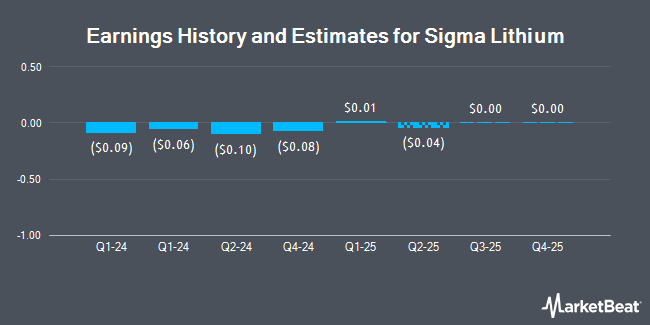

Sigma Lithium Co. (NASDAQ:SGML - Free Report) - Equities research analysts at Cormark cut their FY2024 earnings per share estimates for Sigma Lithium in a research report issued to clients and investors on Monday, November 18th. Cormark analyst M. Whale now expects that the company will post earnings of ($0.12) per share for the year, down from their prior forecast of $0.05. The consensus estimate for Sigma Lithium's current full-year earnings is $0.05 per share. Cormark also issued estimates for Sigma Lithium's Q1 2025 earnings at $0.19 EPS and Q2 2025 earnings at $0.19 EPS.

Separately, BMO Capital Markets dropped their price objective on Sigma Lithium from $25.00 to $20.00 and set an "outperform" rating for the company in a report on Monday, August 19th.

Read Our Latest Report on Sigma Lithium

Sigma Lithium Price Performance

Shares of Sigma Lithium stock traded up $0.19 during trading on Thursday, reaching $14.65. The company's stock had a trading volume of 647,048 shares, compared to its average volume of 1,010,437. The stock has a 50-day moving average price of $13.12 and a two-hundred day moving average price of $12.77. The company has a current ratio of 0.84, a quick ratio of 0.96 and a debt-to-equity ratio of 0.02. Sigma Lithium has a one year low of $8.47 and a one year high of $34.31. The stock has a market capitalization of $1.63 billion, a P/E ratio of -29.67 and a beta of 0.16.

Institutional Trading of Sigma Lithium

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. Point72 DIFC Ltd bought a new stake in shares of Sigma Lithium in the 2nd quarter valued at about $48,000. Point72 Asia Singapore Pte. Ltd. bought a new stake in shares of Sigma Lithium in the 2nd quarter valued at about $107,000. Public Employees Retirement System of Ohio bought a new stake in shares of Sigma Lithium in the 3rd quarter valued at about $122,000. Y Intercept Hong Kong Ltd bought a new stake in shares of Sigma Lithium in the 3rd quarter valued at about $299,000. Finally, Tidal Investments LLC increased its stake in shares of Sigma Lithium by 65.9% in the 1st quarter. Tidal Investments LLC now owns 44,241 shares of the company's stock valued at $573,000 after acquiring an additional 17,566 shares during the last quarter. 64.86% of the stock is owned by institutional investors.

Sigma Lithium Company Profile

(

Get Free Report)

Sigma Lithium Corporation engages in the exploration and development of lithium deposits in Brazil. It holds a 100% interest in the Grota do Cirilo, Genipapo, Santa Clara, and São José properties comprising 29 mineral rights covering an area of approximately 185 square kilometers located in the Araçuaí and Itinga regions of the state of Minas Gerais, Brazil.

Recommended Stories

Before you consider Sigma Lithium, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sigma Lithium wasn't on the list.

While Sigma Lithium currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.