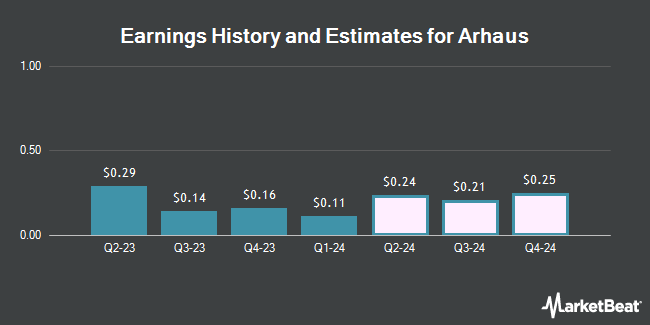

Arhaus, Inc. (NASDAQ:ARHS - Free Report) - Stock analysts at William Blair cut their FY2024 EPS estimates for shares of Arhaus in a research note issued to investors on Thursday, November 7th. William Blair analyst P. Blee now forecasts that the company will post earnings per share of $0.44 for the year, down from their prior forecast of $0.52. The consensus estimate for Arhaus' current full-year earnings is $0.46 per share. William Blair also issued estimates for Arhaus' Q4 2024 earnings at $0.10 EPS and FY2025 earnings at $0.53 EPS.

A number of other research analysts also recently commented on ARHS. TD Cowen lowered their price target on shares of Arhaus from $19.00 to $14.00 and set a "buy" rating for the company in a report on Friday, August 9th. Craig Hallum lowered Arhaus from a "buy" rating to a "hold" rating and decreased their price target for the company from $14.00 to $10.00 in a report on Tuesday, October 15th. Barclays dropped their price objective on shares of Arhaus from $15.00 to $13.00 and set an "overweight" rating for the company in a research note on Friday. Jefferies Financial Group reissued a "hold" rating and issued a $12.00 target price on shares of Arhaus in a research note on Wednesday, October 9th. Finally, Bank of America downgraded shares of Arhaus from a "buy" rating to a "neutral" rating and cut their price target for the company from $15.00 to $11.00 in a report on Thursday. Five analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat, Arhaus currently has a consensus rating of "Moderate Buy" and a consensus price target of $12.80.

Read Our Latest Stock Report on ARHS

Arhaus Price Performance

NASDAQ ARHS traded up $0.12 during trading on Monday, hitting $9.80. 1,010,799 shares of the stock traded hands, compared to its average volume of 1,292,515. The company has a quick ratio of 0.55, a current ratio of 1.25 and a debt-to-equity ratio of 0.17. Arhaus has a 12-month low of $8.22 and a 12-month high of $19.81. The firm has a 50-day simple moving average of $10.65 and a 200-day simple moving average of $13.77. The company has a market capitalization of $1.38 billion, a P/E ratio of 17.38, a price-to-earnings-growth ratio of 10.79 and a beta of 2.58.

Arhaus (NASDAQ:ARHS - Get Free Report) last released its earnings results on Thursday, November 7th. The company reported $0.07 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.08 by ($0.01). Arhaus had a return on equity of 28.45% and a net margin of 6.92%. The business had revenue of $319.13 million for the quarter, compared to analysts' expectations of $328.94 million. During the same quarter in the prior year, the business posted $0.14 EPS. The business's revenue for the quarter was down 2.2% compared to the same quarter last year.

Institutional Investors Weigh In On Arhaus

A number of institutional investors and hedge funds have recently added to or reduced their stakes in ARHS. Amalgamated Bank acquired a new stake in shares of Arhaus in the second quarter valued at about $30,000. Quest Partners LLC raised its stake in shares of Arhaus by 716,800.0% during the 2nd quarter. Quest Partners LLC now owns 7,169 shares of the company's stock worth $121,000 after buying an additional 7,168 shares during the last quarter. Intech Investment Management LLC acquired a new stake in Arhaus in the 3rd quarter valued at about $131,000. Ground Swell Capital LLC purchased a new position in Arhaus during the 2nd quarter valued at about $183,000. Finally, Olympiad Research LP acquired a new position in Arhaus during the third quarter worth about $202,000. Hedge funds and other institutional investors own 27.88% of the company's stock.

About Arhaus

(

Get Free Report)

Arhaus, Inc operates as a lifestyle brand and premium retailer in the home furnishings market in the United States. It provides merchandise assortments across various categories, including furniture, lighting, textiles, décor, and outdoor. The company's furniture products comprise bedroom, dining room, living room, and home office furnishings, which includes sofas, dining tables and chairs, accent chairs, console and coffee tables, beds, headboards, dressers, desks, bookcases, modular storage, and other items; and outdoor products, such as outdoor dining tables, chairs, chaises and other furniture, lighting, textiles, décor, umbrellas, and fire pits.

Featured Articles

Before you consider Arhaus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arhaus wasn't on the list.

While Arhaus currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.