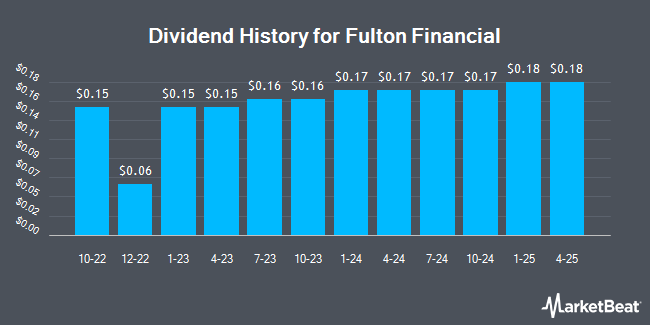

Fulton Financial Co. (NASDAQ:FULT - Get Free Report) declared a quarterly dividend on Wednesday, December 18th,Wall Street Journal reports. Stockholders of record on Tuesday, December 31st will be paid a dividend of 0.18 per share by the bank on Wednesday, January 15th. This represents a $0.72 annualized dividend and a dividend yield of 3.66%. The ex-dividend date of this dividend is Tuesday, December 31st. This is a boost from Fulton Financial's previous quarterly dividend of $0.17.

Fulton Financial has raised its dividend payment by an average of 7.2% annually over the last three years. Fulton Financial has a payout ratio of 39.1% indicating that its dividend is sufficiently covered by earnings. Research analysts expect Fulton Financial to earn $1.80 per share next year, which means the company should continue to be able to cover its $0.68 annual dividend with an expected future payout ratio of 37.8%.

Fulton Financial Trading Down 4.0 %

Fulton Financial stock traded down $0.83 during midday trading on Wednesday, hitting $19.67. 3,016,845 shares of the stock were exchanged, compared to its average volume of 1,440,535. The company has a current ratio of 0.93, a quick ratio of 0.93 and a debt-to-equity ratio of 0.32. The stock's 50-day simple moving average is $19.93 and its 200 day simple moving average is $18.50. Fulton Financial has a fifty-two week low of $13.87 and a fifty-two week high of $22.49. The stock has a market capitalization of $3.58 billion, a price-to-earnings ratio of 12.45 and a beta of 0.78.

Fulton Financial (NASDAQ:FULT - Get Free Report) last released its quarterly earnings results on Tuesday, October 15th. The bank reported $0.50 EPS for the quarter, beating the consensus estimate of $0.44 by $0.06. The firm had revenue of $487.33 million for the quarter, compared to analyst estimates of $321.00 million. Fulton Financial had a net margin of 16.37% and a return on equity of 11.33%. During the same quarter in the previous year, the company earned $0.43 EPS. On average, equities analysts anticipate that Fulton Financial will post 1.74 EPS for the current year.

Wall Street Analyst Weigh In

FULT has been the subject of a number of recent analyst reports. Piper Sandler set a $21.00 price objective on Fulton Financial in a research report on Thursday, October 17th. Keefe, Bruyette & Woods boosted their price target on shares of Fulton Financial from $20.00 to $23.00 and gave the company a "market perform" rating in a research note on Wednesday, December 4th. Stephens raised shares of Fulton Financial from an "equal weight" rating to an "overweight" rating in a research report on Monday, December 9th. Finally, StockNews.com lowered Fulton Financial from a "hold" rating to a "sell" rating in a research report on Monday, November 11th. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and two have assigned a buy rating to the company. According to MarketBeat, the company has an average rating of "Hold" and an average target price of $19.50.

View Our Latest Analysis on Fulton Financial

Insider Buying and Selling

In other news, CEO Curtis J. Myers sold 24,192 shares of Fulton Financial stock in a transaction dated Friday, December 6th. The stock was sold at an average price of $21.16, for a total value of $511,902.72. Following the completion of the transaction, the chief executive officer now owns 155,946 shares in the company, valued at approximately $3,299,817.36. This trade represents a 13.43 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. 1.07% of the stock is owned by insiders.

Fulton Financial Company Profile

(

Get Free Report)

Fulton Financial Corporation operates as a financial holding company that provides consumer and commercial banking products and services in Pennsylvania, Delaware, Maryland, New Jersey, and Virginia. It accepts various checking accounts and savings deposit products, certificates of deposit, and individual retirement accounts.

Further Reading

Before you consider Fulton Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fulton Financial wasn't on the list.

While Fulton Financial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.