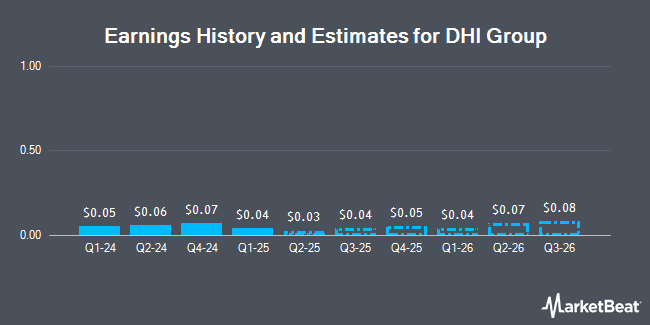

DHI Group, Inc. (NYSE:DHX - Free Report) - Equities researchers at K LIU & lowered their FY2024 earnings estimates for shares of DHI Group in a report issued on Wednesday, November 13th. K LIU & analyst K. Liu now forecasts that the technology company will earn $0.23 per share for the year, down from their prior forecast of $0.26. The consensus estimate for DHI Group's current full-year earnings is $0.21 per share. K LIU & also issued estimates for DHI Group's Q4 2024 earnings at $0.06 EPS, Q1 2025 earnings at $0.05 EPS, Q2 2025 earnings at $0.05 EPS, Q3 2025 earnings at $0.06 EPS, Q4 2025 earnings at $0.07 EPS, FY2025 earnings at $0.24 EPS, Q1 2026 earnings at $0.06 EPS, Q2 2026 earnings at $0.07 EPS, Q3 2026 earnings at $0.07 EPS and FY2026 earnings at $0.28 EPS.

A number of other equities research analysts also recently commented on DHX. B. Riley dropped their price objective on shares of DHI Group from $4.00 to $3.50 and set a "buy" rating on the stock in a research report on Wednesday. Barrington Research reissued an "outperform" rating and issued a $7.00 price objective on shares of DHI Group in a research report on Monday. Finally, StockNews.com downgraded shares of DHI Group from a "strong-buy" rating to a "buy" rating in a research report on Friday, August 16th.

Get Our Latest Stock Analysis on DHX

DHI Group Stock Up 1.8 %

Shares of NYSE:DHX traded up $0.03 during trading hours on Friday, reaching $1.67. The stock had a trading volume of 248,950 shares, compared to its average volume of 214,257. DHI Group has a 1 year low of $1.45 and a 1 year high of $2.98. The firm's 50 day moving average is $1.72 and its 200-day moving average is $1.98. The company has a debt-to-equity ratio of 0.29, a quick ratio of 0.45 and a current ratio of 0.42. The stock has a market capitalization of $80.71 million, a price-to-earnings ratio of 41.76 and a beta of 1.04.

Institutional Trading of DHI Group

A number of large investors have recently bought and sold shares of DHX. Point72 DIFC Ltd acquired a new stake in DHI Group during the 2nd quarter worth $30,000. Cubist Systematic Strategies LLC acquired a new stake in shares of DHI Group in the 2nd quarter worth $35,000. Virtu Financial LLC acquired a new stake in shares of DHI Group in the 1st quarter worth $39,000. Allspring Global Investments Holdings LLC acquired a new stake in shares of DHI Group in the 2nd quarter worth $41,000. Finally, Mirae Asset Global Investments Co. Ltd. acquired a new stake in shares of DHI Group in the 1st quarter worth $45,000. Institutional investors and hedge funds own 69.26% of the company's stock.

DHI Group Company Profile

(

Get Free Report)

DHI Group, Inc provides data, insights, and employment connections through specialized services for technology professionals and other select online communities in the United States. Its solutions include talent profiles; job postings; employer branding; and other services comprising virtual and live career events, sourcing services, and content and data services that provides tailored content to help professionals manage their careers and provide employers insight into recruiting strategies and trends.

Featured Stories

Before you consider DHI Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DHI Group wasn't on the list.

While DHI Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.