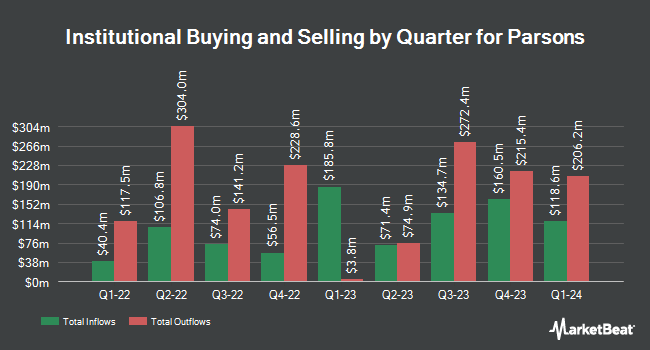

Fuller & Thaler Asset Management Inc. increased its position in shares of Parsons Co. (NYSE:PSN - Free Report) by 5.2% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 1,069,175 shares of the company's stock after acquiring an additional 52,522 shares during the quarter. Fuller & Thaler Asset Management Inc. owned about 1.01% of Parsons worth $98,631,000 as of its most recent SEC filing.

A number of other institutional investors have also recently bought and sold shares of the company. Artisan Partners Limited Partnership boosted its position in shares of Parsons by 271.6% during the fourth quarter. Artisan Partners Limited Partnership now owns 2,069,724 shares of the company's stock worth $190,932,000 after purchasing an additional 1,512,812 shares in the last quarter. Raymond James Financial Inc. bought a new position in Parsons during the fourth quarter worth about $63,417,000. Norges Bank acquired a new position in Parsons in the fourth quarter valued at about $59,447,000. FIL Ltd bought a new stake in shares of Parsons in the fourth quarter worth about $27,868,000. Finally, Invesco Ltd. raised its position in shares of Parsons by 14.2% during the fourth quarter. Invesco Ltd. now owns 2,056,390 shares of the company's stock worth $189,702,000 after purchasing an additional 255,810 shares during the period. Institutional investors and hedge funds own 98.02% of the company's stock.

Parsons Price Performance

NYSE:PSN opened at $64.11 on Wednesday. Parsons Co. has a 52-week low of $54.56 and a 52-week high of $114.68. The company has a market cap of $6.85 billion, a P/E ratio of 84.36, a P/E/G ratio of 0.93 and a beta of 0.66. The company has a debt-to-equity ratio of 0.31, a quick ratio of 1.55 and a current ratio of 1.29. The stock's 50-day simple moving average is $61.30 and its 200 day simple moving average is $84.12.

Parsons announced that its board has approved a stock repurchase plan on Monday, March 24th that authorizes the company to repurchase $250.00 million in shares. This repurchase authorization authorizes the company to reacquire up to 3.9% of its shares through open market purchases. Shares repurchase plans are generally an indication that the company's management believes its stock is undervalued.

Wall Street Analyst Weigh In

Several equities analysts recently issued reports on PSN shares. Benchmark reiterated a "buy" rating and issued a $90.00 price objective on shares of Parsons in a research report on Wednesday, February 26th. William Blair upgraded shares of Parsons from a "market perform" rating to an "outperform" rating in a report on Tuesday, February 18th. The Goldman Sachs Group dropped their price objective on shares of Parsons from $109.00 to $98.00 and set a "buy" rating on the stock in a report on Tuesday, February 25th. TD Cowen lowered shares of Parsons from a "buy" rating to a "hold" rating and set a $105.00 target price for the company. in a research note on Friday, February 21st. Finally, Robert W. Baird dropped their price target on Parsons from $125.00 to $78.00 and set an "outperform" rating on the stock in a research note on Thursday, February 20th. Two equities research analysts have rated the stock with a hold rating and nine have given a buy rating to the stock. Based on data from MarketBeat, Parsons presently has an average rating of "Moderate Buy" and an average target price of $93.60.

Read Our Latest Research Report on PSN

Parsons Company Profile

(

Free Report)

Parsons Corporation provides integrated solutions and services in the defense, intelligence, and critical infrastructure markets in North America, the Middle East, and internationally. The company operates through Federal Solutions and Critical Infrastructure segments. The Federal Solutions segment provides critical technologies, such as cybersecurity; missile defense; intelligence; space launch and ground systems; space and weapon system resiliency; geospatial intelligence; signals intelligence; environmental remediation; border security, critical infrastructure protection; counter unmanned air systems; biometrics and bio surveillance solutions to U.S.

Featured Stories

Want to see what other hedge funds are holding PSN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Parsons Co. (NYSE:PSN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Parsons, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Parsons wasn't on the list.

While Parsons currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.