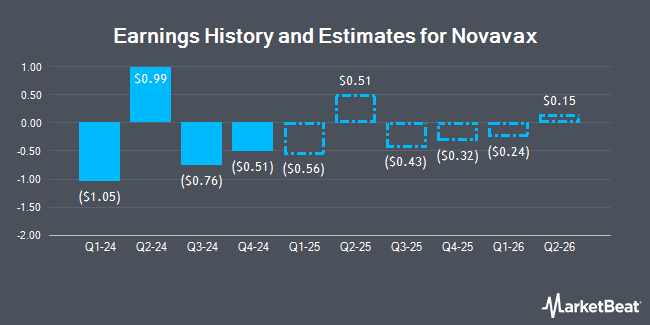

Novavax, Inc. (NASDAQ:NVAX - Free Report) - HC Wainwright cut their FY2024 earnings per share estimates for Novavax in a report issued on Wednesday, November 13th. HC Wainwright analyst V. Bernardino now forecasts that the biopharmaceutical company will post earnings of ($1.29) per share for the year, down from their prior forecast of ($0.84). HC Wainwright currently has a "Buy" rating and a $19.00 price target on the stock. The consensus estimate for Novavax's current full-year earnings is ($1.21) per share. HC Wainwright also issued estimates for Novavax's Q4 2024 earnings at ($0.59) EPS and FY2025 earnings at $1.06 EPS.

Novavax (NASDAQ:NVAX - Get Free Report) last released its quarterly earnings data on Tuesday, November 12th. The biopharmaceutical company reported ($0.76) EPS for the quarter, beating the consensus estimate of ($0.83) by $0.07. The company had revenue of $84.51 million during the quarter, compared to analysts' expectations of $65.80 million. During the same period last year, the business earned ($1.26) earnings per share. The company's revenue for the quarter was down 54.8% compared to the same quarter last year.

A number of other research analysts also recently commented on NVAX. Jefferies Financial Group reduced their price target on Novavax from $31.00 to $25.00 and set a "buy" rating for the company in a report on Wednesday, October 16th. B. Riley reissued a "buy" rating and issued a $26.00 price target (up previously from $23.00) on shares of Novavax in a report on Thursday, October 10th. Finally, JPMorgan Chase & Co. increased their target price on Novavax from $8.00 to $9.00 and gave the stock an "underweight" rating in a report on Monday, August 12th. One investment analyst has rated the stock with a sell rating, three have issued a hold rating and three have given a buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Hold" and a consensus target price of $17.83.

Read Our Latest Research Report on NVAX

Novavax Stock Performance

Shares of NASDAQ:NVAX traded up $0.46 during trading on Monday, hitting $7.78. The company's stock had a trading volume of 5,017,335 shares, compared to its average volume of 9,774,647. The company has a market capitalization of $1.25 billion, a PE ratio of -3.47 and a beta of 2.10. Novavax has a fifty-two week low of $3.53 and a fifty-two week high of $23.86. The stock's 50-day moving average price is $11.26 and its two-hundred day moving average price is $12.51.

Hedge Funds Weigh In On Novavax

Institutional investors have recently bought and sold shares of the stock. Shah Capital Management grew its position in Novavax by 19.0% during the second quarter. Shah Capital Management now owns 9,662,090 shares of the biopharmaceutical company's stock worth $122,322,000 after buying an additional 1,544,263 shares in the last quarter. State Street Corp grew its position in Novavax by 26.7% during the third quarter. State Street Corp now owns 7,687,951 shares of the biopharmaceutical company's stock worth $97,099,000 after buying an additional 1,621,772 shares in the last quarter. Geode Capital Management LLC grew its position in Novavax by 9.5% during the third quarter. Geode Capital Management LLC now owns 3,502,489 shares of the biopharmaceutical company's stock worth $44,245,000 after buying an additional 304,159 shares in the last quarter. Bank of Montreal Can grew its position in Novavax by 26.7% during the third quarter. Bank of Montreal Can now owns 2,454,325 shares of the biopharmaceutical company's stock worth $32,643,000 after buying an additional 517,727 shares in the last quarter. Finally, Two Sigma Advisers LP boosted its holdings in shares of Novavax by 48.9% in the 3rd quarter. Two Sigma Advisers LP now owns 1,999,400 shares of the biopharmaceutical company's stock worth $25,252,000 after acquiring an additional 656,900 shares in the last quarter. 53.04% of the stock is currently owned by institutional investors.

About Novavax

(

Get Free Report)

Novavax, Inc, a biotechnology company, that promotes improved health by discovering, developing, and commercializing vaccines to protect against serious infectious diseases. It offers vaccine platform that combines a recombinant protein approach, nanoparticle technology, and its patented Matrix-M adjuvant to enhance the immune response.

Featured Stories

Before you consider Novavax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novavax wasn't on the list.

While Novavax currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.