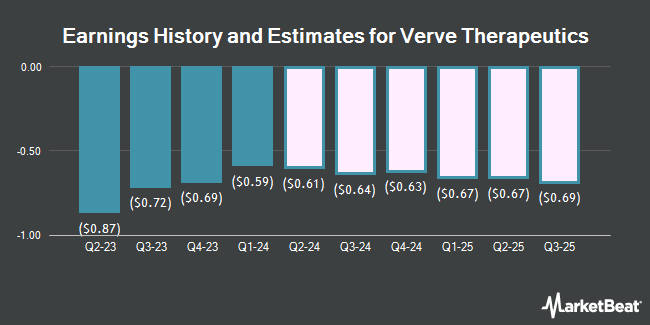

Verve Therapeutics, Inc. (NASDAQ:VERV - Free Report) - Analysts at William Blair raised their FY2024 earnings per share estimates for shares of Verve Therapeutics in a research note issued to investors on Tuesday, November 5th. William Blair analyst M. Minter now expects that the company will post earnings per share of ($2.32) for the year, up from their prior forecast of ($2.41). The consensus estimate for Verve Therapeutics' current full-year earnings is ($2.65) per share. William Blair also issued estimates for Verve Therapeutics' Q4 2024 earnings at ($0.55) EPS, Q1 2025 earnings at ($0.66) EPS, Q2 2025 earnings at ($0.63) EPS, Q3 2025 earnings at ($0.67) EPS, Q4 2025 earnings at ($0.67) EPS and FY2025 earnings at ($2.63) EPS.

Verve Therapeutics (NASDAQ:VERV - Get Free Report) last issued its quarterly earnings data on Tuesday, November 5th. The company reported ($0.59) earnings per share for the quarter, beating the consensus estimate of ($0.70) by $0.11. Verve Therapeutics had a negative net margin of 807.65% and a negative return on equity of 35.23%. The firm had revenue of $6.87 million for the quarter, compared to analyst estimates of $2.75 million. During the same quarter last year, the firm earned ($0.72) earnings per share. The company's revenue for the quarter was up 120.2% on a year-over-year basis.

Several other research firms have also recently weighed in on VERV. HC Wainwright lowered their price objective on shares of Verve Therapeutics from $15.00 to $14.00 and set a "buy" rating for the company in a research report on Wednesday. Royal Bank of Canada decreased their price objective on Verve Therapeutics from $20.00 to $17.00 and set an "outperform" rating for the company in a research report on Wednesday. Finally, Canaccord Genuity Group increased their price objective on Verve Therapeutics from $29.00 to $32.00 and gave the stock a "buy" rating in a report on Wednesday. Five analysts have rated the stock with a buy rating, Based on data from MarketBeat, the company currently has a consensus rating of "Buy" and a consensus target price of $25.75.

View Our Latest Report on VERV

Verve Therapeutics Trading Down 1.1 %

VERV traded down $0.07 on Friday, hitting $6.29. 493,500 shares of the stock traded hands, compared to its average volume of 1,302,925. Verve Therapeutics has a 52 week low of $4.30 and a 52 week high of $19.34. The firm has a market capitalization of $532.51 million, a PE ratio of -2.59 and a beta of 1.75. The business has a fifty day moving average price of $5.48 and a two-hundred day moving average price of $5.70.

Institutional Investors Weigh In On Verve Therapeutics

A number of hedge funds have recently added to or reduced their stakes in VERV. Accredited Investors Inc. raised its stake in shares of Verve Therapeutics by 14.3% during the 3rd quarter. Accredited Investors Inc. now owns 20,000 shares of the company's stock worth $97,000 after purchasing an additional 2,500 shares during the period. Aigen Investment Management LP purchased a new stake in Verve Therapeutics during the 3rd quarter worth about $74,000. Los Angeles Capital Management LLC lifted its holdings in shares of Verve Therapeutics by 8.2% in the third quarter. Los Angeles Capital Management LLC now owns 262,393 shares of the company's stock worth $1,270,000 after buying an additional 19,925 shares in the last quarter. Harbor Capital Advisors Inc. boosted its holdings in Verve Therapeutics by 78.7% in the 3rd quarter. Harbor Capital Advisors Inc. now owns 53,524 shares of the company's stock valued at $259,000 after purchasing an additional 23,565 shares during the period. Finally, US Bancorp DE grew its position in Verve Therapeutics by 1,631.7% during the third quarter. US Bancorp DE now owns 18,806 shares of the company's stock worth $91,000 after buying an additional 17,720 shares in the last quarter. Institutional investors and hedge funds own 97.11% of the company's stock.

About Verve Therapeutics

(

Get Free Report)

Verve Therapeutics, Inc, a clinical stage genetic medicines company, engages in developing gene editing medicines for patients to treat cardiovascular diseases in the United States. The company's lead product candidate is VERVE-101, a single-course gene editing treatment that permanently turns off the PCSK9 gene in the liver; and VERVE-102, a product candidate that targets the PCSK9 gene for the treatment of HeFH.

Featured Stories

Before you consider Verve Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verve Therapeutics wasn't on the list.

While Verve Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.