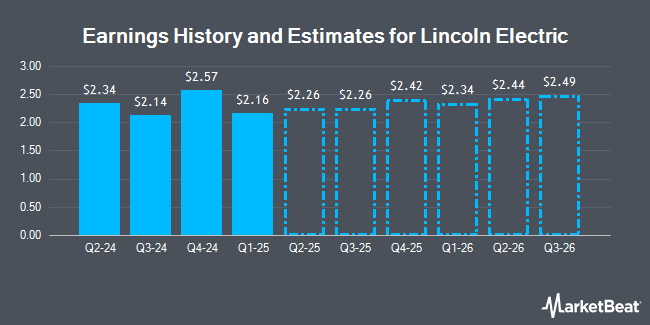

Lincoln Electric Holdings, Inc. (NASDAQ:LECO - Free Report) - Equities research analysts at Seaport Res Ptn issued their FY2024 earnings estimates for shares of Lincoln Electric in a research report issued on Monday, November 4th. Seaport Res Ptn analyst W. Liptak forecasts that the industrial products company will earn $8.73 per share for the year. The consensus estimate for Lincoln Electric's current full-year earnings is $8.83 per share.

Lincoln Electric (NASDAQ:LECO - Get Free Report) last issued its quarterly earnings data on Thursday, October 31st. The industrial products company reported $2.14 EPS for the quarter, beating the consensus estimate of $2.05 by $0.09. The business had revenue of $983.76 million during the quarter, compared to the consensus estimate of $988.07 million. Lincoln Electric had a net margin of 11.93% and a return on equity of 40.03%. The firm's revenue was down 4.8% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $2.40 EPS.

A number of other analysts also recently weighed in on the company. Robert W. Baird decreased their price target on Lincoln Electric from $220.00 to $212.00 and set an "outperform" rating for the company in a report on Wednesday, September 4th. StockNews.com downgraded Lincoln Electric from a "buy" rating to a "hold" rating in a report on Monday. Finally, Stifel Nicolaus increased their price target on Lincoln Electric from $184.00 to $185.00 and gave the stock a "hold" rating in a report on Wednesday, October 16th. One research analyst has rated the stock with a sell rating, three have assigned a hold rating and four have given a buy rating to the company. According to MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of $221.67.

Read Our Latest Analysis on LECO

Lincoln Electric Trading Down 0.6 %

NASDAQ:LECO traded down $1.31 during trading hours on Thursday, hitting $217.09. 284,629 shares of the company were exchanged, compared to its average volume of 321,019. The company has a current ratio of 1.85, a quick ratio of 1.20 and a debt-to-equity ratio of 0.86. The company has a fifty day simple moving average of $190.47 and a 200 day simple moving average of $198.23. Lincoln Electric has a one year low of $169.51 and a one year high of $261.13. The stock has a market capitalization of $12.25 billion, a price-to-earnings ratio of 26.06, a price-to-earnings-growth ratio of 1.50 and a beta of 1.14.

Lincoln Electric Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 31st will be paid a $0.75 dividend. The ex-dividend date of this dividend is Tuesday, December 31st. This is an increase from Lincoln Electric's previous quarterly dividend of $0.71. This represents a $3.00 annualized dividend and a dividend yield of 1.38%. Lincoln Electric's dividend payout ratio (DPR) is currently 33.89%.

Insider Activity

In other Lincoln Electric news, SVP Michael J. Whitehead sold 1,100 shares of Lincoln Electric stock in a transaction dated Friday, September 6th. The stock was sold at an average price of $175.96, for a total transaction of $193,556.00. Following the completion of the transaction, the senior vice president now owns 11,178 shares in the company, valued at approximately $1,966,880.88. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. 2.63% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Lincoln Electric

A number of hedge funds have recently added to or reduced their stakes in LECO. Vanguard Group Inc. lifted its position in shares of Lincoln Electric by 0.3% during the 1st quarter. Vanguard Group Inc. now owns 5,709,315 shares of the industrial products company's stock worth $1,458,387,000 after buying an additional 15,062 shares in the last quarter. EdgePoint Investment Group Inc. lifted its position in shares of Lincoln Electric by 48.0% during the 2nd quarter. EdgePoint Investment Group Inc. now owns 2,747,083 shares of the industrial products company's stock worth $518,210,000 after buying an additional 891,111 shares in the last quarter. Capital International Investors lifted its position in shares of Lincoln Electric by 7.0% during the 1st quarter. Capital International Investors now owns 1,856,125 shares of the industrial products company's stock worth $474,129,000 after buying an additional 121,914 shares in the last quarter. Victory Capital Management Inc. lifted its position in shares of Lincoln Electric by 81.9% during the 3rd quarter. Victory Capital Management Inc. now owns 1,097,965 shares of the industrial products company's stock worth $210,831,000 after buying an additional 494,464 shares in the last quarter. Finally, Dimensional Fund Advisors LP lifted its position in shares of Lincoln Electric by 7.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 525,647 shares of the industrial products company's stock worth $99,155,000 after buying an additional 38,206 shares in the last quarter. Institutional investors and hedge funds own 79.61% of the company's stock.

About Lincoln Electric

(

Get Free Report)

Lincoln Electric Holdings, Inc, through its subsidiaries, designs, develops, manufactures, and sells welding, cutting, and brazing products worldwide. The company operates through three segments: Americas Welding, International Welding, and The Harris Products Group. It offers brazing and soldering filler metals, arc welding equipment, plasma and oxyfuel cutting systems, wire feeding systems, fume control equipment, welding accessories, and specialty gas regulators, and education solutions, as well as a portfolio of automated solutions for joining, cutting, material handling, module assembly, and end of line testing, as well as involved in brazing and soldering alloys, and in the retail business in the United States.

Featured Articles

Before you consider Lincoln Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lincoln Electric wasn't on the list.

While Lincoln Electric currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.