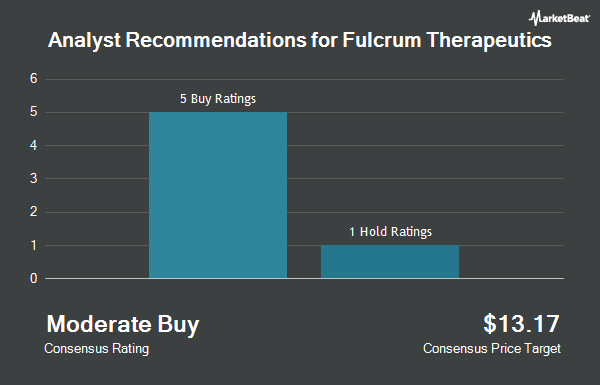

Fulcrum Therapeutics, Inc. (NASDAQ:FULC - Get Free Report) has been given a consensus rating of "Hold" by the ten research firms that are covering the stock, MarketBeat Ratings reports. One investment analyst has rated the stock with a sell rating, six have assigned a hold rating and three have given a buy rating to the company. The average 12-month price objective among analysts that have updated their coverage on the stock in the last year is $9.33.

Several research firms have weighed in on FULC. Bank of America downgraded shares of Fulcrum Therapeutics from a "neutral" rating to an "underperform" rating and decreased their price target for the stock from $10.00 to $2.00 in a research report on Thursday, September 12th. Royal Bank of Canada reaffirmed a "sector perform" rating and set a $4.00 price objective on shares of Fulcrum Therapeutics in a report on Thursday, November 14th. Cantor Fitzgerald downgraded shares of Fulcrum Therapeutics from an "overweight" rating to a "neutral" rating in a report on Thursday, September 12th. Stifel Nicolaus lowered Fulcrum Therapeutics from a "buy" rating to a "hold" rating and decreased their price target for the company from $22.00 to $3.00 in a report on Thursday, September 12th. Finally, HC Wainwright reiterated a "neutral" rating and set a $4.00 price objective on shares of Fulcrum Therapeutics in a research report on Thursday, November 14th.

View Our Latest Stock Analysis on FULC

Hedge Funds Weigh In On Fulcrum Therapeutics

Several institutional investors have recently bought and sold shares of the business. National Bank of Canada FI increased its position in shares of Fulcrum Therapeutics by 869.6% during the second quarter. National Bank of Canada FI now owns 4,460 shares of the company's stock worth $28,000 after purchasing an additional 4,000 shares in the last quarter. China Universal Asset Management Co. Ltd. boosted its holdings in shares of Fulcrum Therapeutics by 64.4% in the 3rd quarter. China Universal Asset Management Co. Ltd. now owns 12,002 shares of the company's stock valued at $43,000 after acquiring an additional 4,701 shares during the last quarter. SG Americas Securities LLC grew its position in Fulcrum Therapeutics by 26.5% during the 3rd quarter. SG Americas Securities LLC now owns 33,019 shares of the company's stock worth $118,000 after purchasing an additional 6,926 shares during the period. Profund Advisors LLC acquired a new stake in Fulcrum Therapeutics during the second quarter worth about $68,000. Finally, American Century Companies Inc. grew its stake in shares of Fulcrum Therapeutics by 13.2% during the 2nd quarter. American Century Companies Inc. now owns 104,371 shares of the company's stock worth $647,000 after purchasing an additional 12,167 shares during the period. 89.83% of the stock is owned by hedge funds and other institutional investors.

Fulcrum Therapeutics Price Performance

Shares of FULC traded down $0.02 during trading hours on Wednesday, hitting $2.99. The stock had a trading volume of 782,323 shares, compared to its average volume of 994,200. Fulcrum Therapeutics has a 12 month low of $2.86 and a 12 month high of $13.70. The firm has a market capitalization of $161.28 million, a PE ratio of -9.64 and a beta of 2.24. The stock has a fifty day moving average price of $3.41 and a 200 day moving average price of $6.38.

About Fulcrum Therapeutics

(

Get Free ReportFulcrum Therapeutics, Inc, a clinical-stage biopharmaceutical company, focuses on developing products for improving the lives of patients with genetically defined diseases in the areas of high unmet medical need in the United States. Its product candidates are losmapimod, a small molecule for the treatment of facioscapulohumeral muscular dystrophy is under phase III clinical trial; and pociredir, a fetal hemoglobin inducer for the treatment of sickle cell disease and beta-thalassemia is under phase I clinical trial.

Read More

Before you consider Fulcrum Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fulcrum Therapeutics wasn't on the list.

While Fulcrum Therapeutics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.