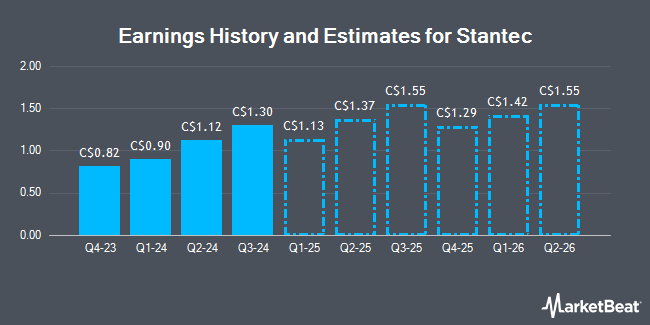

Stantec Inc. (TSE:STN - Free Report) NYSE: STN - Stifel Canada upped their FY2024 EPS estimates for Stantec in a note issued to investors on Sunday, November 10th. Stifel Canada analyst I. Gillies now anticipates that the company will post earnings of $4.33 per share for the year, up from their previous estimate of $4.24. Stifel Canada also issued estimates for Stantec's Q1 2025 earnings at $1.15 EPS.

A number of other equities research analysts have also weighed in on STN. BMO Capital Markets boosted their price target on Stantec from C$128.00 to C$131.00 in a research note on Wednesday, July 24th. Stifel Nicolaus lifted their target price on shares of Stantec from C$130.00 to C$145.00 in a research note on Friday, October 4th. Raymond James lowered shares of Stantec from an "outperform" rating to a "market perform" rating and cut their price target for the company from C$125.00 to C$120.00 in a research note on Thursday, August 8th. Canaccord Genuity Group raised their price target on shares of Stantec from C$125.00 to C$135.00 in a report on Monday. Finally, Scotiabank raised shares of Stantec to a "strong-buy" rating in a report on Friday, October 25th. Three analysts have rated the stock with a hold rating, eight have issued a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of C$124.33.

Read Our Latest Stock Analysis on STN

Stantec Stock Up 0.9 %

Shares of Stantec stock traded up C$1.04 during trading on Wednesday, reaching C$115.70. The company's stock had a trading volume of 322,364 shares, compared to its average volume of 262,310. The company has a 50-day simple moving average of C$111.46 and a two-hundred day simple moving average of C$112.79. Stantec has a 1-year low of C$92.40 and a 1-year high of C$122.57. The company has a market cap of C$13.20 billion, a price-to-earnings ratio of 38.06, a P/E/G ratio of 1.46 and a beta of 0.82. The company has a quick ratio of 1.46, a current ratio of 1.39 and a debt-to-equity ratio of 80.74.

Insider Buying and Selling at Stantec

In other news, Director Vito Culmone purchased 2,000 shares of the stock in a transaction that occurred on Tuesday, August 20th. The shares were purchased at an average cost of C$112.97 per share, with a total value of C$225,940.00. Over the last ninety days, insiders purchased 2,145 shares of company stock valued at $241,711. 0.27% of the stock is owned by company insiders.

Stantec Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be given a dividend of $0.21 per share. This represents a $0.84 annualized dividend and a yield of 0.73%. The ex-dividend date of this dividend is Tuesday, December 31st. Stantec's dividend payout ratio is currently 27.63%.

Stantec Company Profile

(

Get Free Report)

Stantec Inc provides professional services in the areas of infrastructure and facilities to the public and private sectors in Canada, the United States, and internationally. It offers evaluation, planning, and designing infrastructure solutions; solutions for sustainable water resources, planning, management, and infrastructure; environmental services; integrated architecture, engineering, interior design, and planning solutions for buildings; and energy and resources solutions.

Read More

Before you consider Stantec, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stantec wasn't on the list.

While Stantec currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.