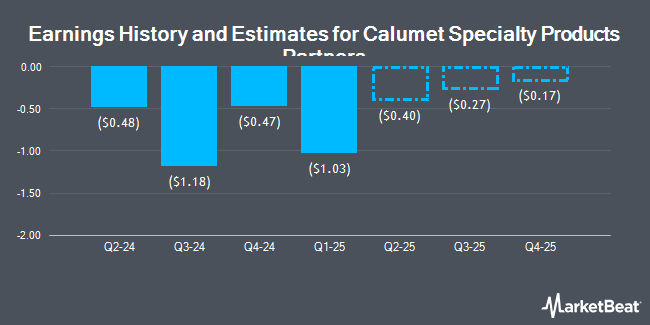

Calumet Specialty Products Partners, L.P. (NASDAQ:CLMT - Free Report) - HC Wainwright decreased their FY2024 earnings estimates for Calumet Specialty Products Partners in a research note issued to investors on Monday, November 11th. HC Wainwright analyst A. Dayal now anticipates that the oil and gas company will earn ($3.02) per share for the year, down from their previous forecast of ($2.05). HC Wainwright has a "Buy" rating and a $25.00 price target on the stock. The consensus estimate for Calumet Specialty Products Partners' current full-year earnings is ($2.02) per share. HC Wainwright also issued estimates for Calumet Specialty Products Partners' Q4 2024 earnings at ($1.13) EPS and FY2025 earnings at $0.28 EPS.

Several other equities analysts have also issued reports on CLMT. TD Cowen decreased their price objective on Calumet Specialty Products Partners from $27.00 to $26.00 and set a "buy" rating for the company in a research report on Monday. Wells Fargo & Company increased their price objective on Calumet Specialty Products Partners from $25.00 to $29.00 and gave the stock an "overweight" rating in a report on Monday, October 21st. The Goldman Sachs Group decreased their price target on shares of Calumet Specialty Products Partners from $17.00 to $15.00 and set a "buy" rating for the company in a research note on Monday, August 5th. Finally, StockNews.com assumed coverage on shares of Calumet Specialty Products Partners in a research report on Wednesday, October 23rd. They issued a "sell" rating for the company. One investment analyst has rated the stock with a sell rating and four have given a buy rating to the company's stock. According to MarketBeat, Calumet Specialty Products Partners has an average rating of "Moderate Buy" and a consensus price target of $23.75.

View Our Latest Report on CLMT

Calumet Specialty Products Partners Stock Performance

CLMT stock traded up $0.18 during midday trading on Thursday, hitting $20.08. 130,898 shares of the company's stock were exchanged, compared to its average volume of 394,712. Calumet Specialty Products Partners has a one year low of $9.97 and a one year high of $25.29. The company has a market cap of $1.72 billion, a PE ratio of -7.21 and a beta of 1.90. The stock's fifty day moving average price is $19.44 and its 200-day moving average price is $17.06.

Calumet Specialty Products Partners (NASDAQ:CLMT - Get Free Report) last posted its earnings results on Friday, November 8th. The oil and gas company reported ($1.18) earnings per share for the quarter, missing the consensus estimate of ($0.59) by ($0.59). The business had revenue of $1.10 billion for the quarter, compared to the consensus estimate of $888.36 million. During the same quarter in the previous year, the business posted $0.03 EPS. The business's revenue for the quarter was down 4.3% on a year-over-year basis.

Institutional Trading of Calumet Specialty Products Partners

Large investors have recently added to or reduced their stakes in the company. Founders Financial Alliance LLC lifted its stake in Calumet Specialty Products Partners by 8.4% in the 2nd quarter. Founders Financial Alliance LLC now owns 48,400 shares of the oil and gas company's stock valued at $777,000 after purchasing an additional 3,750 shares during the last quarter. Creative Planning boosted its stake in shares of Calumet Specialty Products Partners by 46.4% in the second quarter. Creative Planning now owns 62,459 shares of the oil and gas company's stock valued at $1,002,000 after buying an additional 19,800 shares during the period. DRW Securities LLC acquired a new stake in Calumet Specialty Products Partners during the second quarter worth approximately $898,000. Wedbush Securities Inc. acquired a new stake in shares of Calumet Specialty Products Partners during the 2nd quarter worth $169,000. Finally, Wasserstein Debt Opportunities Management L.P. raised its stake in Calumet Specialty Products Partners by 2.9% in the second quarter. Wasserstein Debt Opportunities Management L.P. now owns 6,891,314 shares of the oil and gas company's stock valued at $110,606,000 after purchasing an additional 193,063 shares in the last quarter. Institutional investors and hedge funds own 34.41% of the company's stock.

Calumet Specialty Products Partners Company Profile

(

Get Free Report)

Calumet, Inc manufactures, formulates, and markets a diversified slate of specialty branded products and renewable fuels to various consumer-facing and industrial markets in North America and internationally. It operates through Specialty Products and Solutions; Montana/Renewables; and Performance brands segments.

See Also

Before you consider Calumet Specialty Products Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Calumet Specialty Products Partners wasn't on the list.

While Calumet Specialty Products Partners currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.