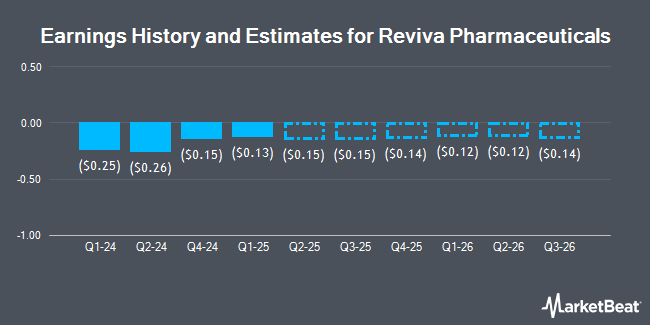

Reviva Pharmaceuticals Holdings, Inc. (NASDAQ:RVPH - Free Report) - Equities researchers at Zacks Small Cap increased their FY2024 earnings estimates for Reviva Pharmaceuticals in a research note issued to investors on Monday, December 23rd. Zacks Small Cap analyst J. Vandermosten now expects that the company will earn ($0.97) per share for the year, up from their previous estimate of ($0.98). The consensus estimate for Reviva Pharmaceuticals' current full-year earnings is ($1.01) per share. Zacks Small Cap also issued estimates for Reviva Pharmaceuticals' Q4 2024 earnings at ($0.22) EPS.

Separately, EF Hutton Acquisition Co. I raised shares of Reviva Pharmaceuticals to a "strong-buy" rating in a report on Monday, September 23rd.

Get Our Latest Stock Analysis on Reviva Pharmaceuticals

Reviva Pharmaceuticals Stock Performance

Reviva Pharmaceuticals stock traded up $0.14 during mid-day trading on Wednesday, hitting $1.78. 4,269,756 shares of the company traded hands, compared to its average volume of 767,740. The stock has a fifty day moving average price of $1.40 and a 200-day moving average price of $1.25. The stock has a market cap of $59.52 million, a price-to-earnings ratio of -1.60 and a beta of -0.02. Reviva Pharmaceuticals has a one year low of $0.60 and a one year high of $5.67.

Hedge Funds Weigh In On Reviva Pharmaceuticals

An institutional investor recently raised its position in Reviva Pharmaceuticals stock. Geode Capital Management LLC grew its holdings in Reviva Pharmaceuticals Holdings, Inc. (NASDAQ:RVPH - Free Report) by 17.9% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 278,496 shares of the company's stock after purchasing an additional 42,376 shares during the period. Geode Capital Management LLC owned about 0.83% of Reviva Pharmaceuticals worth $401,000 as of its most recent SEC filing. Hedge funds and other institutional investors own 63.18% of the company's stock.

Reviva Pharmaceuticals Company Profile

(

Get Free Report)

Reviva Pharmaceuticals Holdings, Inc, a biopharmaceutical company, discovers, develops, and commercializes next-generation therapeutics for diseases targeting unmet medical needs in the areas of central nervous system, respiratory, inflammatory, and cardiometabolic diseases. The company's lead product candidate comprises brilaroxazine (RP5063) for the treatment of various neuropsychiatric indications, including schizophrenia, bipolar disorder, major depressive disorder, attentiondeficit/hyperactivity disorder, behavioral and psychotic symptoms of dementia and Alzheimer's disease, and Parkinson's disease psychosis; in clinical development respiratory indications, such as pulmonary arterial hypertension and idiopathic pulmonary fibrosis; and in preclinical development for the treatment of psoriasis.

Recommended Stories

Before you consider Reviva Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Reviva Pharmaceuticals wasn't on the list.

While Reviva Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.