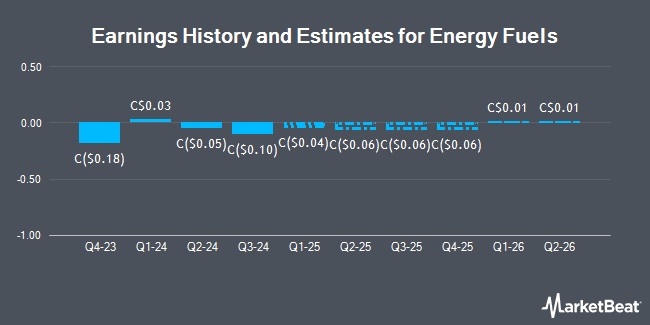

Energy Fuels Inc. (TSE:EFR - Free Report) NASDAQ: UUUU - Investment analysts at B. Riley raised their FY2024 EPS estimates for Energy Fuels in a research note issued on Tuesday, November 5th. B. Riley analyst M. Key now forecasts that the company will earn ($0.12) per share for the year, up from their previous forecast of ($0.14). The consensus estimate for Energy Fuels' current full-year earnings is $0.19 per share. B. Riley also issued estimates for Energy Fuels' Q4 2024 earnings at $0.00 EPS, FY2025 earnings at $0.00 EPS, FY2027 earnings at $0.50 EPS and FY2028 earnings at $1.40 EPS.

Energy Fuels Price Performance

TSE:EFR traded up C$0.34 during mid-day trading on Thursday, hitting C$8.78. The company's stock had a trading volume of 450,041 shares, compared to its average volume of 409,097. Energy Fuels has a fifty-two week low of C$5.71 and a fifty-two week high of C$11.88. The company has a current ratio of 28.28, a quick ratio of 19.23 and a debt-to-equity ratio of 0.32. The company has a market capitalization of C$1.72 billion, a price-to-earnings ratio of -70.33 and a beta of 1.54. The stock has a fifty day moving average of C$7.52 and a 200-day moving average of C$7.75.

Energy Fuels Company Profile

(

Get Free Report)

Energy Fuels Inc, together with its subsidiaries, engages in the extraction, recovery, recycling, exploration, permitting, evaluation, and sale of uranium mineral properties in the United States. The company produces and sells vanadium pentoxide, rare earth elements, and heavy mineral sands, such as ilmenite, rutile, zircon, and monazite.

Featured Articles

Before you consider Energy Fuels, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Energy Fuels wasn't on the list.

While Energy Fuels currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.