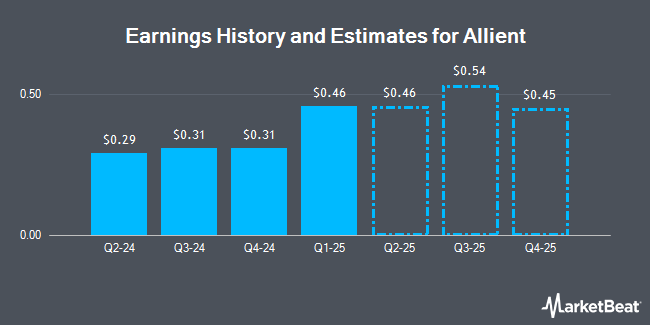

Allient Inc. (NASDAQ:ALNT - Free Report) - Stock analysts at Roth Capital upped their FY2024 EPS estimates for Allient in a research note issued on Tuesday, November 12th. Roth Capital analyst G. Sweeney now forecasts that the company will post earnings of $1.43 per share for the year, up from their prior estimate of $1.36. The consensus estimate for Allient's current full-year earnings is $1.39 per share.

A number of other equities analysts have also commented on the stock. Northland Securities decreased their price target on shares of Allient from $35.00 to $30.00 and set a "market perform" rating on the stock in a report on Friday, August 9th. Roth Mkm lowered their price target on shares of Allient from $39.00 to $28.00 and set a "buy" rating for the company in a report on Tuesday, August 13th. Finally, Craig Hallum dropped their price objective on Allient from $41.00 to $30.00 and set a "buy" rating for the company in a report on Friday, August 9th.

Get Our Latest Analysis on Allient

Allient Stock Performance

Shares of NASDAQ:ALNT traded down $0.24 during midday trading on Friday, reaching $24.24. The company had a trading volume of 208,666 shares, compared to its average volume of 101,329. Allient has a 52-week low of $16.91 and a 52-week high of $36.33. The company's 50 day moving average price is $19.29 and its 200 day moving average price is $23.43. The company has a current ratio of 4.10, a quick ratio of 2.18 and a debt-to-equity ratio of 0.85. The stock has a market cap of $408.20 million, a P/E ratio of 27.64 and a beta of 1.51.

Allient (NASDAQ:ALNT - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The company reported $0.31 earnings per share for the quarter, beating the consensus estimate of $0.21 by $0.10. The firm had revenue of $125.21 million for the quarter, compared to analyst estimates of $124.28 million. Allient had a net margin of 2.64% and a return on equity of 10.80%. During the same quarter in the prior year, the business earned $0.61 earnings per share.

Institutional Trading of Allient

A number of institutional investors and hedge funds have recently modified their holdings of the business. Shell Asset Management Co. bought a new position in Allient in the first quarter worth approximately $35,000. CWM LLC grew its position in shares of Allient by 798.2% during the second quarter. CWM LLC now owns 1,006 shares of the company's stock worth $25,000 after purchasing an additional 894 shares in the last quarter. Ameritas Investment Partners Inc. bought a new stake in Allient during the 1st quarter valued at approximately $49,000. Allspring Global Investments Holdings LLC purchased a new position in Allient in the 1st quarter worth approximately $57,000. Finally, Point72 DIFC Ltd bought a new position in Allient in the 3rd quarter worth approximately $33,000. Institutional investors own 61.57% of the company's stock.

Allient Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Thursday, December 5th. Stockholders of record on Thursday, November 21st will be given a $0.03 dividend. This represents a $0.12 annualized dividend and a dividend yield of 0.50%. The ex-dividend date of this dividend is Thursday, November 21st. Allient's dividend payout ratio is presently 13.64%.

About Allient

(

Get Free Report)

Allient Inc, together with its subsidiaries, designs, manufactures, and sells precision and specialty controlled motion components and systems for various industries in the United States, Canada, South America, Europe, and Asia-Pacific. It offers brush and brushless DC motors, brushless servo and torque motors, coreless DC motors, integrated brushless motor-drives, gearmotors, gearing, modular digital servo drives, motion controllers, optical encoders, active and passive filters, input/output modules, industrial communications gateways, light-weighting technologies, and other controlled motion-related products, as well as nano precision positioning systems, servo control systems, and digital servo amplifiers and drives.

See Also

Before you consider Allient, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allient wasn't on the list.

While Allient currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.