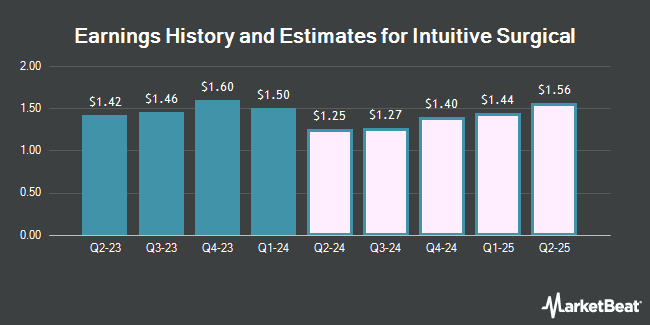

Intuitive Surgical, Inc. (NASDAQ:ISRG - Free Report) - Investment analysts at Leerink Partnrs lowered their FY2024 EPS estimates for shares of Intuitive Surgical in a research note issued on Monday, November 25th. Leerink Partnrs analyst M. Kratky now expects that the medical equipment provider will earn $5.39 per share for the year, down from their previous forecast of $5.41. The consensus estimate for Intuitive Surgical's current full-year earnings is $5.45 per share.

Intuitive Surgical (NASDAQ:ISRG - Get Free Report) last issued its quarterly earnings data on Thursday, October 17th. The medical equipment provider reported $1.56 earnings per share for the quarter, topping the consensus estimate of $1.24 by $0.32. Intuitive Surgical had a return on equity of 13.41% and a net margin of 28.51%. The company had revenue of $2.04 billion during the quarter, compared to analyst estimates of $2.01 billion.

ISRG has been the topic of a number of other research reports. Oppenheimer reaffirmed a "market perform" rating on shares of Intuitive Surgical in a research report on Friday, October 18th. The Goldman Sachs Group set a $604.00 price objective on shares of Intuitive Surgical in a report on Friday, October 18th. Royal Bank of Canada lifted their target price on shares of Intuitive Surgical from $525.00 to $555.00 and gave the company an "outperform" rating in a report on Friday, October 18th. Piper Sandler restated an "overweight" rating and set a $538.00 price target (up from $495.00) on shares of Intuitive Surgical in a research note on Friday, October 18th. Finally, Wells Fargo & Company lifted their price objective on Intuitive Surgical from $466.00 to $549.00 and gave the company an "overweight" rating in a research note on Friday, October 18th. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating and fourteen have issued a buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $526.06.

Get Our Latest Report on Intuitive Surgical

Intuitive Surgical Stock Performance

Shares of Intuitive Surgical stock traded down $3.55 during trading hours on Wednesday, hitting $538.55. The company's stock had a trading volume of 938,359 shares, compared to its average volume of 1,455,400. The firm has a fifty day moving average of $507.94 and a 200-day moving average of $466.79. The stock has a market cap of $191.82 billion, a price-to-earnings ratio of 86.58, a P/E/G ratio of 5.28 and a beta of 1.39. Intuitive Surgical has a twelve month low of $304.50 and a twelve month high of $552.00.

Institutional Trading of Intuitive Surgical

Several institutional investors have recently modified their holdings of the stock. State Street Corp lifted its position in Intuitive Surgical by 1.4% in the third quarter. State Street Corp now owns 15,050,121 shares of the medical equipment provider's stock valued at $7,393,673,000 after acquiring an additional 210,363 shares during the last quarter. FMR LLC increased its position in shares of Intuitive Surgical by 8.3% during the third quarter. FMR LLC now owns 10,971,085 shares of the medical equipment provider's stock worth $5,389,765,000 after purchasing an additional 838,793 shares in the last quarter. Geode Capital Management LLC lifted its holdings in shares of Intuitive Surgical by 1.9% in the 3rd quarter. Geode Capital Management LLC now owns 7,512,925 shares of the medical equipment provider's stock valued at $3,677,194,000 after purchasing an additional 143,440 shares during the last quarter. Fisher Asset Management LLC boosted its position in shares of Intuitive Surgical by 1.8% in the 3rd quarter. Fisher Asset Management LLC now owns 4,782,381 shares of the medical equipment provider's stock valued at $2,349,441,000 after purchasing an additional 86,208 shares during the period. Finally, Baillie Gifford & Co. grew its stake in Intuitive Surgical by 0.6% during the 3rd quarter. Baillie Gifford & Co. now owns 3,848,547 shares of the medical equipment provider's stock worth $1,890,676,000 after buying an additional 24,183 shares during the last quarter. Hedge funds and other institutional investors own 83.64% of the company's stock.

Insiders Place Their Bets

In related news, General Counsel Gary Loeb sold 300 shares of the business's stock in a transaction that occurred on Monday, September 9th. The stock was sold at an average price of $475.00, for a total transaction of $142,500.00. Following the completion of the sale, the general counsel now owns 1,595 shares in the company, valued at $757,625. The trade was a 15.83 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CFO Jamie Samath sold 108 shares of the company's stock in a transaction that occurred on Tuesday, November 26th. The shares were sold at an average price of $542.06, for a total value of $58,542.48. Following the completion of the transaction, the chief financial officer now directly owns 8,757 shares of the company's stock, valued at $4,746,819.42. This trade represents a 1.22 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 50,647 shares of company stock worth $26,170,907 in the last 90 days. Corporate insiders own 0.80% of the company's stock.

About Intuitive Surgical

(

Get Free Report)

Intuitive Surgical, Inc develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally. The company offers the da Vinci Surgical System that enables complex surgery using a minimally invasive approach; and Ion endoluminal system, which extends its commercial offerings beyond surgery into diagnostic procedures enabling minimally invasive biopsies in the lung.

Featured Articles

Before you consider Intuitive Surgical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intuitive Surgical wasn't on the list.

While Intuitive Surgical currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.