The Manufacturers Life Insurance Company cut its position in Fulton Financial Co. (NASDAQ:FULT - Free Report) by 16.7% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 582,871 shares of the bank's stock after selling 116,781 shares during the period. The Manufacturers Life Insurance Company owned 0.32% of Fulton Financial worth $10,567,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

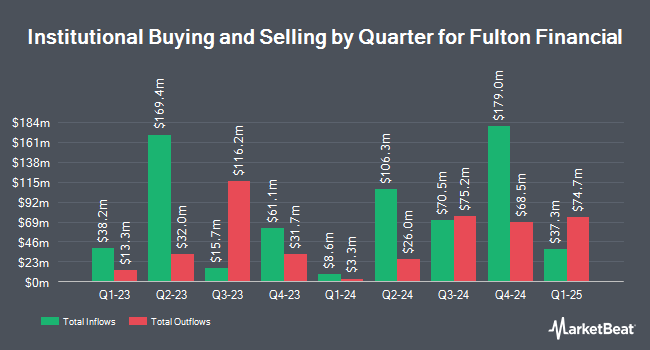

Several other large investors have also recently made changes to their positions in the company. Family Firm Inc. purchased a new position in Fulton Financial in the 2nd quarter worth approximately $46,000. Coston McIsaac & Partners purchased a new position in Fulton Financial during the third quarter worth approximately $54,000. Blue Trust Inc. boosted its stake in Fulton Financial by 21.9% during the second quarter. Blue Trust Inc. now owns 3,840 shares of the bank's stock worth $61,000 after buying an additional 691 shares during the last quarter. AE Wealth Management LLC purchased a new stake in Fulton Financial in the 2nd quarter valued at $172,000. Finally, Atwater Malick LLC purchased a new stake in shares of Fulton Financial in the second quarter valued at about $175,000. 72.02% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of brokerages have issued reports on FULT. Piper Sandler set a $21.00 target price on Fulton Financial in a research report on Thursday, October 17th. StockNews.com lowered shares of Fulton Financial from a "hold" rating to a "sell" rating in a research note on Monday, November 11th. One analyst has rated the stock with a sell rating, four have issued a hold rating and one has issued a buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $18.83.

Read Our Latest Analysis on FULT

Fulton Financial Stock Down 1.4 %

NASDAQ:FULT traded down $0.30 during mid-day trading on Tuesday, hitting $21.17. The stock had a trading volume of 236,763 shares, compared to its average volume of 1,457,779. The company has a current ratio of 0.93, a quick ratio of 0.93 and a debt-to-equity ratio of 0.32. Fulton Financial Co. has a twelve month low of $13.87 and a twelve month high of $22.49. The company has a market capitalization of $3.85 billion, a PE ratio of 13.40 and a beta of 0.77. The stock has a 50-day simple moving average of $19.12 and a two-hundred day simple moving average of $18.16.

Fulton Financial (NASDAQ:FULT - Get Free Report) last released its quarterly earnings data on Tuesday, October 15th. The bank reported $0.50 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.44 by $0.06. The business had revenue of $487.33 million during the quarter, compared to analysts' expectations of $321.00 million. Fulton Financial had a net margin of 16.37% and a return on equity of 11.33%. During the same period in the previous year, the company earned $0.43 EPS. On average, equities research analysts anticipate that Fulton Financial Co. will post 1.74 EPS for the current year.

Fulton Financial Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, October 15th. Stockholders of record on Tuesday, October 1st were given a dividend of $0.17 per share. This represents a $0.68 annualized dividend and a dividend yield of 3.21%. The ex-dividend date of this dividend was Tuesday, October 1st. Fulton Financial's dividend payout ratio (DPR) is presently 43.04%.

About Fulton Financial

(

Free Report)

Fulton Financial Corporation operates as a financial holding company that provides consumer and commercial banking products and services in Pennsylvania, Delaware, Maryland, New Jersey, and Virginia. It accepts various checking accounts and savings deposit products, certificates of deposit, and individual retirement accounts.

Read More

Before you consider Fulton Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fulton Financial wasn't on the list.

While Fulton Financial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.