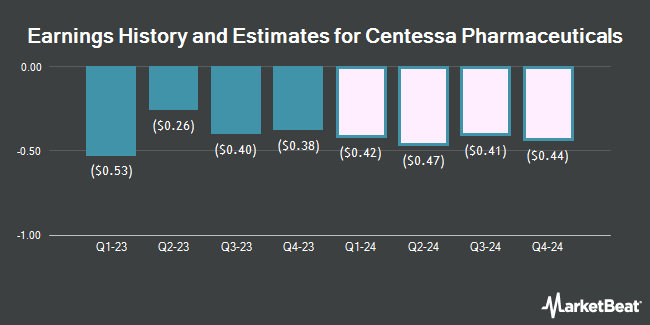

Centessa Pharmaceuticals plc (NASDAQ:CNTA - Free Report) - Equities research analysts at Leerink Partnrs increased their FY2024 earnings per share (EPS) estimates for shares of Centessa Pharmaceuticals in a report issued on Wednesday, November 20th. Leerink Partnrs analyst D. Risinger now anticipates that the company will earn ($1.56) per share for the year, up from their previous forecast of ($1.65). The consensus estimate for Centessa Pharmaceuticals' current full-year earnings is ($1.62) per share. Leerink Partnrs also issued estimates for Centessa Pharmaceuticals' Q4 2024 earnings at ($0.41) EPS and FY2025 earnings at ($1.50) EPS.

Other equities research analysts also recently issued reports about the stock. Oppenheimer reaffirmed an "outperform" rating and issued a $14.00 target price on shares of Centessa Pharmaceuticals in a research note on Wednesday, August 14th. BMO Capital Markets boosted their price objective on shares of Centessa Pharmaceuticals from $20.00 to $35.00 and gave the company an "outperform" rating in a research report on Monday, September 16th. Jefferies Financial Group raised their price objective on Centessa Pharmaceuticals from $13.00 to $19.00 and gave the company a "buy" rating in a research report on Wednesday, September 11th. Guggenheim increased their price objective on shares of Centessa Pharmaceuticals from $24.00 to $28.00 and gave the company a "buy" rating in a research report on Friday, November 15th. Finally, B. Riley started coverage on Centessa Pharmaceuticals in a report on Thursday, September 19th. They issued a "buy" rating and a $33.00 price objective for the company. Six investment analysts have rated the stock with a buy rating, According to MarketBeat.com, Centessa Pharmaceuticals currently has a consensus rating of "Buy" and an average target price of $25.83.

Get Our Latest Research Report on Centessa Pharmaceuticals

Centessa Pharmaceuticals Stock Performance

CNTA stock traded down $0.91 during midday trading on Friday, hitting $17.28. The company's stock had a trading volume of 620,973 shares, compared to its average volume of 411,182. Centessa Pharmaceuticals has a 1 year low of $5.58 and a 1 year high of $18.74. The stock's 50-day moving average price is $16.09 and its 200 day moving average price is $12.33. The stock has a market cap of $1.96 billion, a price-to-earnings ratio of -11.89 and a beta of 1.47. The company has a quick ratio of 21.52, a current ratio of 21.52 and a debt-to-equity ratio of 0.15.

Centessa Pharmaceuticals (NASDAQ:CNTA - Get Free Report) last released its earnings results on Tuesday, November 12th. The company reported ($0.37) EPS for the quarter, topping the consensus estimate of ($0.42) by $0.05.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently bought and sold shares of the business. Geode Capital Management LLC lifted its holdings in shares of Centessa Pharmaceuticals by 68.7% in the third quarter. Geode Capital Management LLC now owns 56,597 shares of the company's stock valued at $905,000 after purchasing an additional 23,058 shares in the last quarter. Jane Street Group LLC acquired a new position in Centessa Pharmaceuticals in the third quarter worth about $2,834,000. Wellington Management Group LLP bought a new stake in shares of Centessa Pharmaceuticals in the 3rd quarter worth approximately $1,609,000. State Street Corp acquired a new position in shares of Centessa Pharmaceuticals during the third quarter worth approximately $777,000. Finally, RTW Investments LP bought a new stake in shares of Centessa Pharmaceuticals during the 3rd quarter worth about $800,000. Institutional investors and hedge funds own 82.01% of the company's stock.

Insider Transactions at Centessa Pharmaceuticals

In related news, CEO Saurabh Saha sold 55,000 shares of Centessa Pharmaceuticals stock in a transaction on Friday, September 20th. The shares were sold at an average price of $16.53, for a total transaction of $909,150.00. Following the sale, the chief executive officer now directly owns 721,924 shares in the company, valued at $11,933,403.72. This trade represents a 7.08 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Gregory M. Weinhoff sold 25,000 shares of Centessa Pharmaceuticals stock in a transaction on Monday, September 9th. The shares were sold at an average price of $15.00, for a total transaction of $375,000.00. Following the completion of the transaction, the insider now owns 223,369 shares in the company, valued at approximately $3,350,535. This represents a 10.07 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 308,158 shares of company stock valued at $5,007,043 over the last ninety days. Insiders own 11.59% of the company's stock.

Centessa Pharmaceuticals Company Profile

(

Get Free Report)

Centessa Pharmaceuticals plc, a clinical-stage pharmaceutical company, discovers, develops, and delivers medicines for patients. Its products pipeline includes SerpinPC, an activated protein C inhibitor for the treatment of hemophilia A and B; and ORX750, an orally administered OX2R agonist for the treatment of narcolepsy and other sleep disorders.

Featured Articles

Before you consider Centessa Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Centessa Pharmaceuticals wasn't on the list.

While Centessa Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.