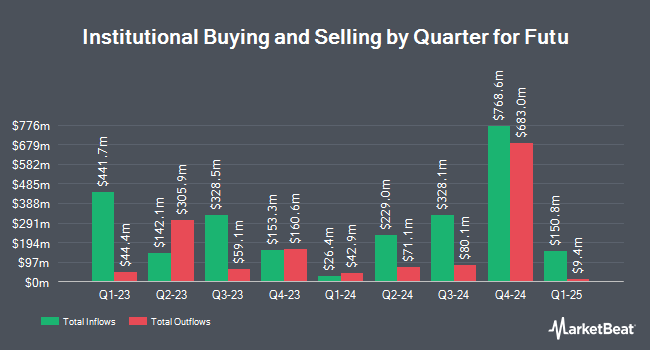

Daiwa Securities Group Inc. increased its position in shares of Futu Holdings Limited (NASDAQ:FUTU - Free Report) by 139.5% in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 10,300 shares of the company's stock after purchasing an additional 6,000 shares during the quarter. Daiwa Securities Group Inc.'s holdings in Futu were worth $824,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also bought and sold shares of the company. Zurcher Kantonalbank Zurich Cantonalbank lifted its position in Futu by 11.0% during the fourth quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 19,780 shares of the company's stock worth $1,582,000 after purchasing an additional 1,961 shares during the period. Callan Family Office LLC acquired a new position in Futu during the fourth quarter worth about $632,000. Candriam S.C.A. acquired a new position in Futu during the fourth quarter worth about $28,004,000. Raymond James Financial Inc. acquired a new position in Futu during the fourth quarter worth about $786,000. Finally, Aigen Investment Management LP acquired a new position in Futu during the fourth quarter worth about $446,000.

Futu Stock Performance

Shares of Futu stock traded up $0.23 on Wednesday, hitting $114.70. The stock had a trading volume of 1,631,276 shares, compared to its average volume of 2,527,227. The stock has a 50 day moving average of $102.81 and a 200 day moving average of $92.19. Futu Holdings Limited has a twelve month low of $51.80 and a twelve month high of $130.88. The firm has a market capitalization of $15.80 billion, a P/E ratio of 28.11, a PEG ratio of 0.79 and a beta of 0.78.

Analyst Ratings Changes

Several research analysts have commented on the company. UBS Group boosted their target price on Futu from $130.00 to $136.00 and gave the stock a "buy" rating in a research note on Monday. Citigroup downgraded Futu from a "buy" rating to a "neutral" rating and boosted their target price for the stock from $79.00 to $95.00 in a research note on Tuesday, November 19th. Finally, JPMorgan Chase & Co. boosted their target price on Futu from $160.00 to $170.00 and gave the stock an "overweight" rating in a research note on Friday, March 14th. One investment analyst has rated the stock with a hold rating and four have issued a buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $121.20.

Get Our Latest Report on FUTU

About Futu

(

Free Report)

Futu Holdings Limited provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally. It offers online financial services, including securities and derivative trades brokerage, margin financing and fund distribution services through its Futubull and Moomoo digital platforms.

Featured Stories

Before you consider Futu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Futu wasn't on the list.

While Futu currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.