Citigroup cut shares of Futu (NASDAQ:FUTU - Free Report) from a buy rating to a neutral rating in a report published on Tuesday, Marketbeat.com reports. The firm currently has $95.00 price target on the stock, up from their previous price target of $79.00.

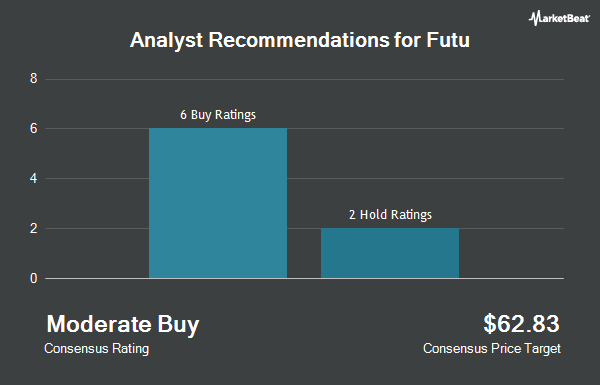

A number of other brokerages also recently issued reports on FUTU. Bank of America upped their price target on Futu from $80.20 to $90.00 and gave the company a "buy" rating in a report on Friday, September 27th. Morgan Stanley upgraded shares of Futu from an "equal weight" rating to an "overweight" rating and upped their target price for the company from $70.00 to $115.00 in a research note on Monday. One equities research analyst has rated the stock with a hold rating and six have assigned a buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $85.07.

Check Out Our Latest Research Report on FUTU

Futu Trading Down 6.1 %

Futu stock traded down $5.60 during mid-day trading on Tuesday, hitting $86.70. The company had a trading volume of 4,536,637 shares, compared to its average volume of 2,362,999. Futu has a 12 month low of $43.61 and a 12 month high of $130.50. The stock's 50 day moving average price is $91.22 and its two-hundred day moving average price is $75.40. The company has a market capitalization of $11.95 billion, a PE ratio of 22.40, a price-to-earnings-growth ratio of 0.93 and a beta of 0.75.

Futu (NASDAQ:FUTU - Get Free Report) last announced its quarterly earnings data on Tuesday, August 20th. The company reported $1.11 EPS for the quarter. The company had revenue of $400.73 million for the quarter. Futu had a net margin of 39.27% and a return on equity of 16.77%. Equities research analysts anticipate that Futu will post 4.75 EPS for the current year.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently made changes to their positions in the stock. Allspring Global Investments Holdings LLC boosted its position in Futu by 14.6% during the third quarter. Allspring Global Investments Holdings LLC now owns 877 shares of the company's stock valued at $84,000 after purchasing an additional 112 shares in the last quarter. CIBC Asset Management Inc lifted its position in shares of Futu by 4.3% during the third quarter. CIBC Asset Management Inc now owns 5,403 shares of the company's stock valued at $517,000 after buying an additional 222 shares during the last quarter. DekaBank Deutsche Girozentrale boosted its holdings in shares of Futu by 3.2% in the 1st quarter. DekaBank Deutsche Girozentrale now owns 7,346 shares of the company's stock valued at $394,000 after buying an additional 230 shares in the last quarter. Signaturefd LLC grew its position in shares of Futu by 8.4% in the 2nd quarter. Signaturefd LLC now owns 3,205 shares of the company's stock worth $210,000 after buying an additional 247 shares during the last quarter. Finally, CWM LLC grew its position in shares of Futu by 67.7% in the 3rd quarter. CWM LLC now owns 743 shares of the company's stock worth $71,000 after buying an additional 300 shares during the last quarter.

Futu Company Profile

(

Get Free Report)

Futu Holdings Limited provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally. It offers online financial services, including securities and derivative trades brokerage, margin financing and fund distribution services through its Futubull and Moomoo digital platforms.

Featured Stories

Before you consider Futu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Futu wasn't on the list.

While Futu currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.