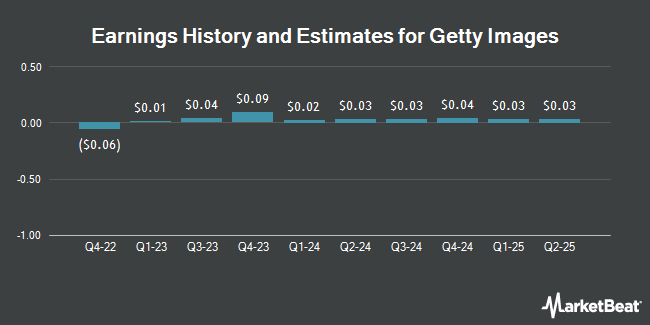

Getty Images Holdings, Inc. (NYSE:GETY - Free Report) - Research analysts at Wedbush reduced their FY2024 earnings estimates for shares of Getty Images in a research note issued to investors on Friday, November 8th. Wedbush analyst M. Pachter now expects that the company will earn $0.07 per share for the year, down from their previous forecast of $0.10. The consensus estimate for Getty Images' current full-year earnings is $0.09 per share.

GETY has been the subject of a number of other research reports. Benchmark restated a "buy" rating and set a $6.00 price objective on shares of Getty Images in a research report on Tuesday, August 13th. Citigroup cut their price objective on shares of Getty Images from $6.00 to $5.00 and set a "buy" rating for the company in a research report on Tuesday, August 13th. Finally, Macquarie cut their price objective on shares of Getty Images from $4.00 to $3.50 and set a "neutral" rating for the company in a research report on Monday, August 12th.

Check Out Our Latest Report on GETY

Getty Images Stock Performance

Getty Images stock traded up $0.13 during trading hours on Monday, reaching $3.58. 359,296 shares of the stock were exchanged, compared to its average volume of 477,825. The stock has a market cap of $1.47 billion, a P/E ratio of 28.75 and a beta of 2.02. The company has a debt-to-equity ratio of 1.92, a quick ratio of 0.78 and a current ratio of 0.78. Getty Images has a 52-week low of $2.88 and a 52-week high of $5.77. The firm's 50 day moving average is $3.78 and its 200 day moving average is $3.64.

Getty Images (NYSE:GETY - Get Free Report) last released its quarterly earnings results on Friday, August 9th. The company reported $0.01 EPS for the quarter, missing the consensus estimate of $0.02 by ($0.01). Getty Images had a net margin of 5.91% and a return on equity of 6.52%. The business had revenue of $229.14 million during the quarter, compared to analysts' expectations of $228.42 million. The company's revenue for the quarter was up 1.5% on a year-over-year basis.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. Ninety One UK Ltd purchased a new position in Getty Images in the 2nd quarter valued at about $583,000. Bank of New York Mellon Corp purchased a new position in shares of Getty Images during the 2nd quarter worth about $910,000. Natixis purchased a new position in shares of Getty Images during the 1st quarter worth about $42,000. The Manufacturers Life Insurance Company lifted its holdings in shares of Getty Images by 136.7% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 68,268 shares of the company's stock worth $223,000 after acquiring an additional 39,423 shares during the period. Finally, Nisa Investment Advisors LLC purchased a new position in shares of Getty Images during the 2nd quarter worth about $49,000. 45.75% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at Getty Images

In related news, Director Chinh Chu sold 48,400 shares of the stock in a transaction dated Wednesday, October 30th. The shares were sold at an average price of $4.05, for a total value of $196,020.00. Following the sale, the director now directly owns 9,706,670 shares of the company's stock, valued at approximately $39,312,013.50. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. In related news, Director Chinh Chu sold 48,400 shares of the stock in a transaction dated Wednesday, October 30th. The shares were sold at an average price of $4.05, for a total value of $196,020.00. Following the sale, the director now directly owns 9,706,670 shares of the company's stock, valued at approximately $39,312,013.50. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CEO Craig Warren Peters sold 32,170 shares of the stock in a transaction dated Tuesday, September 24th. The shares were sold at an average price of $3.61, for a total transaction of $116,133.70. Following the completion of the sale, the chief executive officer now directly owns 1,245,401 shares in the company, valued at approximately $4,495,897.61. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 169,427 shares of company stock valued at $652,130 in the last ninety days. 12.30% of the stock is currently owned by company insiders.

Getty Images Company Profile

(

Get Free Report)

Getty Images Holdings, Inc offers creative and editorial visual content solutions in the Americas, Europe, the Middle East, Africa, and Asia-Pacific. Its products include Getty Images that offers creative and editorial content including stills, music and video which focuses on corporate, agency, and media customers; iStock.com, an e-commerce offering where customers have access to creative stills and video; Unsplash.com, a platform offering free stock photo downloads and paid subscriptions targeted to the high-growth prosumer and semi-professional creator segments; and Unsplash+ that provides access to unique model released content with expanded legal protections.

Further Reading

Before you consider Getty Images, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Getty Images wasn't on the list.

While Getty Images currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.