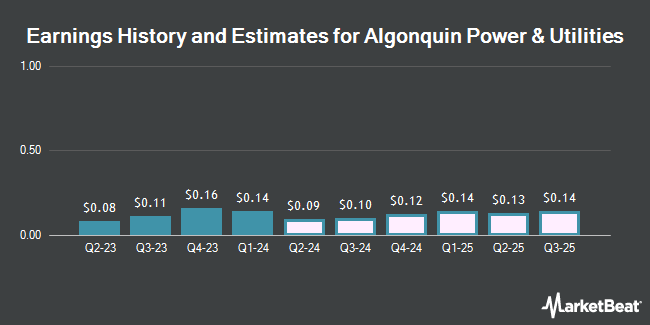

Algonquin Power & Utilities Corp. (NYSE:AQN - Free Report) - Stock analysts at Raymond James decreased their FY2024 EPS estimates for Algonquin Power & Utilities in a research report issued to clients and investors on Sunday, November 10th. Raymond James analyst D. Quezada now expects that the utilities provider will earn $0.40 per share for the year, down from their previous forecast of $0.44. Raymond James currently has a "Market Perform" rating and a $7.00 target price on the stock. The consensus estimate for Algonquin Power & Utilities' current full-year earnings is $0.41 per share. Raymond James also issued estimates for Algonquin Power & Utilities' Q4 2024 earnings at $0.09 EPS and Q3 2025 earnings at $0.08 EPS.

Other analysts have also issued reports about the stock. Janney Montgomery Scott started coverage on shares of Algonquin Power & Utilities in a research report on Thursday, September 5th. They set a "neutral" rating and a $6.00 price target on the stock. CIBC lowered their price target on Algonquin Power & Utilities from $5.75 to $5.50 and set a "neutral" rating on the stock in a research report on Tuesday, October 22nd. Desjardins cut their price objective on Algonquin Power & Utilities from $5.50 to $5.25 and set a "hold" rating for the company in a research report on Monday, August 12th. Royal Bank of Canada reissued a "sector perform" rating and issued a $6.00 price objective on shares of Algonquin Power & Utilities in a research report on Friday, October 11th. Finally, Scotiabank dropped their target price on Algonquin Power & Utilities from $5.75 to $5.25 and set a "sector perform" rating for the company in a report on Friday. One research analyst has rated the stock with a sell rating, nine have issued a hold rating, one has given a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $6.18.

Get Our Latest Stock Report on Algonquin Power & Utilities

Algonquin Power & Utilities Stock Down 2.2 %

AQN stock traded down $0.11 during mid-day trading on Tuesday, reaching $4.81. The company had a trading volume of 1,742,295 shares, compared to its average volume of 5,624,070. Algonquin Power & Utilities has a 52 week low of $4.67 and a 52 week high of $6.79. The company has a market capitalization of $3.69 billion, a price-to-earnings ratio of -3.81 and a beta of 0.68. The company has a debt-to-equity ratio of 1.08, a current ratio of 0.97 and a quick ratio of 0.78. The stock has a 50 day simple moving average of $5.18 and a two-hundred day simple moving average of $5.73.

Algonquin Power & Utilities (NYSE:AQN - Get Free Report) last released its earnings results on Thursday, November 7th. The utilities provider reported $0.08 earnings per share for the quarter, missing analysts' consensus estimates of $0.09 by ($0.01). The business had revenue of $573.20 million during the quarter, compared to the consensus estimate of $620.46 million. Algonquin Power & Utilities had a negative net margin of 39.12% and a positive return on equity of 5.11%. The firm's revenue for the quarter was up 1.5% on a year-over-year basis. During the same period last year, the business posted $0.11 EPS.

Algonquin Power & Utilities Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 31st will be given a dividend of $0.065 per share. This represents a $0.26 dividend on an annualized basis and a dividend yield of 5.41%. The ex-dividend date of this dividend is Tuesday, December 31st. Algonquin Power & Utilities's payout ratio is -20.15%.

Hedge Funds Weigh In On Algonquin Power & Utilities

Large investors have recently added to or reduced their stakes in the business. Vanguard Group Inc. increased its position in shares of Algonquin Power & Utilities by 1.0% during the first quarter. Vanguard Group Inc. now owns 26,248,892 shares of the utilities provider's stock valued at $165,893,000 after acquiring an additional 262,333 shares during the last quarter. National Bank of Canada FI raised its stake in shares of Algonquin Power & Utilities by 3.4% in the second quarter. National Bank of Canada FI now owns 10,565,940 shares of the utilities provider's stock valued at $61,759,000 after buying an additional 342,528 shares during the period. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp lifted its holdings in shares of Algonquin Power & Utilities by 156.0% in the second quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 8,905,059 shares of the utilities provider's stock worth $52,341,000 after buying an additional 5,426,523 shares in the last quarter. The Manufacturers Life Insurance Company increased its holdings in Algonquin Power & Utilities by 320.6% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 7,273,228 shares of the utilities provider's stock worth $42,633,000 after acquiring an additional 5,544,063 shares during the period. Finally, Point72 Asset Management L.P. lifted its stake in Algonquin Power & Utilities by 31.2% in the 2nd quarter. Point72 Asset Management L.P. now owns 5,956,389 shares of the utilities provider's stock worth $34,989,000 after purchasing an additional 1,415,889 shares in the last quarter. Institutional investors own 62.28% of the company's stock.

About Algonquin Power & Utilities

(

Get Free Report)

Algonquin Power & Utilities Corp. operates in the power and utility industries in the United States, Canada, and other regions. The company operates in two segments, Regulated Services Group and Renewable Energy Group. The company primarily owns and operates a regulated electric, water distribution and wastewater collection, and natural gas utility systems and transmission operations.

See Also

Before you consider Algonquin Power & Utilities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Algonquin Power & Utilities wasn't on the list.

While Algonquin Power & Utilities currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.