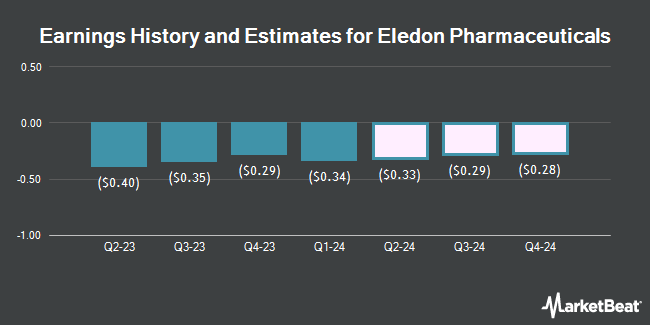

Eledon Pharmaceuticals, Inc. (NASDAQ:ELDN - Free Report) - Stock analysts at Lifesci Capital increased their FY2024 EPS estimates for Eledon Pharmaceuticals in a note issued to investors on Wednesday, November 13th. Lifesci Capital analyst R. Katkhuda now forecasts that the company will post earnings per share of ($1.35) for the year, up from their previous estimate of ($1.47). The consensus estimate for Eledon Pharmaceuticals' current full-year earnings is ($1.52) per share. Lifesci Capital also issued estimates for Eledon Pharmaceuticals' Q4 2024 earnings at ($0.37) EPS.

Eledon Pharmaceuticals (NASDAQ:ELDN - Get Free Report) last released its quarterly earnings results on Tuesday, November 12th. The company reported ($0.32) EPS for the quarter, missing the consensus estimate of ($0.30) by ($0.02).

Eledon Pharmaceuticals Price Performance

ELDN stock traded down $0.13 during midday trading on Friday, hitting $4.00. 235,024 shares of the stock traded hands, compared to its average volume of 196,067. The stock's fifty day simple moving average is $3.26 and its 200-day simple moving average is $2.89. Eledon Pharmaceuticals has a 1-year low of $1.11 and a 1-year high of $5.54. The firm has a market cap of $158.62 million, a P/E ratio of -1.99 and a beta of 0.76.

Institutional Trading of Eledon Pharmaceuticals

Institutional investors have recently modified their holdings of the stock. Clarity Capital Partners LLC purchased a new position in shares of Eledon Pharmaceuticals in the third quarter worth about $29,000. Dimensional Fund Advisors LP purchased a new position in Eledon Pharmaceuticals during the second quarter worth about $80,000. Marco Investment Management LLC raised its stake in Eledon Pharmaceuticals by 22.3% during the second quarter. Marco Investment Management LLC now owns 30,344 shares of the company's stock worth $80,000 after purchasing an additional 5,535 shares during the period. CM Management LLC raised its stake in Eledon Pharmaceuticals by 14.3% during the first quarter. CM Management LLC now owns 160,000 shares of the company's stock worth $330,000 after purchasing an additional 20,000 shares during the period. Finally, Renaissance Technologies LLC raised its stake in shares of Eledon Pharmaceuticals by 57.1% in the 2nd quarter. Renaissance Technologies LLC now owns 136,773 shares of the company's stock valued at $361,000 after acquiring an additional 49,704 shares during the period. Institutional investors and hedge funds own 56.77% of the company's stock.

About Eledon Pharmaceuticals

(

Get Free Report)

Eledon Pharmaceuticals, Inc operates as a clinical stage biotechnology company. The company uses its immunology expertise in targeting the CD40 Ligand (CD40L, also called CD154) pathway to develop therapies to protect transplanted organs and prevent rejection, and to treat amyotrophic lateral sclerosis (ALS).

Featured Stories

Before you consider Eledon Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eledon Pharmaceuticals wasn't on the list.

While Eledon Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.