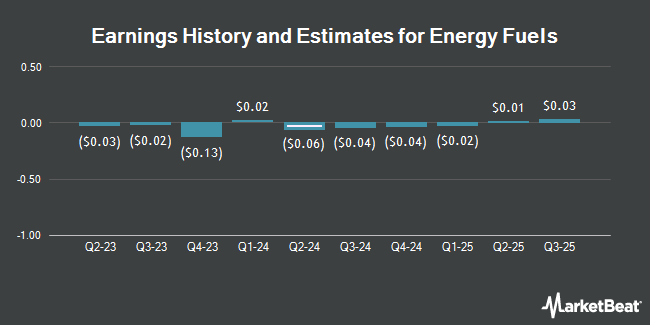

Energy Fuels Inc. (NYSE:UUUU - Free Report) - Investment analysts at B. Riley lifted their FY2024 earnings per share estimates for Energy Fuels in a report released on Tuesday, November 5th. B. Riley analyst M. Key now anticipates that the company will earn ($0.09) per share for the year, up from their prior estimate of ($0.10). The consensus estimate for Energy Fuels' current full-year earnings is ($0.11) per share. B. Riley also issued estimates for Energy Fuels' Q4 2024 earnings at $0.00 EPS, FY2025 earnings at $0.00 EPS and FY2028 earnings at $1.01 EPS.

Energy Fuels (NYSE:UUUU - Get Free Report) last posted its quarterly earnings results on Thursday, October 31st. The company reported ($0.07) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.05) by ($0.02). The company had revenue of $4.05 million during the quarter, compared to analyst estimates of $5.10 million. Energy Fuels had a negative net margin of 90.40% and a negative return on equity of 9.16%.

UUUU has been the topic of several other reports. Roth Mkm dropped their price target on Energy Fuels from $6.00 to $5.50 and set a "neutral" rating on the stock in a research report on Monday. HC Wainwright increased their target price on shares of Energy Fuels from $10.75 to $11.00 and gave the stock a "buy" rating in a report on Monday. One research analyst has rated the stock with a sell rating, two have assigned a hold rating and two have assigned a buy rating to the company. According to MarketBeat.com, the company has an average rating of "Hold" and an average price target of $8.50.

View Our Latest Analysis on Energy Fuels

Energy Fuels Price Performance

NYSE:UUUU traded up $0.29 during mid-day trading on Thursday, reaching $6.34. The stock had a trading volume of 3,341,190 shares, compared to its average volume of 3,095,031. The company has a market capitalization of $1.23 billion, a price-to-earnings ratio of -27.45 and a beta of 1.60. Energy Fuels has a 1-year low of $4.19 and a 1-year high of $8.68. The stock's 50 day simple moving average is $5.51 and its two-hundred day simple moving average is $5.66.

Hedge Funds Weigh In On Energy Fuels

Several hedge funds and other institutional investors have recently modified their holdings of UUUU. Vanguard Group Inc. increased its position in Energy Fuels by 1.4% in the 1st quarter. Vanguard Group Inc. now owns 6,014,689 shares of the company's stock valued at $37,832,000 after acquiring an additional 82,766 shares during the period. MMCAP International Inc. SPC increased its holdings in shares of Energy Fuels by 56.5% during the first quarter. MMCAP International Inc. SPC now owns 5,780,394 shares of the company's stock valued at $36,359,000 after purchasing an additional 2,087,385 shares during the period. Van ECK Associates Corp raised its stake in shares of Energy Fuels by 84.8% during the third quarter. Van ECK Associates Corp now owns 2,360,881 shares of the company's stock valued at $12,961,000 after purchasing an additional 1,083,480 shares in the last quarter. Vident Advisory LLC lifted its holdings in Energy Fuels by 30.8% in the first quarter. Vident Advisory LLC now owns 1,507,537 shares of the company's stock worth $9,482,000 after purchasing an additional 355,242 shares during the period. Finally, Goehring & Rozencwajg Associates LLC grew its position in Energy Fuels by 19.7% in the 2nd quarter. Goehring & Rozencwajg Associates LLC now owns 1,095,044 shares of the company's stock valued at $6,636,000 after buying an additional 179,900 shares in the last quarter. Institutional investors and hedge funds own 48.24% of the company's stock.

Energy Fuels Company Profile

(

Get Free Report)

Energy Fuels Inc, together with its subsidiaries, engages in the extraction, recovery, recycling, exploration, permitting, evaluation, and sale of uranium mineral properties in the United States. The company produces and sells vanadium pentoxide, rare earth elements, and heavy mineral sands, such as ilmenite, rutile, zircon, and monazite.

Read More

Before you consider Energy Fuels, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Energy Fuels wasn't on the list.

While Energy Fuels currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.