FTC Solar (NASDAQ:FTCI - Get Free Report)'s stock had its "buy" rating restated by stock analysts at HC Wainwright in a research note issued on Wednesday,Benzinga reports. They presently have a $1.50 target price on the stock. HC Wainwright's target price would indicate a potential upside of 236.78% from the company's current price.

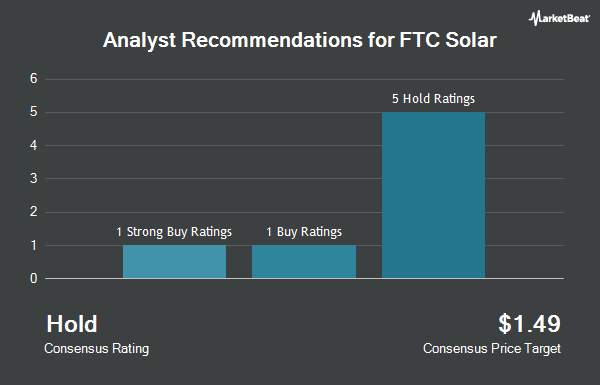

Several other brokerages also recently issued reports on FTCI. TD Cowen reduced their price target on shares of FTC Solar from $1.50 to $1.00 and set a "buy" rating on the stock in a research report on Friday, August 9th. UBS Group reduced their price target on shares of FTC Solar from $0.50 to $0.30 and set a "neutral" rating on the stock in a research report on Friday, August 9th. Four analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of $0.85.

View Our Latest Stock Analysis on FTC Solar

FTC Solar Stock Down 2.1 %

Shares of FTCI traded down $0.01 during trading hours on Wednesday, hitting $0.45. The stock had a trading volume of 870,311 shares, compared to its average volume of 2,549,900. The company's fifty day moving average is $0.50 and its two-hundred day moving average is $0.44. FTC Solar has a 52 week low of $0.18 and a 52 week high of $1.00.

Insider Buying and Selling at FTC Solar

In other news, Director Ahmad R. Chatila bought 110,000 shares of the company's stock in a transaction dated Wednesday, September 4th. The stock was bought at an average price of $0.23 per share, with a total value of $25,300.00. Following the completion of the acquisition, the director now owns 1,713,046 shares of the company's stock, valued at $394,000.58. This represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the SEC, which is accessible through this link. In other news, Director Cortes Isidoro Alfonso Quiroga bought 200,000 shares of the company's stock in a transaction dated Friday, August 16th. The stock was bought at an average price of $0.25 per share, with a total value of $50,000.00. Following the completion of the acquisition, the director now owns 2,251,740 shares of the company's stock, valued at $562,935. This represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the SEC, which is accessible through this link. Also, Director Ahmad R. Chatila purchased 110,000 shares of the firm's stock in a transaction that occurred on Wednesday, September 4th. The stock was bought at an average price of $0.23 per share, for a total transaction of $25,300.00. Following the transaction, the director now directly owns 1,713,046 shares of the company's stock, valued at $394,000.58. This trade represents a 0.00 % increase in their position. The disclosure for this purchase can be found here. Insiders acquired 748,000 shares of company stock valued at $175,280 in the last quarter. 22.60% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

A hedge fund recently raised its stake in FTC Solar stock. Mercer Global Advisors Inc. ADV lifted its stake in shares of FTC Solar, Inc. (NASDAQ:FTCI - Free Report) by 527.9% in the 2nd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 99,120 shares of the company's stock after buying an additional 83,334 shares during the quarter. Mercer Global Advisors Inc. ADV owned about 0.08% of FTC Solar worth $35,000 as of its most recent filing with the Securities & Exchange Commission. 45.36% of the stock is currently owned by hedge funds and other institutional investors.

About FTC Solar

(

Get Free Report)

FTC Solar, Inc engages in the provision of solar tracker systems, software, and engineering services in the United States, Asia, Europe, the Middle East, North Africa, South Africa, and Australia. The company offers a self-powered, two-panel in-portrait, and single-axis tracker solution under the Voyager brand name; and a one module-in-portrait solar tracker solution under the Pioneer brand name.

See Also

Before you consider FTC Solar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FTC Solar wasn't on the list.

While FTC Solar currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.