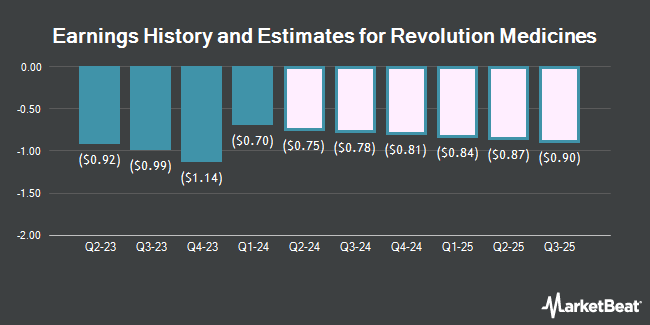

Revolution Medicines, Inc. (NASDAQ:RVMD - Free Report) - Analysts at HC Wainwright lowered their FY2024 EPS estimates for shares of Revolution Medicines in a research note issued on Thursday, November 7th. HC Wainwright analyst R. Burns now expects that the company will earn ($3.44) per share for the year, down from their prior estimate of ($3.38). HC Wainwright currently has a "Buy" rating and a $64.00 target price on the stock. The consensus estimate for Revolution Medicines' current full-year earnings is ($3.42) per share. HC Wainwright also issued estimates for Revolution Medicines' Q4 2024 earnings at ($0.99) EPS, Q1 2025 earnings at ($1.01) EPS, Q2 2025 earnings at ($1.03) EPS, Q3 2025 earnings at ($1.04) EPS, Q4 2025 earnings at ($1.06) EPS and FY2025 earnings at ($4.14) EPS.

Several other research firms have also issued reports on RVMD. Bank of America boosted their target price on Revolution Medicines from $48.00 to $55.00 and gave the stock a "buy" rating in a research report on Tuesday, July 16th. Piper Sandler upped their price objective on Revolution Medicines from $57.00 to $70.00 and gave the stock an "overweight" rating in a research report on Thursday. Wedbush reiterated an "outperform" rating and issued a $59.00 price target on shares of Revolution Medicines in a research note on Thursday, August 8th. JPMorgan Chase & Co. boosted their price target on Revolution Medicines from $54.00 to $63.00 and gave the stock an "overweight" rating in a research report on Thursday. Finally, Barclays raised their target price on shares of Revolution Medicines from $54.00 to $60.00 and gave the company an "overweight" rating in a research note on Friday, September 27th. Eleven research analysts have rated the stock with a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, Revolution Medicines presently has a consensus rating of "Buy" and a consensus price target of $61.00.

Check Out Our Latest Stock Analysis on Revolution Medicines

Revolution Medicines Price Performance

Shares of Revolution Medicines stock traded up $0.34 during midday trading on Monday, hitting $60.78. 914,984 shares of the company were exchanged, compared to its average volume of 1,335,808. The firm has a 50 day simple moving average of $47.56 and a 200-day simple moving average of $43.27. Revolution Medicines has a 52 week low of $19.05 and a 52 week high of $62.35. The firm has a market cap of $10.22 billion, a P/E ratio of -16.84 and a beta of 1.40.

Revolution Medicines (NASDAQ:RVMD - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The company reported ($0.94) EPS for the quarter, missing analysts' consensus estimates of ($0.89) by ($0.05). During the same period in the previous year, the company posted ($0.99) EPS.

Institutional Investors Weigh In On Revolution Medicines

Several hedge funds have recently added to or reduced their stakes in the business. GAMMA Investing LLC raised its position in Revolution Medicines by 55.8% during the 3rd quarter. GAMMA Investing LLC now owns 620 shares of the company's stock worth $28,000 after purchasing an additional 222 shares during the last quarter. Nisa Investment Advisors LLC grew its stake in shares of Revolution Medicines by 10.5% in the 2nd quarter. Nisa Investment Advisors LLC now owns 3,378 shares of the company's stock valued at $131,000 after buying an additional 320 shares during the period. Amalgamated Bank increased its stake in Revolution Medicines by 7.4% during the 2nd quarter. Amalgamated Bank now owns 5,272 shares of the company's stock valued at $205,000 after purchasing an additional 365 shares in the last quarter. KBC Group NV raised its stake in shares of Revolution Medicines by 12.9% in the third quarter. KBC Group NV now owns 3,221 shares of the company's stock worth $146,000 after purchasing an additional 368 shares during the last quarter. Finally, Headlands Technologies LLC boosted its holdings in Revolution Medicines by 140.9% during the 1st quarter. Headlands Technologies LLC now owns 1,513 shares of the company's stock worth $49,000 after acquiring an additional 885 shares during the last quarter. 94.34% of the stock is currently owned by institutional investors and hedge funds.

Insiders Place Their Bets

In other Revolution Medicines news, Director Barbara Weber sold 5,200 shares of Revolution Medicines stock in a transaction on Tuesday, October 8th. The stock was sold at an average price of $48.02, for a total value of $249,704.00. Following the completion of the transaction, the director now directly owns 13,065 shares of the company's stock, valued at $627,381.30. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. In other news, Director Barbara Weber sold 5,200 shares of Revolution Medicines stock in a transaction on Tuesday, October 8th. The stock was sold at an average price of $48.02, for a total value of $249,704.00. Following the transaction, the director now owns 13,065 shares in the company, valued at approximately $627,381.30. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CFO Jack Anders sold 10,000 shares of the stock in a transaction dated Friday, October 11th. The stock was sold at an average price of $50.30, for a total transaction of $503,000.00. Following the completion of the transaction, the chief financial officer now directly owns 98,932 shares of the company's stock, valued at $4,976,279.60. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 127,866 shares of company stock worth $6,355,624 in the last quarter. 8.00% of the stock is currently owned by corporate insiders.

About Revolution Medicines

(

Get Free Report)

Revolution Medicines, Inc, a clinical-stage precision oncology company, develops novel targeted therapies for RAS-addicted cancers. The company's research and development pipeline comprises RAS(ON) inhibitors designed to be used as monotherapy in combination with other RAS(ON) inhibitors and/or in combination with RAS companion inhibitors or other therapeutic agents, and RAS companion inhibitors for combination treatment strategies.

Featured Articles

Before you consider Revolution Medicines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Revolution Medicines wasn't on the list.

While Revolution Medicines currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.