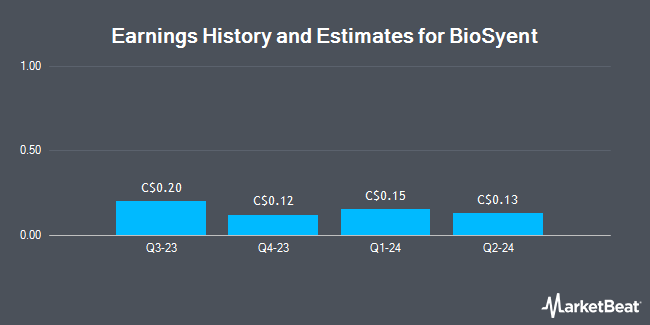

BioSyent Inc. (CVE:RX - Free Report) - Equities research analysts at Bloom Burton upped their FY2024 earnings estimates for BioSyent in a report released on Thursday, November 21st. Bloom Burton analyst D. Martin now expects that the company will post earnings per share of $0.63 for the year, up from their previous estimate of $0.59. The consensus estimate for BioSyent's current full-year earnings is $0.69 per share. Bloom Burton also issued estimates for BioSyent's FY2025 earnings at $0.80 EPS and FY2026 earnings at $0.91 EPS.

BioSyent Stock Performance

Shares of RX traded up C$0.45 during mid-day trading on Monday, reaching C$11.70. 5,017 shares of the company's stock traded hands, compared to its average volume of 6,849. BioSyent has a 12 month low of C$8.24 and a 12 month high of C$11.74. The company has a debt-to-equity ratio of 3.19, a quick ratio of 6.91 and a current ratio of 6.13. The stock has a market capitalization of C$135.60 million, a P/E ratio of 19.50 and a beta of 0.93. The business's 50-day moving average price is C$11.05 and its 200-day moving average price is C$10.27.

BioSyent (CVE:RX - Get Free Report) last announced its quarterly earnings data on Monday, August 26th. The company reported C$0.13 earnings per share for the quarter, meeting analysts' consensus estimates of C$0.13. BioSyent had a net margin of 21.14% and a return on equity of 20.88%. The business had revenue of C$8.95 million during the quarter, compared to the consensus estimate of C$8.80 million.

Insider Transactions at BioSyent

In related news, Director Seyed Ahmad Ashrafi sold 2,320 shares of the stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of C$10.95, for a total value of C$25,404.00. 33.65% of the stock is currently owned by insiders.

BioSyent Company Profile

(

Get Free Report)

BioSyent Inc, together with its subsidiaries, acquires or licenses, develops, and sells pharmaceutical and other healthcare products in Canada and internationally. Its products include FeraMAX Pd Therapeutic 150 for the treatment of iron deficiency anemia; FeraMAX Pd Maintenance 45, a chewable supplement for the prevention of iron deficiency anemia; and FeraMAX Pd Powder 15, a powder form product used for preventing iron deficiency and iron deficiency anemia.

Recommended Stories

Before you consider BioSyent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BioSyent wasn't on the list.

While BioSyent currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.