raised their price objective on shares of Freshworks from $13.00 to $18.00 and gave the stock an "overweight" rating in a research note on Thursday, November 7th. Canaccord Genuity Group upped their target price on shares of Freshworks from $17.00 to $19.00 and gave the company a "buy" rating in a report on Thursday, November 7th. JMP Securities upped their price objective on shares of Freshworks from $21.00 to $24.00 and gave the company a "market outperform" rating in a research note on Thursday, November 7th. Scotiabank lowered their target price on shares of Freshworks from $18.00 to $16.00 and set a "sector perform" rating for the company in a research note on Wednesday, July 31st. Finally, Needham & Company LLC reissued a "buy" rating and set a $20.00 price target on shares of Freshworks in a research note on Thursday, November 7th. Seven analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. According to MarketBeat.com, Freshworks has an average rating of "Moderate Buy" and an average target price of $18.69.

Read Our Latest Stock Report on Freshworks

Freshworks Stock Up 1.9 %

FRSH opened at $15.28 on Thursday. Freshworks Inc. has a 12-month low of $10.81 and a 12-month high of $24.98. The firm's fifty day moving average price is $12.35 and its 200 day moving average price is $12.49.

Insider Transactions at Freshworks

In other news, Director Zachary Nelson sold 8,433 shares of Freshworks stock in a transaction dated Monday, November 4th. The shares were sold at an average price of $12.19, for a total value of $102,798.27. Following the completion of the transaction, the director now directly owns 23,497 shares of the company's stock, valued at approximately $286,428.43. The trade was a 26.41 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, Director Jennifer H. Taylor sold 4,685 shares of the stock in a transaction dated Tuesday, September 10th. The stock was sold at an average price of $11.17, for a total transaction of $52,331.45. Following the sale, the director now owns 35,853 shares in the company, valued at approximately $400,478.01. This trade represents a 11.56 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 35,463 shares of company stock valued at $406,714. Insiders own 19.15% of the company's stock.

About Freshworks

(

Free Report)

Freshworks Inc, a software development company, provides software-as-a-service products worldwide. It offers Freshworks Customer Service Suite, which provides automated, personalized self-service on various channels, including web, chat, mobile messaging, email, and social; Freshdesk, a ticketing-centric customer service solution; Freshsuccess, a customer success solution; and Freshchat that provides agents with a modern conversational experience to proactively engage customers across digital messaging channels.

Recommended Stories

Want to see what other hedge funds are holding FRSH? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Freshworks Inc. (NASDAQ:FRSH - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Freshworks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Freshworks wasn't on the list.

While Freshworks currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.